Real Return Calculator

Calculate Your Real Savings Growth

See how inflation affects your high-yield savings account. Based on U.S. FDIC limits ($250k) and EU limits (€100k).

Results

Your purchasing power is decreasing. This is the inflation risk mentioned in the article.

Key insight: High-yield savings protects your principal but doesn't protect against inflation. If your APY is lower than inflation rate, your purchasing power decreases.

People hear "high-yield" and think it means high risk. That’s a myth. You won’t lose your principal in a high-yield savings account - not if it’s with a legitimate bank or credit union in the U.S. or EU. But that doesn’t mean it’s risk-free. Let’s cut through the noise.

Your money is protected - up to a point

In the United States, accounts at FDIC-insured banks are protected up to $250,000 per depositor, per institution. In the European Union, the equivalent is the Deposit Guarantee Scheme, which covers up to €100,000 per person, per bank. That means if the bank fails, your money comes back. No ifs, ands, or buts.

That protection is automatic. You don’t need to apply for it. You don’t need to pay extra. Just make sure the bank displays the FDIC or EU deposit guarantee logo. If you’re unsure, check the bank’s website footer or call customer service. If they can’t tell you right away, walk away.

But here’s what most people miss: this protection only covers the principal. It doesn’t protect you from losing purchasing power.

Inflation is the real enemy

Let’s say you put €10,000 into a high-yield savings account earning 4.5% APY. That’s great - you’ll make €450 in a year. Sounds like a win.

But what if inflation is 5%? Your money grew, but prices grew faster. That €10,450 buys you less than your original €10,000 did a year ago. You didn’t lose cash. You lost value.

This isn’t theoretical. In 2022, inflation in the U.S. hit 9.1%. Even the best savings accounts at the time only paid around 4.5%. People who kept all their cash in savings saw their real wealth shrink for over a year. Same thing happened in the EU in 2023.

High-yield savings accounts aren’t designed to beat inflation. They’re designed to be safer than keeping cash under your mattress. If you want to grow wealth over time, you need other tools - stocks, bonds, real estate. But for short-term goals? This is still the safest place to park your emergency fund.

What about fees? Can they eat your money?

Some banks charge monthly maintenance fees. Others charge for excessive withdrawals. Some require minimum balances to earn the advertised rate.

Here’s the deal: if you’re shopping for a high-yield savings account, avoid anything with fees unless you’re absolutely sure you’ll never trigger them. Most online banks offer truly fee-free accounts with no minimums. Why pay for something you can get for free?

For example, Ally Bank, Marcus by Goldman Sachs, and many EU-based digital banks like N26 or Revolut offer 4%+ APY with no fees and no minimum balance. You don’t need to jump through hoops. Just compare the fine print. Look for: "no monthly service fee," "no minimum balance," and "no withdrawal limits." If those aren’t listed, keep looking.

What if the bank goes under? Will I get my money back?

Yes - if you’re within the insurance limit. The FDIC and EU deposit schemes don’t just promise protection. They’ve paid out billions during bank failures. The last major U.S. bank collapse was Silicon Valley Bank in March 2023. The FDIC stepped in within 48 hours. Customers got their full insured amounts back, even before the bank was sold.

In the EU, the process is similar. When a bank fails, the national deposit guarantee scheme pays out within seven working days. That’s faster than most credit card disputes.

But here’s the catch: if you have more than €100,000 (or $250,000) in one bank, the excess isn’t covered. So if you’re sitting on €150,000, split it between two banks. One at €100,000, the other at €50,000. Simple. Safe.

Can interest rates drop and hurt me?

Yes - but not the way you think. You won’t lose money. But you might earn less.

High-yield savings accounts have variable rates. That means the bank can lower the APY at any time. In 2024, many accounts dropped from 5.25% to 4.1% as the Federal Reserve cut rates. That’s a 22% drop in earnings.

That’s frustrating, but it’s not a loss. You still have your original deposit. The rate change just means your money grows slower. If you’re saving for a house down payment in two years, that’s fine. If you’re counting on 5% returns to fund your retirement? That’s a problem.

Tip: Don’t pick a savings account based on the highest rate today. Pick one based on reliability, low fees, and easy access. Rates change. Your needs shouldn’t.

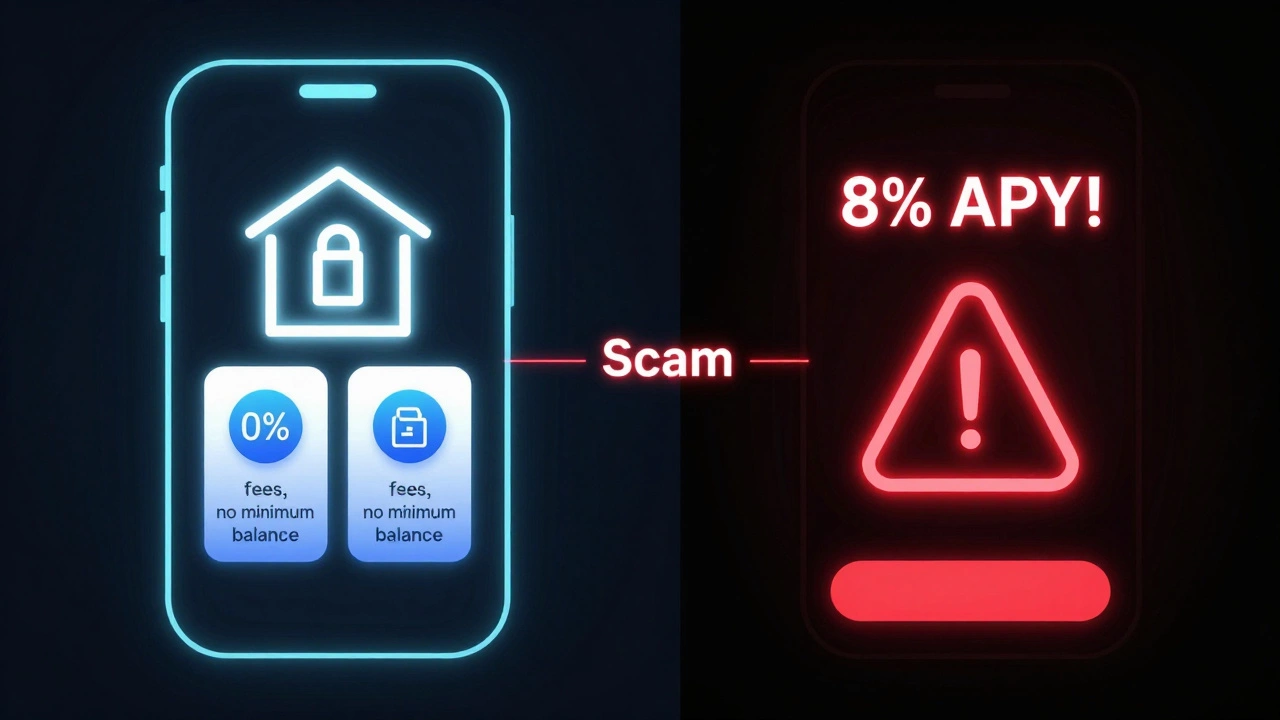

What about scams? Can I get hacked?

Yes - but not because of the account type. Fraud happens through phishing, weak passwords, or malware. Your savings account isn’t the target. Your login is.

Use two-factor authentication. Never click links in emails claiming to be from your bank. Use a password manager. If your bank offers biometric login (fingerprint or face ID), turn it on.

Real banks will never call you asking for your password. If they do, hang up. Report it.

And never share your account details with anyone - not a "financial advisor," not a "tech support rep," not even your cousin who "knows someone."

Is there ever a case where you lose money?

Only if you do one of these three things:

- You deposit more than the insured limit and the bank fails.

- You fall for a scam and give away your login details.

- You confuse a high-yield savings account with a risky investment - like a crypto savings product or a peer-to-peer lending platform.

Those last two are the real dangers. There are plenty of apps that say "earn 8% on your savings" - but they’re not banks. They’re unregulated platforms. They don’t have FDIC or EU deposit insurance. If they go under, you’re out of luck.

Stick to regulated banks and credit unions. If it’s not a bank, it’s not a savings account. It’s a gamble.

So - can you lose money?

No, not if you play it right.

You won’t lose your principal. You won’t get robbed by the bank. You won’t be left with nothing if the institution fails.

But you can lose buying power. You can earn less than you hoped. You can get tricked by fake platforms pretending to be banks.

High-yield savings accounts are the safest place to keep cash you need in the next 1-5 years. Emergency fund? Check. Vacation fund? Check. Down payment stash? Check.

But if you’re trying to build wealth over 10+ years? That’s where investing comes in. Savings accounts are your safety net - not your rocket ship.

Keep your money where it’s protected. Know the limits. Watch for inflation. Avoid scams. And don’t let the word "high-yield" fool you into thinking you’re getting something extraordinary. You’re just getting what you’re supposed to: safe, steady growth with zero risk to your principal.