40-40-20 Budget Calculator

Budget Calculator

This tool applies the 40-40-20 budget rule to help you plan your debt consolidation strategy. Enter your take-home pay and see how much you can allocate to needs, debt repayment, and wants.

Debt Repayment Estimate

Using the 40-40-20 rule, here's how much you can pay toward debt each month.

Note: The actual payoff time may vary based on interest rate fluctuations and payment consistency.

The 40-40-20 budget rule is a simple way to manage your money when you're trying to get out of debt. It doesn’t require fancy apps, complicated spreadsheets, or years of financial training. You just divide your take-home pay into three buckets: 40% for needs, 40% for debt repayment and savings, and 20% for wants. It’s not magic, but it works - especially if you’re drowning in credit card balances, medical bills, or personal loans.

How the 40-40-20 Rule Actually Works

Let’s say you bring home €3,000 a month after taxes. Under the 40-40-20 rule:

- €1,200 goes to needs - rent, groceries, utilities, basic transportation, minimum debt payments

- €1,200 goes to debt repayment and savings - paying extra on loans, building an emergency fund, contributing to retirement

- €600 goes to wants - dining out, streaming services, clothes, vacations, hobbies

The magic isn’t in the numbers - it’s in the discipline. Most people think they need to cut everything fun to get out of debt. But the 40-40-20 rule says: you can still have a life while paying off debt. The key is making sure your debt repayment gets the same priority as your rent.

Why This Rule Works Better Than 50/30/20 for Debt

You’ve probably heard of the 50/30/20 rule: 50% needs, 30% wants, 20% savings. It’s popular. But if you’re carrying high-interest debt, that 20% for savings isn’t enough. Credit card interest alone can eat up €200-€400 a month. That’s more than half of your "savings" bucket.

The 40-40-20 rule flips the script. Instead of treating debt repayment as an afterthought, it gives it equal weight to your basic living costs. In Dublin, where rent averages €1,800 and groceries cost €400+, squeezing debt repayment into 20% leaves you stuck. But with 40% dedicated to paying down what you owe, you’re not just making minimum payments - you’re actually shrinking your balance.

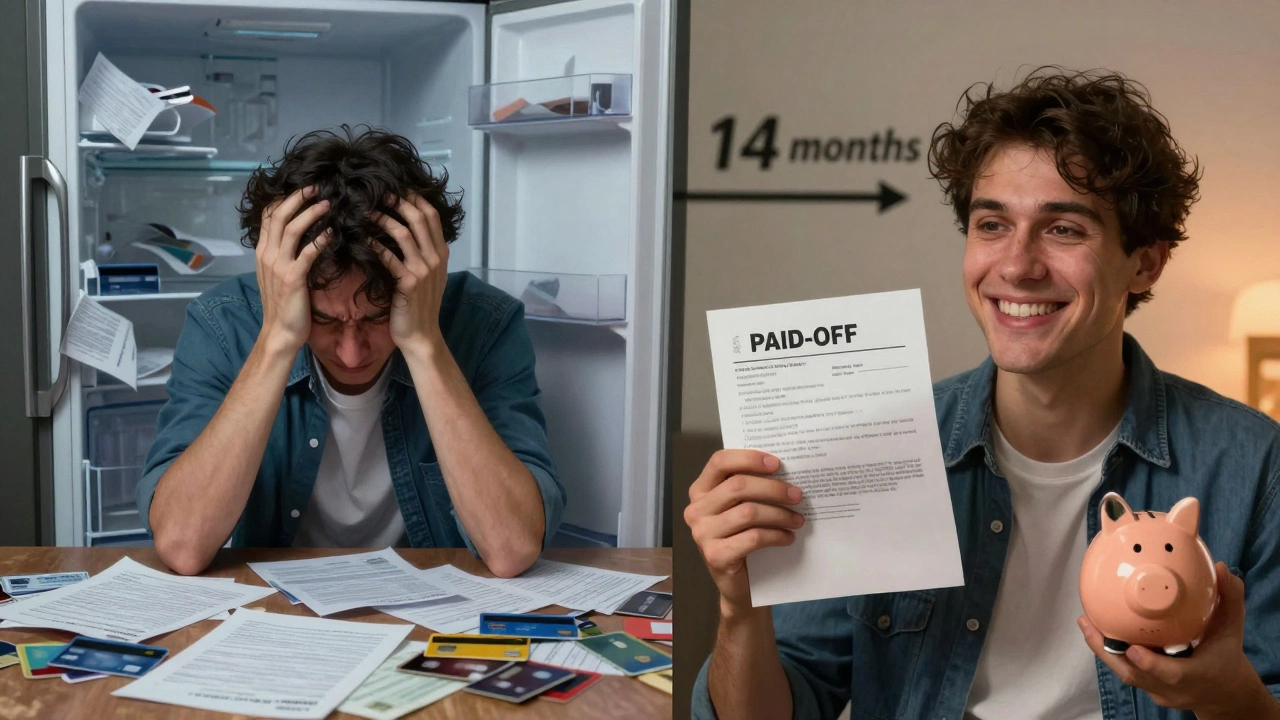

Real example: Maria, a teacher in Dundalk, had €15,000 in credit card debt at 18% APR. She was paying €300 a month - barely covering interest. She switched to the 40-40-20 rule. Her take-home pay was €2,800. She moved €1,120 to debt repayment. Within 14 months, she was debt-free. She didn’t get a raise. She didn’t win the lottery. She just moved money from "wants" to "debt."

What Counts as a "Need"?

Not everything you think is a need actually is. A "need" is something you can’t live without - and you can’t delay it without serious consequences.

- ✅ Rent or mortgage payment

- ✅ Groceries and essential household supplies

- ✅ Basic utilities: electricity, water, heating, internet (if you work from home)

- ✅ Minimum payments on all debts

- ✅ Necessary transportation: bus pass, fuel for work commute, car maintenance

- ✅ Essential healthcare: prescriptions, doctor visits

❌ Not needs: gym membership (unless your job requires it), premium phone plans, Netflix, pet food (unless you’re a service animal owner), luxury toiletries, subscriptions you haven’t used in months.

Track your spending for two weeks. If you’re spending €200 on coffee and takeout, that’s not a need - it’s a want. And that’s where the 40-40-20 rule helps you redirect money.

What Goes Into the 40% Debt and Savings Bucket?

This is the engine of the rule. Half your income goes to breaking free from debt and building safety nets. But here’s the catch: you don’t split it 50/50. You prioritize debt first.

Use this order:

- Pay more than the minimum on your highest-interest debt (credit cards, payday loans)

- Build a €1,000 emergency fund - just enough to cover a flat tire or broken fridge

- Keep paying extra on debt until it’s gone

- Then shift that entire 40% to savings: retirement, house fund, vacation

Why start with €1,000? Because when your car breaks down and you can’t afford a €600 repair, you’ll just put it on a credit card. That’s how debt comes back.

Once your debt is paid off, that 40% becomes your new savings superpower. You can save €1,200 a month - faster than most people save €300.

How to Handle Irregular Income

If you’re self-employed, freelance, or work shifts, your income changes every month. The 40-40-20 rule still works - you just need to adjust.

Use your average monthly income over the last six months. If you earned €2,500, €3,200, €2,800, €3,100, €2,700, and €3,000, your average is €2,850. Use that number to calculate your buckets.

When you have a high-income month, put the extra into your debt/savings bucket. When you have a low-income month, you still stick to your percentages. You might cut back on "wants" more than usual - but you won’t skip debt payments.

One Dublin freelancer, Liam, used this method to pay off €22,000 in student loans and medical bills in 22 months. He didn’t make more money - he just stopped treating his "wants" like they were emergencies.

Common Mistakes People Make

Even when people know the rule, they mess it up. Here are the top three:

- Putting savings before debt - If you have a credit card at 22% APR, you’re losing money by saving €100 while paying €200 in interest. Pay off the debt first.

- Ignoring minimum payments - The 40% is for extra payments. You still have to pay the minimum on everything. Otherwise, you’ll hurt your credit score.

- Letting "wants" creep into "needs" - Buying organic groceries because "it’s healthier"? That’s a want. Buying rice and beans to feed your family? That’s a need.

Also, don’t try to do this alone. If you’re overwhelmed, talk to a free money advisor through Money Advice and Budgeting Service (MABS). They help thousands in Ireland each year - no fees, no pressure.

What Happens After You’re Debt-Free?

When your last debt payment clears, you don’t go back to spending. You upgrade your 40% bucket.

Now, instead of paying €1,200 to debt, you save €1,200. That’s €14,400 a year - enough for a down payment on a house, a car replacement, or early retirement contributions.

Some people shift to 20% needs, 40% savings, 40% wants. Others keep 40-40-20 and just stop paying debt. Either way, you’ve built a habit: your money works for you, not against you.

One woman in Galway paid off €30,000 in debt using this rule. Two years later, she bought a small apartment with cash. She didn’t wait for the "perfect time." She just kept moving money from "wants" to "freedom."

Is the 40-40-20 Rule Right for You?

It’s not for everyone. But if you’re:

- Struggling to make progress on your debt

- Feeling like you’re working hard but getting nowhere

- Worried your savings will never catch up

Then this rule gives you structure without starvation. You don’t have to live like a monk. You just have to be honest about what you need - and what you just want.

Start small. Track your spending for one week. Calculate your take-home pay. Then try the 40-40-20 split. See how it feels. You might be surprised how fast your debt shrinks - and how much lighter you feel.

Can I use the 40-40-20 budget rule if I have student loans?

Yes. Student loans count as debt in the 40% bucket. If they’re high-interest (like private loans), pay them off before focusing on savings. If they’re government-backed with low rates, you can pay the minimum and still put extra into higher-interest debts first.

What if my rent is more than 40% of my income?

If rent eats up more than 40%, you’re in a tough spot. This rule won’t work until you reduce housing costs. Consider moving to a cheaper area, getting a roommate, or negotiating with your landlord. Housing is the biggest expense for most people - and it’s the first place to fix if you’re stuck in debt.

Does the 40-40-20 rule work with debt consolidation loans?

Yes - and it’s actually ideal. A consolidation loan simplifies multiple debts into one payment. Put that payment into your 40% debt bucket. Then use the extra money you used to pay on multiple cards to build savings. Don’t use the freed-up credit cards - that’s how people end up back in debt.

How long does it take to see results with the 40-40-20 rule?

Most people see their debt shrink by 20-30% within four months if they stick to the plan. Full debt freedom usually takes 12-24 months, depending on how much you owe. The faster you pay extra, the sooner you’ll feel the relief.

Is the 40-40-20 rule better than debt snowball or avalanche?

It’s not a replacement - it’s a container. The snowball (pay smallest debt first) and avalanche (pay highest interest first) are strategies for which debt to tackle first. The 40-40-20 rule tells you how much to pay overall. Use avalanche inside the 40% bucket for fastest results.

Next Steps: Try It This Week

Here’s what to do right now:

- Check your last payslip. Write down your take-home pay.

- Track every euro you spent for 7 days - even coffee and bus tickets.

- Sort your spending into needs, debt/savings, and wants.

- Calculate what 40%, 40%, and 20% of your income would be.

- Ask yourself: where can I move money from wants to debt?

You don’t need to be perfect. Just start. One month from now, you’ll look back and wonder why you didn’t try this sooner.