Archive: 2026/01

A pension plan is your key to financial security in retirement. Learn how workplace, private, and State pensions work in Ireland, how much you need to save, and why starting now changes everything.

Read More

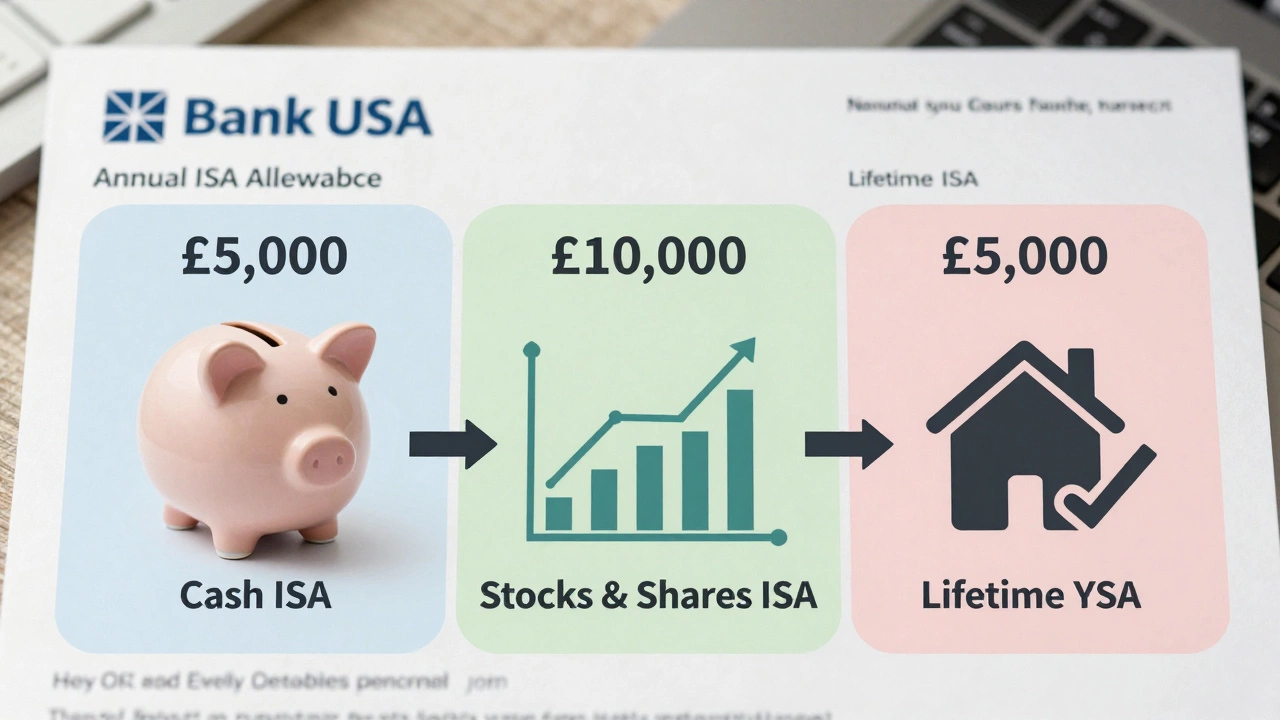

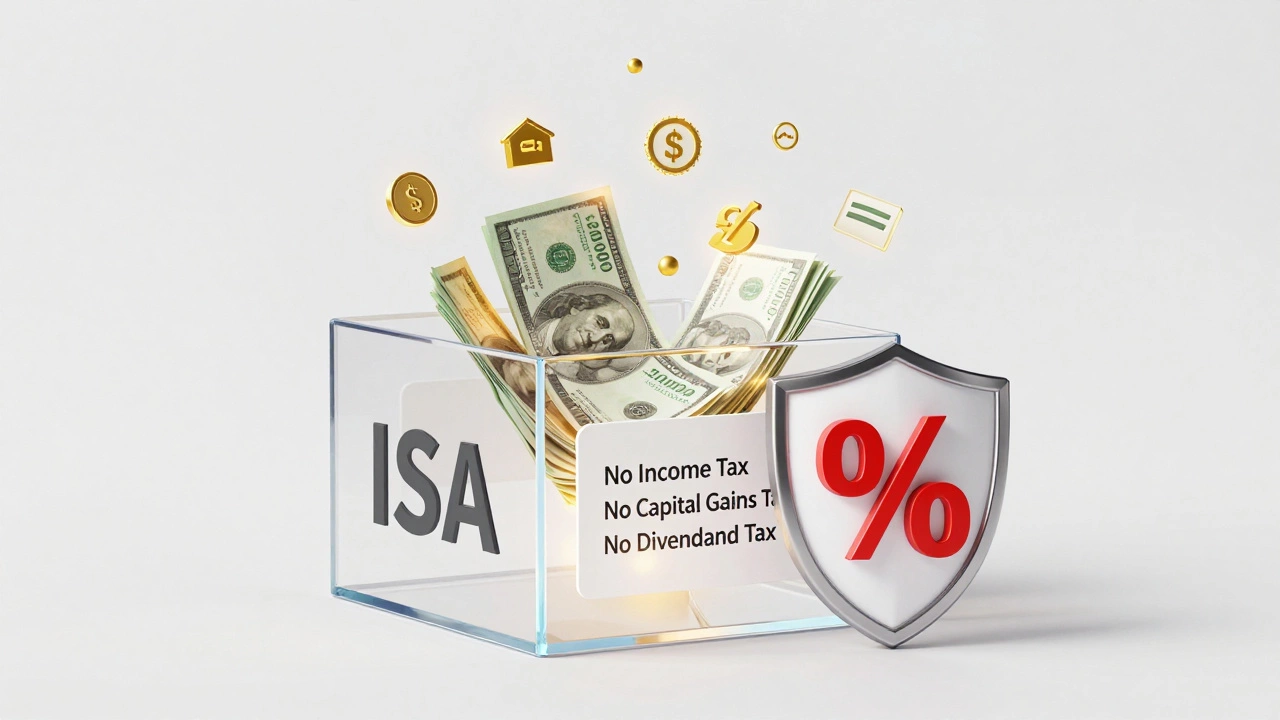

You can't put $20,000 in a UK cash ISA because the allowance is £20,000 (about $25,000) and must be split across all ISA types. Learn how to use your full allowance wisely.

Read More

The cheapest way to take equity out of your home in Ireland is usually a home equity loan or cash-out refinance. Reverse mortgages work if you're over 62 and have no income. Avoid high-cost alternatives and always get independent advice.

Read More

How long will $1 million last in retirement? In 2026, it depends on where you live, what you own, and how you spend. A realistic breakdown for retirees in Ireland shows that $1 million can last - but only with smart planning, downsizing, and using your State Pension.

Read More

A $300,000 annuity pays between $1,800 and $2,700 per month at retirement, depending on age, gender, and payout options. Learn how interest rates, insurance companies, and payment structures affect your income in 2026.

Read More

If you can't get a loan, there are still ways to get cash fast-sell items, use pawn shops, ask for an advance, apply for grants, or borrow from credit unions. No credit check needed.

Read More

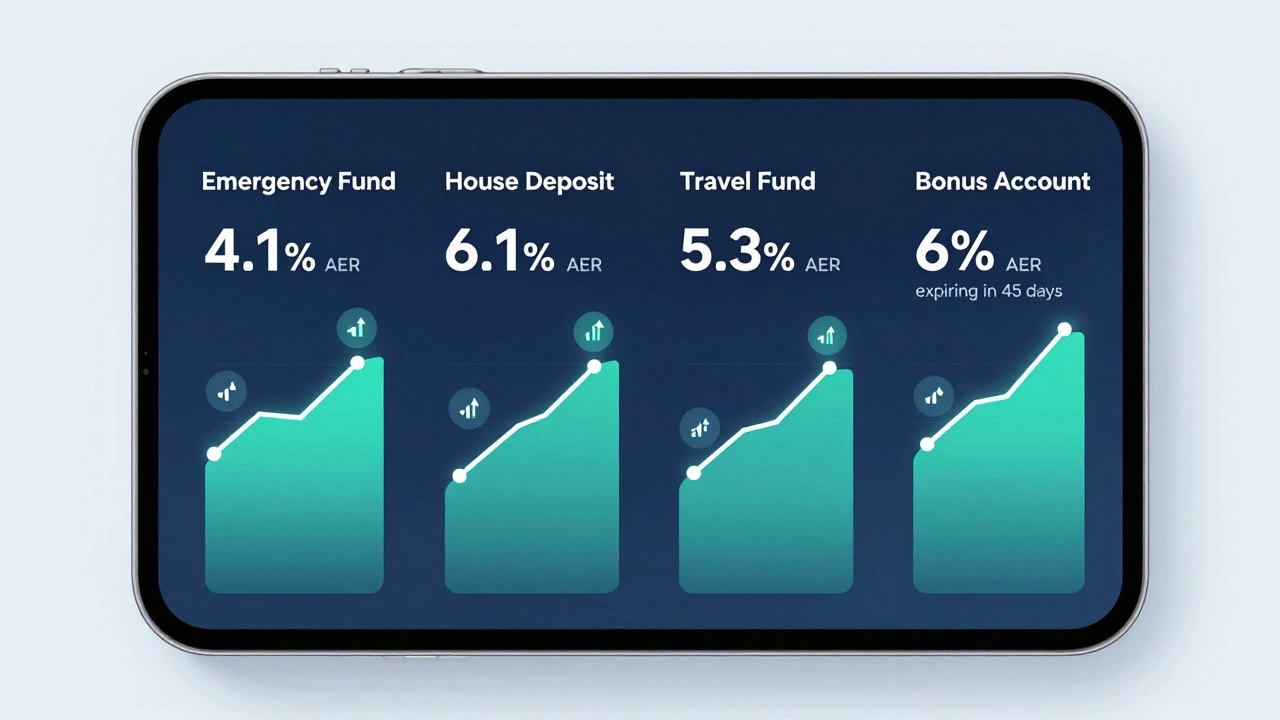

Find out which savings account is best for saving money in 2026 in Ireland, including high-interest options, notice accounts, fixed-term deals, and how to avoid common traps. Learn how to split your savings for maximum growth and safety.

Read More

Debt relief can hurt your credit, but not all types do. Debt settlement damages scores, while debt management plans and consolidation loans may help. Learn how each option affects your credit and how to recover.

Read More

The emergency fund is the only budget line that should come before everything else. Without it, every financial plan is fragile. Learn how to build one step by step - even if you’re starting with €10.

Read More

You can ask your car lender to lower your rate-especially if your credit improved or market rates dropped. Learn how to negotiate, when to refinance, and how much you could save on your car loan.

Read More

ISA accounts let you save or invest up to £20,000 a year tax-free in the UK. Learn how Cash, Stocks and Shares, and other ISAs work, what you can and can't do, and how to avoid common mistakes in 2026.

Read More