Home Insurance Premium Calculator

Estimate Your Annual Increase

It’s completely normal for home insurance to go up every year. If your premium increased last year - and again this year - you’re not alone. Most homeowners in Ireland and across Europe see their home insurance costs rise annually. It’s not a trick. It’s not a mistake. It’s how the system works.

Why Home Insurance Rises Every Year

There are three big reasons your home insurance premium ticks up each year: inflation, claims history, and risk changes.

Inflation is the biggest driver. Rebuilding your home isn’t the same cost today as it was five years ago. Brick, timber, roofing materials, and labor have all gotten more expensive. In Ireland, construction costs rose by 8.7% between 2022 and 2024, according to the Central Statistics Office. That means if your house was worth €300,000 to rebuild in 2023, it might now cost €326,000. Your insurer has to cover that gap, so your premium rises to match.

Claims history also plays a role. If your area had a spike in flood claims last year - say, after heavy rainfall in County Cork or Galway - insurers will adjust rates for everyone in that region. Even if you never filed a claim, you’re still paying for the collective risk. Similarly, if you made a claim yourself, even for something small like a burst pipe, your personal rate could jump 15-25% the next year.

Risk changes matter too. Did your town install new drainage? Maybe your street got better lighting? Those are good things. But if a new housing development went up nearby, or a local factory closed and left empty buildings, that could increase fire or burglary risk. Insurers track these shifts closely. They use data from the Insurance Authority of Ireland and local councils to update pricing models every six months.

How Much Can You Expect to Pay More?

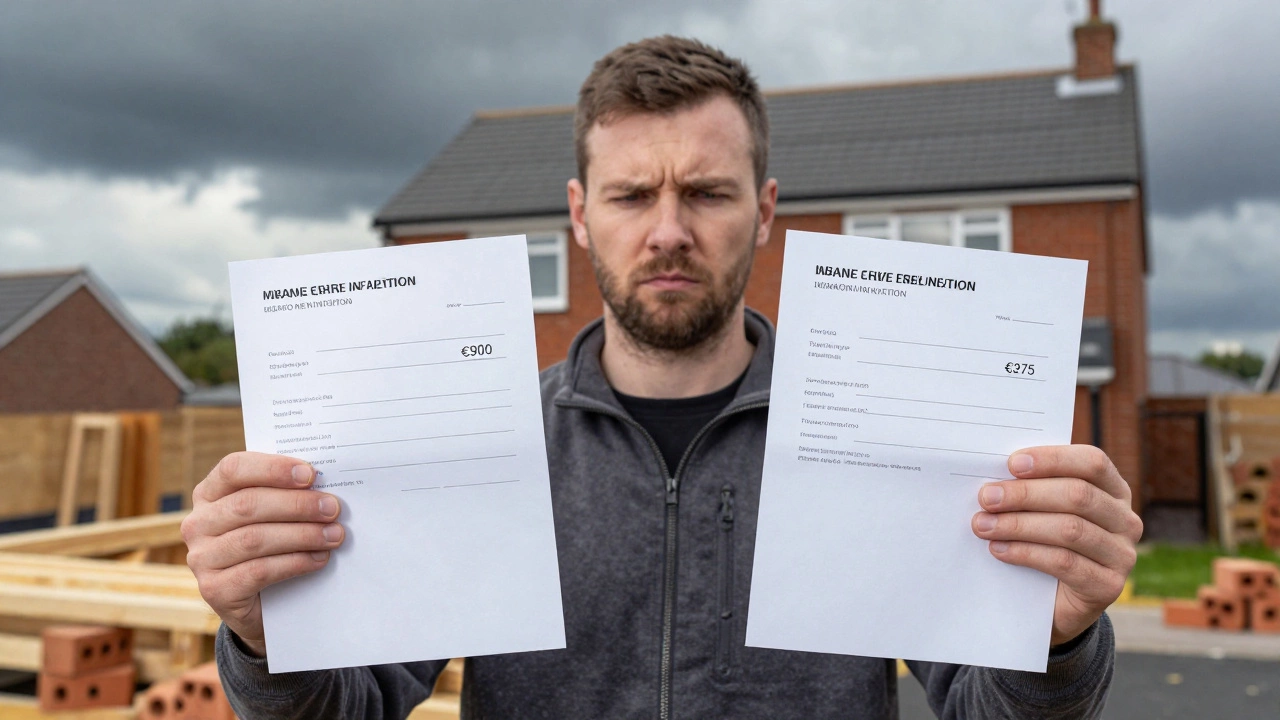

A typical annual increase ranges from 5% to 12%. In 2025, the average home insurance premium in Ireland rose by 8.3%, according to the Irish Insurance Federation. That means if you paid €900 in 2024, you’re likely looking at €975 in 2025.

Some years are worse than others. After the 2023 floods in the Midlands, some households saw hikes of 15% or more. In 2024, following a record number of storm-related claims, insurers raised rates across the board. These spikes aren’t permanent - they usually settle back down after two or three years - but they’re painful when they happen.

It’s also worth noting: your insurer doesn’t have to tell you why your premium went up. They’re not required by law to send a detailed breakdown. You’ll usually just get a renewal letter with a higher number. That’s frustrating, but it’s standard practice.

What You Can Do About It

Just because it’s normal doesn’t mean you have to accept it without question. There are smart ways to fight back.

- Shop around every year. Most people renew automatically. That’s a mistake. The average homeowner in Ireland could save €150-€300 a year just by comparing quotes. Use comparison sites like MoneySuperMarket or ComparetheMarket.ie, but don’t stop there. Call independent brokers. They often have access to niche insurers that don’t appear online.

- Check your sum insured. Many people insure their home for too little. If you’ve added an extension, renovated your kitchen, or bought expensive fixtures, your current coverage might be outdated. But don’t over-insure either - paying for more coverage than you need also drives up costs. Use the CSO Home Rebuilding Cost Calculator to get an accurate figure.

- Improve security. Installing a certified alarm system, deadbolts, or smart locks can reduce your premium by 10-15%. Some insurers even offer discounts for CCTV or motion-sensor lighting. Ask your provider what upgrades qualify.

- Bundle policies. If you also have car insurance, combining it with home insurance often saves 10-20%. But only do this if the bundle is actually cheaper than separate policies. Some companies inflate the home insurance part to make the bundle look good.

- Pay annually. Paying monthly might seem easier, but most insurers charge interest or admin fees. Paying once a year can cut your total cost by 5% or more.

When a Raise Is Unfair

Not every increase is justified. Watch out for these red flags:

- Your premium jumped more than 20% with no change to your home or claims history.

- You’ve been with the same insurer for 10 years and suddenly got a huge hike while competitors lowered rates.

- You’re being charged more than a neighbor with a similar house in the same area.

If any of these happen, ask for a written explanation. If they refuse, file a complaint with the Financial Services and Pensions Ombudsman (FSPO). They’ve handled over 1,200 home insurance disputes in 2024 alone - and won 68% of them for consumers.

What Happens If You Don’t Pay the Increase?

Don’t ignore it. If you don’t pay, your policy will be canceled. That’s dangerous. Most mortgage lenders require home insurance. If you’re uninsured, your lender could step in and force-place insurance - which is almost always more expensive and offers less coverage.

Also, if you’re uninsured and something happens - a fire, a flood, a theft - you’ll be on the hook for the full cost. That could mean losing your home, your savings, or both.

Instead of refusing to pay, talk to your insurer. Many offer payment plans or temporary discounts if you explain financial hardship. They’d rather keep you as a customer than lose you.

Long-Term Trends

Home insurance in Ireland isn’t getting cheaper. Climate change is making storms more frequent. Construction labor shortages are pushing prices up. And with the housing crisis, more people are renting out properties - which insurers see as higher risk.

Experts predict annual increases will stay between 6% and 10% through 2027. That doesn’t mean you should give up. It means you need to be smarter. Treat your home insurance like your energy bill: don’t just accept the renewal. Compare. Negotiate. Adjust.

One final tip: keep a folder of your past renewal letters. Track the year-over-year changes. That way, if your insurer says, "Your premium went up 12% this year," you can say, "But last year it went up 15%. Why the difference?" Sometimes, just asking makes them rethink.

Is it legal for home insurance to increase every year?

Yes, it’s legal. Insurers can raise premiums annually as long as they give you at least 30 days’ notice before renewal. They don’t need to prove the increase is fair, but they must follow the rules set by the Central Bank of Ireland. If the increase seems excessive or arbitrary, you can challenge it through the Financial Services and Pensions Ombudsman.

Can I switch insurers mid-year to avoid a hike?

You can switch anytime, but you’ll likely lose the money you’ve already paid for the year. Most insurers don’t refund unused portions unless you cancel within the 14-day cooling-off period after signing up. If you’re halfway through your policy, switching might not save you money unless the new policy is significantly cheaper. Wait until renewal unless you’re facing a drastic increase.

Why do I pay more than my neighbor for the same house?

Insurers use different data models. One might focus on your postcode’s claim history, another on your credit score or payment history. Even small differences - like how long you’ve been with your insurer, whether you pay monthly or annually, or if you’ve had a previous claim - can lead to different quotes. Your neighbor might have stayed with the same company for 15 years and got a loyalty discount you don’t qualify for.

Do home improvements affect my insurance cost?

Yes - but not always in the way you think. Adding a conservatory or upgrading your roof might increase your sum insured, raising your premium. But if you install a new alarm, fire suppression system, or flood barriers, you might get a discount. Always tell your insurer about renovations - even small ones. If you don’t, and something happens, they might refuse to pay out.

What’s the best way to find cheaper home insurance?

Don’t rely on one comparison site. Use at least two, then call independent brokers. Some insurers only work with brokers. Also, check if your employer, credit union, or professional association offers group rates. In 2025, Dublin residents who used their local credit union’s insurance scheme saved an average of €180 annually. Don’t assume your current insurer is the cheapest - most aren’t.