Welcome to Treasury Leaders Hub – Your UK Treasury Resource

Looking for clear, up‑to‑date advice on cash flow, risk, or investment moves? You’ve landed in the right spot. We break down complex treasury topics into bite‑size tips you can act on today.

What We Cover

From personal finance basics like budgeting and loan cost calculators to deep dives on mortgage trends and crypto investing, every post is written for busy finance leaders who need fast, reliable answers.

Why Trust Our Insights

Our team follows UK market shifts, regulatory changes, and real‑world case studies. You’ll find step‑by‑step guides on managing a $5,000 loan, planning a $300k early retirement, or spotting the next $1 crypto. Each article is packed with numbers, tools, and actionable steps – no fluff, just what matters.

Ready to level up your treasury game? Browse the latest posts, grab a template, and start making smarter decisions right away.

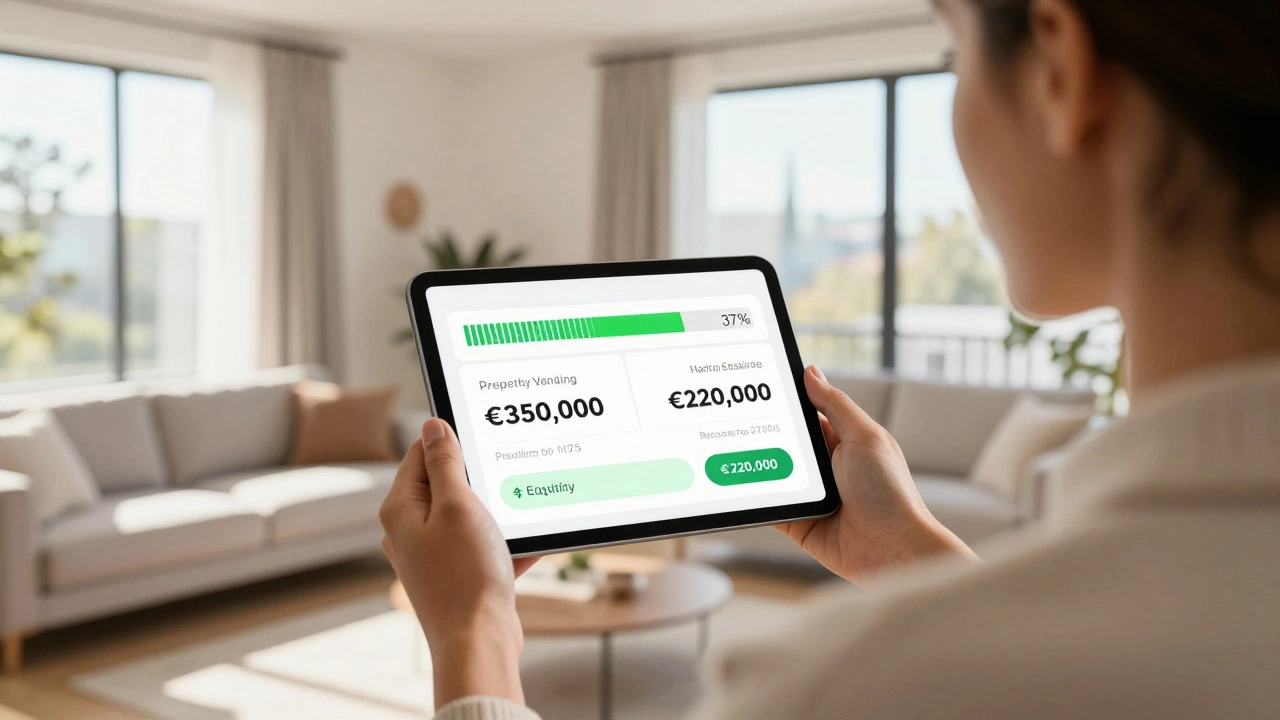

In Ireland, you typically need at least 20% equity to remortgage. Learn how to calculate your home equity, what lenders require, and how to improve your chances of approval for better rates and cash-out options.

Read More

Equity release lets you access cash from your home in retirement, but you pay compound interest that grows over time. Understand how it works before committing.

Read More

Home insurance premiums in Ireland typically rise each year due to inflation, claims trends, and risk changes. While increases are normal, you can save hundreds by comparing quotes, adjusting coverage, and improving home security.

Read More

Warren Buffett doesn't just tell you to save money-he shows you how to build real wealth by saving early, investing wisely, and prioritizing freedom over spending. His advice is simple but life-changing.

Read More

Can crypto make you rich? Yes-but only if you avoid hype, invest consistently in Bitcoin and Ethereum, hold through crashes, and earn yield through staking. Most people lose money chasing memes. Real wealth takes time, patience, and strategy.

Read More

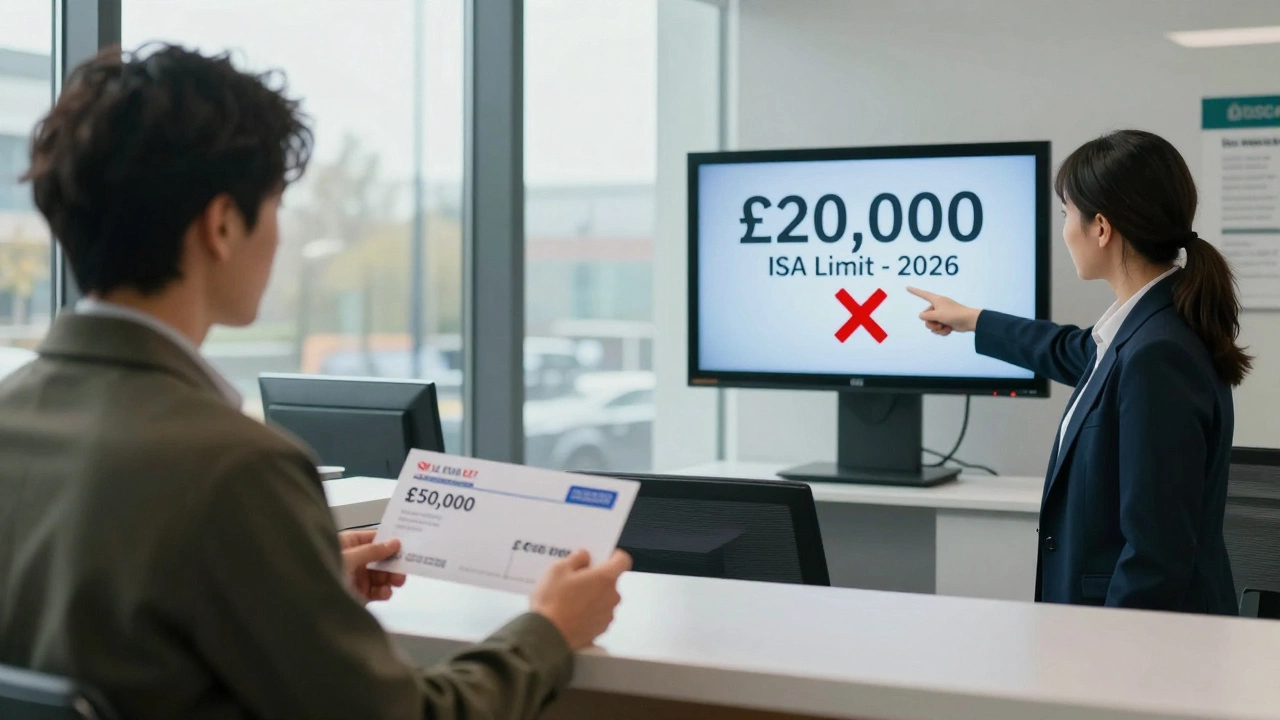

You can't put $50,000 in a cash ISA in one year - the UK limit is £20,000. But with smart planning over three years, you can get there tax-free. Here's how to maximize your ISA allowance and avoid costly mistakes.

Read More

Most experts recommend keeping 3 to 6 months' worth of essential expenses in a savings account. In Ireland, that means €4,500 to €27,000 depending on your household size and income. Learn how to calculate your ideal emergency fund and where to keep it for maximum safety and returns.

Read More

Shopping around for home insurance in Ireland can save you hundreds each year. Learn how to compare quotes, avoid common mistakes, and find better coverage without overpaying.

Read More

There's no perfect timeline for holding crypto, but data shows holding for at least 3-5 years dramatically increases your chances of profit. Avoid trading, limit your exposure, and focus on Bitcoin and Ethereum for long-term safety.

Read More

USAA home insurance is available only to military-affiliated members. Learn exactly who qualifies, from active duty personnel to veterans and their families. Find out how to check eligibility and alternatives if you don't meet the criteria.

Read More

The 40-40-20 budget rule divides your income into 40% for needs, 40% for debt repayment and savings, and 20% for wants. It's a practical way to get out of debt without sacrificing your lifestyle - especially useful if you're consolidating loans or credit card balances.

Read More

A pension plan is your key to financial security in retirement. Learn how workplace, private, and State pensions work in Ireland, how much you need to save, and why starting now changes everything.

Read More