ISA Savings Calculator

See how many years it takes to save $50,000 within the £20,000 annual ISA limit and calculate your potential tax savings.

Years to Reach $50,000

Tax-Free Interest Earned

Potential Tax Savings

Total Value with Interest

You’ve got $50,000 sitting in a regular savings account, and you’re wondering if you can shove it all into a cash ISA to avoid paying tax on the interest. The short answer? No - not in one year. But there’s a smart way to get close, and it’s not as complicated as you think.

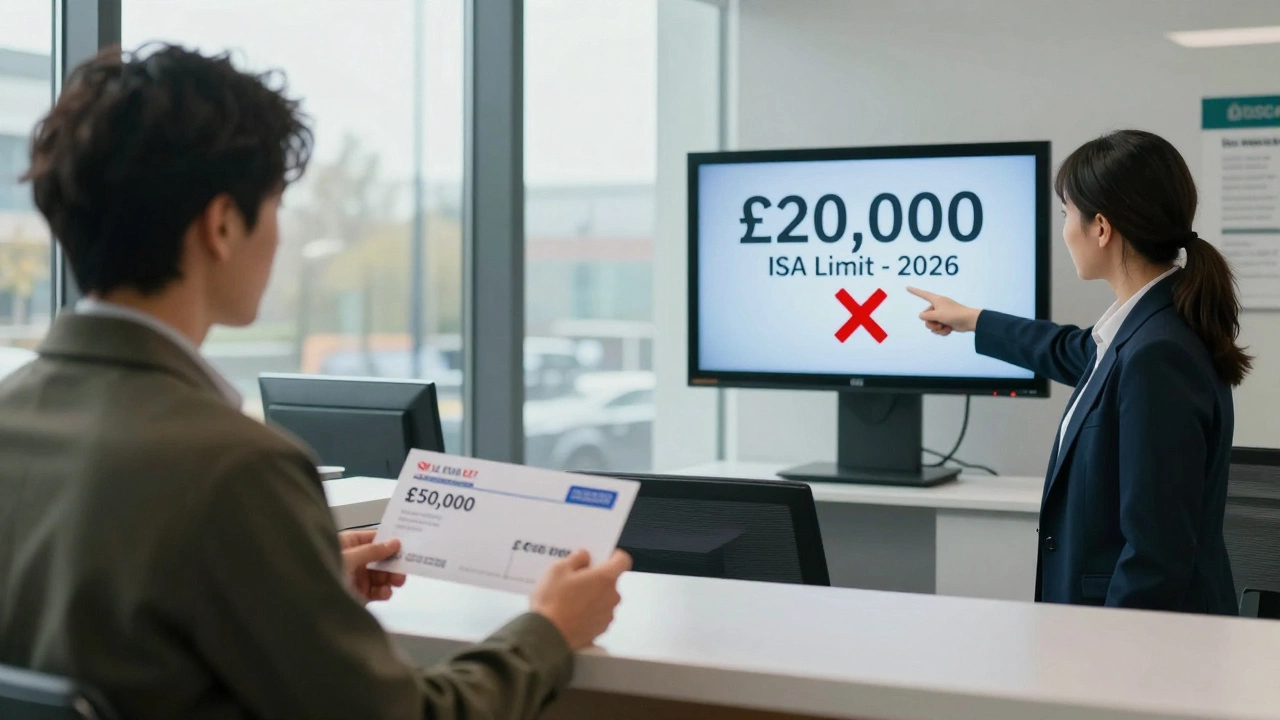

What’s the cash ISA limit in 2026?

The UK government sets a strict annual limit on how much you can put into all your ISAs combined. For the 2025/2026 tax year, that limit is £20,000. That’s about $25,500 USD, depending on the exchange rate. You can’t exceed this, no matter how many cash ISAs you open. Even if you split your money across five different banks, the total you can deposit in a single tax year still caps at £20,000.

Some people think they can carry over unused allowance from last year. They can’t. ISA allowances don’t roll over. If you only put in £5,000 last year, you don’t get to add that leftover £15,000 to this year’s limit. You get £20,000 fresh every April 6th.

Can you put $50,000 in over multiple years?

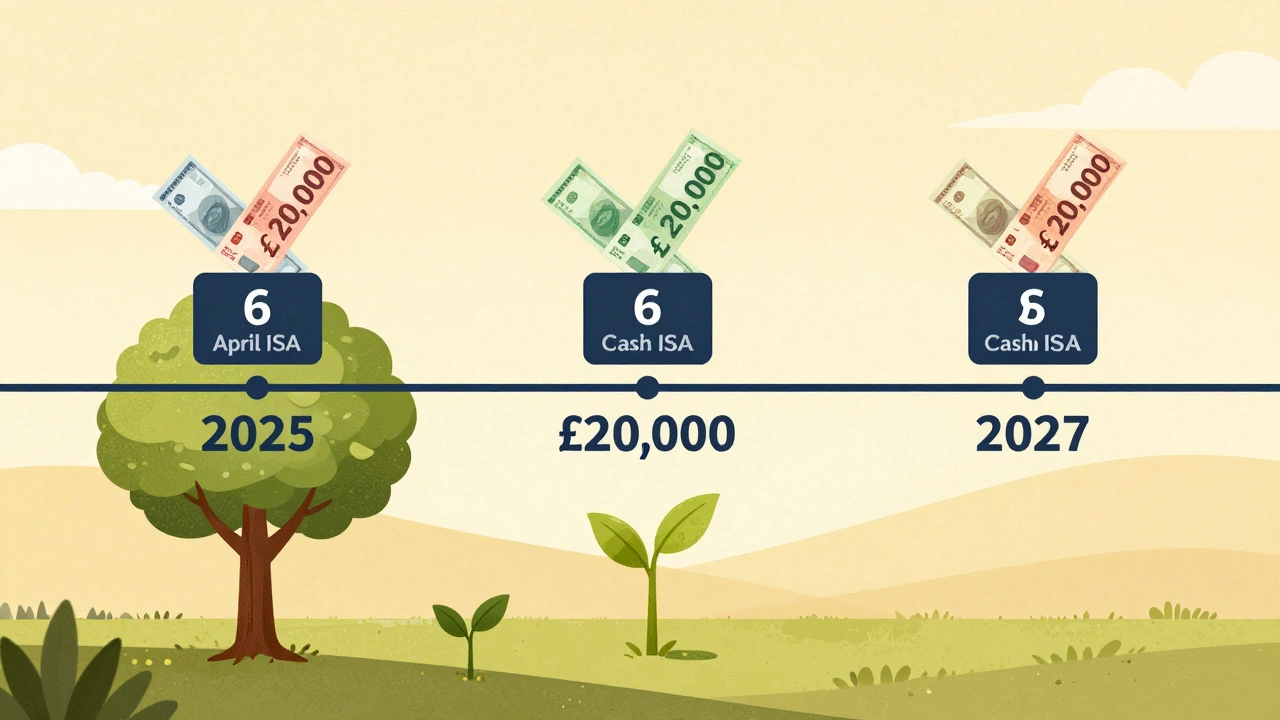

Yes - but not all at once. If you max out your £20,000 allowance every year, you’ll have deposited £60,000 over three years. That’s $76,500 USD. So if you’re planning to move $50,000 into a cash ISA, you can do it in under three years - assuming you’re disciplined and don’t touch the money.

Let’s say you start in April 2025. You put in £20,000. Then again in April 2026, another £20,000. That’s £40,000. Then in April 2027, you put in the final £10,000. Done. In under three years, you’ve moved $50,000 into tax-free savings. The interest you earn on that money? Zero tax. That’s the real power of a cash ISA.

Why not just use a regular savings account?

It comes down to tax. In a regular savings account, any interest you earn over £1,000 (for basic rate taxpayers) or £500 (for higher rate) gets taxed at your income tax rate. So if you’re earning 4% interest on $50,000, that’s $2,000 a year in interest. If you’re a basic rate taxpayer (20%), that’s $400 in tax. In a cash ISA? Zero. Every penny of interest stays yours.

Here’s a real example. Sarah, a teacher in Manchester, put £20,000 into a cash ISA in 2025. Her account pays 4.2%. In one year, she earned £840 in interest. In a regular savings account, she’d have paid £168 in tax. That’s £672 she kept - just by using the right account.

What about other ISA types?

You don’t have to put all £20,000 into cash. You can split it. For example:

- £10,000 in a cash ISA

- £10,000 in a stocks and shares ISA

That’s perfectly legal. In fact, it’s often smarter. Cash ISAs are safe, but they don’t beat inflation over the long term. If inflation is 3% and your cash ISA pays 3.5%, you’re barely keeping up. But if you put half your allowance into a stocks and shares ISA, you might earn 6-8% over time. That’s real growth.

Still, if your goal is to save for a house deposit or an emergency fund, cash ISAs make sense. They’re liquid, safe, and tax-free. Just don’t ignore the long-term value of mixing in some investment.

Can you transfer money from an old ISA?

Yes - and this is where people get tripped up. If you’ve got £15,000 in a cash ISA from last year, you can transfer it to a new provider without touching your current year’s allowance. Transfers don’t count against your £20,000 limit. You can even transfer from a stocks and shares ISA to a cash ISA, or vice versa.

But here’s the catch: never withdraw the money yourself. If you take it out and then put it into a new ISA, it counts as a new contribution. You’ll blow your allowance. Always use the official ISA transfer process. Your new provider will handle it for you - just ask for a transfer form.

What happens if you accidentally overpay?

The ISA rules are strict. If you deposit more than £20,000 in a single tax year - even by mistake - HMRC will find out. They track every ISA contribution through your provider. If you go over, they’ll:

- Remove the excess amount

- Charge you tax on any interest earned on the overpaid amount

- Possibly fine you if it’s repeated

It’s not worth the risk. Always check your total contributions before you deposit. Most providers show your current year’s usage in your online dashboard. If you’re unsure, call them. Better safe than sorry.

Who can open a cash ISA?

You must be:

- A UK resident (or a Crown servant working overseas)

- At least 16 years old for a cash ISA

- Over 18 for a stocks and shares ISA

You can only have one cash ISA per tax year. But you can switch providers anytime. So if you find a better rate, move your money - just use the transfer process. Don’t close and reopen.

What are the best cash ISA rates in 2026?

Rates change often, but as of early 2026, here’s what’s available:

| Provider | Rate (AER) | Fixed Term? | Minimum Deposit | Access Type |

|---|---|---|---|---|

| Atom Bank | 4.85% | Yes (1 year) | £1 | Fixed |

| Yorkshire Building Society | 4.70% | No | £500 | Notice (90 days) |

| Coventry Building Society | 4.65% | No | £1 | Instant |

| Barclays | 4.50% | No | £1 | Instant |

| Monzo | 4.45% | No | £1 | Instant |

Notice accounts require you to give 90 days’ warning before withdrawing. That’s fine if you’re saving for a down payment. But if you need quick access, go for instant access. Rates are still competitive.

What about joint cash ISAs?

You can’t have them. ISAs are personal. Even if you’re married or in a long-term relationship, each person gets their own £20,000 allowance. You can’t combine them. Some couples open separate ISAs and pool their savings - that’s fine. But the government doesn’t recognize joint ISAs.

What if you move abroad?

If you move outside the UK, you can keep your existing ISA and still earn tax-free interest. But you can’t make new contributions after the tax year you left. So if you moved to Spain in January 2026, you can’t put any more money into your ISA after April 5, 2026. Your existing balance? Still protected. The interest? Still tax-free.

Final tip: Use the full allowance every year

Most people leave money on the table. They don’t even hit £10,000. If you can afford it, max out your ISA every year. It’s one of the few truly free financial perks in the UK. Over 10 years, maxing out £20,000 annually with 4% interest gives you over £250,000 in savings - and every pound of interest is yours. No tax. No penalties. Just pure growth.

So can you put $50,000 in a cash ISA? Not in one go. But if you’re patient, disciplined, and use the rules right - you absolutely can. And that’s the real win.

Can I put $50,000 in a cash ISA in one year?

No. The UK ISA allowance for 2025/2026 is £20,000 (about $25,500 USD). You cannot exceed this amount in a single tax year, even if you use multiple providers. Any overpayment will be removed by HMRC and you may be taxed on interest earned from the excess.

Can I transfer money from an old ISA to a new one?

Yes, and you should always do it through a formal transfer. Never withdraw the money yourself. If you take it out and then deposit it into a new ISA, it counts as a new contribution and will eat into your current year’s £20,000 allowance. Use your new provider’s transfer form - they’ll handle the rest.

Do I pay tax on cash ISA interest?

No. One of the main benefits of a cash ISA is that all interest earned is completely tax-free. Whether you’re a basic, higher, or additional rate taxpayer, you keep every penny of interest. This makes it ideal for saving short-term goals like a house deposit or emergency fund.

Can I have more than one cash ISA?

You can only pay into one cash ISA per tax year. But you can switch providers at any time by transferring your balance. You can also hold old ISAs from previous years - they just don’t count toward your current year’s £20,000 limit.

What happens if I move to another country?

You can keep your existing ISA and continue earning tax-free interest. But you cannot make new contributions after the tax year you leave the UK. For example, if you move abroad in January 2026, you can’t add more money after April 5, 2026. Your existing balance stays protected with no tax on interest.