Emergency Fund Calculator

Calculate Your Emergency Fund

Determine how much you need to save for financial security based on your essential monthly expenses.

Your Emergency Fund Target

Minimum Target (3 months):

Recommended Target (6 months):

Time to reach minimum target:

Important Rules

Only use your emergency fund for true emergencies:

- Medical bills you didn't plan for

- Car breakdown that stops you from working

- Loss of income (job, freelance work)

- Urgent home repairs

When you’re trying to get your finances under control, it’s easy to get lost in the noise. Pay off credit cards? Save for a vacation? Build a side income? Cut out coffee? Everyone has a different answer. But here’s the truth most people miss: the budget that should always come first isn’t about debt or savings or even groceries. It’s about protecting your ability to keep showing up.

The Only Budget Line That Keeps Everything Else Alive

Think about your income like water flowing into a house. If the foundation cracks, everything else floods. That’s why the first line in every budget - the one you pay before anything else - should be your emergency fund. Not your rent. Not your student loans. Not even your phone bill. Your emergency fund.This isn’t a suggestion from a financial guru on YouTube. This is what happens when people skip it. A friend of mine in Dublin lost her job last year. She had $3,000 saved. When her income stopped, she used that money to cover rent, groceries, and her daughter’s school supplies. No loans. No panic. No selling her laptop. She had six weeks to find a new job without losing her home.

That’s the power of a real emergency fund. It’s not a luxury. It’s your financial airbag. And if you don’t have one, nothing else you do with your money matters long-term.

How Much Is Enough? (And No, $1,000 Isn’t It)

You’ve heard the advice: save three to six months of expenses. That’s correct - but it’s useless if you don’t know what that actually looks like in your life.Start with your non-negotiables. Rent or mortgage. Utilities. Basic groceries. Transportation. Minimum debt payments. Add them up for one month. Then multiply by three. That’s your starting point.

For example, if your essential monthly costs are €1,800, your emergency fund target is €5,400. If you live in a city with high rent or variable bills - like Dublin - aim for €7,200 or more. Why? Because emergencies don’t wait for payday. A broken boiler in winter. A sudden medical bill. A car repair that hits right before rent is due. These aren’t rare. They’re normal.

And no, your credit card isn’t your emergency fund. Carrying a balance at 22% interest while you "save" for a rainy day is like pouring water into a bucket with a hole. You’re losing more than you’re gaining.

Where Do You Even Start? (The Real Way)

Most people try to save €500 a month. They fail. Then they give up. That’s not because they’re lazy. It’s because they’re trying to do it backward.Here’s the only method that works: Pay yourself first - literally. Set up an automatic transfer the day after you get paid. Not the end of the month. Not when you feel like it. Right after your paycheck lands.

Start small. €25 a week. €100 a month. Doesn’t matter. What matters is consistency. Open a separate savings account. Not your main one. Not your joint account with your partner. A standalone account you can’t touch unless it’s a real emergency. Name it something like "Survival Fund" so you don’t confuse it with "Vacation Money."

Then, every time you get a raise, bonus, or tax refund, put half of it straight into that account. No thinking. No debating. Just move it. In six months, you’ll have €600. In a year, you’ll have €1,500. That’s enough to cover a flat tire or a lost phone. And that’s the first win.

After that, you build momentum. Every time you pay off a small debt, redirect that payment to your emergency fund. Every time you cut a subscription, add that amount to your weekly transfer. You’re not saving money. You’re reinvesting freedom.

What Counts as an Emergency? (The Hard Truth)

People treat their emergency fund like a general-purpose stash. They use it for a new TV. A weekend trip. A birthday gift. That’s not an emergency. That’s poor planning.Real emergencies are things that threaten your safety, health, or ability to earn. Here’s the list:

- Medical bills you didn’t plan for

- Car breakdown that stops you from getting to work

- Loss of income (job, freelance work, gig economy)

- Urgent home repairs (leaking roof, broken heating in winter)

- Legal fees from an unexpected situation

- Essential travel for a family emergency

Here’s what doesn’t count:

- Buying a new phone because yours is "slow"

- Going on vacation because you "deserve it"

- Replacing your couch because you don’t like the color

- Paying for a wedding gift you can’t afford

If you’re not sure, ask: "Will this stop me from working, staying safe, or keeping a roof over my head?" If the answer is no, don’t touch it. That’s not an emergency. That’s a choice.

What Happens When You Don’t Have One?

I’ve seen too many people in Dublin - smart, hardworking people - get crushed by one small crisis. A child gets sick. The car needs a new transmission. The landlord raises the rent. They reach for their credit card. Then another. Then a personal loan. Suddenly, they’re paying €300 a month in interest on a €2,000 debt.That’s not debt. That’s a trap. And it’s avoidable.

Without an emergency fund, every surprise becomes a crisis. And every crisis makes you more likely to make bad financial decisions. You take a high-interest loan. You skip your medication. You work a second job that burns you out. You lose sleep. You lose control.

That’s why the emergency fund isn’t just a line item. It’s your peace of mind. It’s your freedom to say no. It’s your power to wait instead of panic.

The One Habit That Builds It Without Thinking

The best part? You don’t need to be perfect. You don’t need to track every euro. You just need to make it automatic.Set up a direct debit from your main account to your emergency fund. Even €15 a week. Do it on the same day you get paid. Set a reminder on your phone: "Pay yourself first. Always."

After six months, check your balance. If it’s under €1,000, increase the amount. If it’s over €2,000, celebrate. Then keep going. You’re not saving for a goal. You’re building a shield.

And here’s the secret: once you have even a small emergency fund, everything else gets easier. You stop worrying about small expenses. You stop feeling trapped. You start making smarter choices because you’re not in survival mode anymore.

What Comes Next? (The Real Budget)

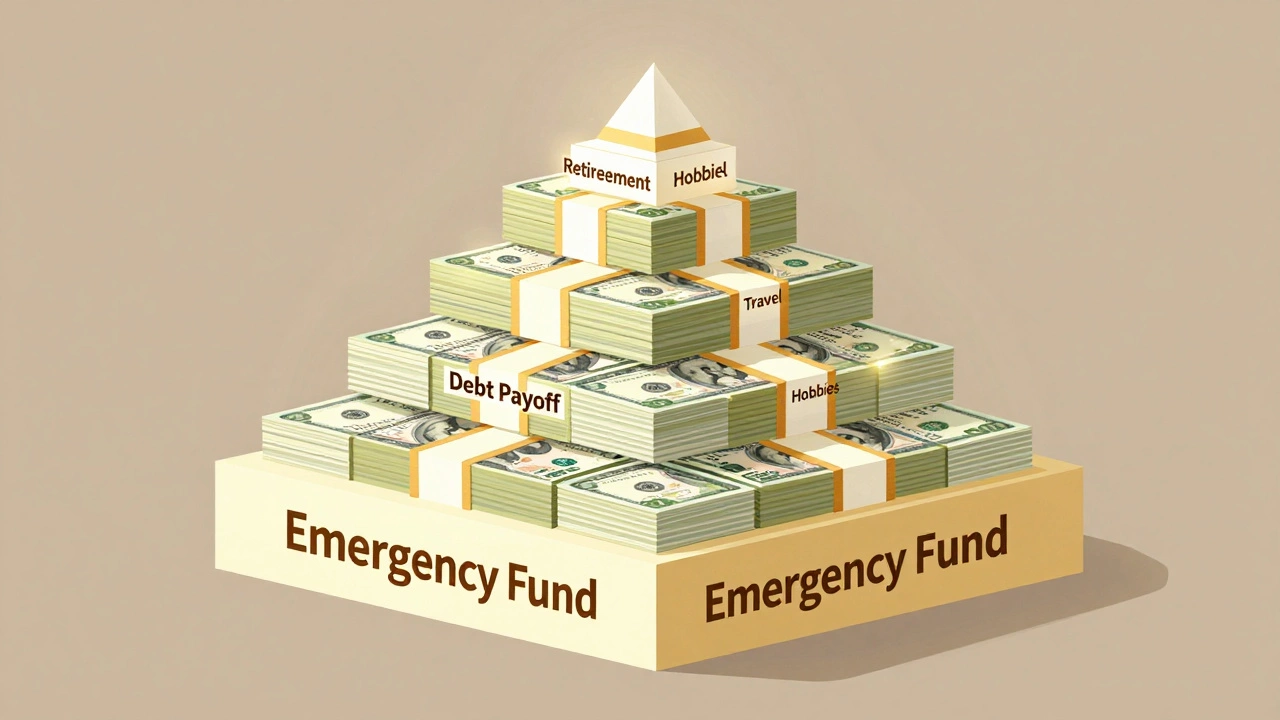

Once your emergency fund hits your target, then you can start thinking about other things: paying off debt, saving for a house, investing. But none of that matters if you don’t have a buffer.Think of your budget like a pyramid. The base is your emergency fund. Without it, the whole structure collapses. Everything else - debt payoff, retirement, travel, hobbies - sits on top. You can’t build the top without the bottom.

So before you make your next budget spreadsheet, ask yourself: Do I have a real emergency fund? Is it accessible? Is it growing? If the answer is no, that’s your only job right now. Not paying off your credit card. Not saving for a new car. Just this one thing.

Because when the next surprise hits - and it will - you won’t be scrambling. You’ll be calm. And that’s worth more than any budget trick ever could.

What if I can’t afford to save right now?

Even €5 a week counts. Start with what you can. Save €10 from your next paycheck. Put it in a jar or a separate account. The goal isn’t to save big - it’s to build the habit. Once you start, you’ll find ways to save more. Small steps add up faster than you think.

Should I use my emergency fund to pay off debt?

Only if you have no other option and you’re in danger of losing your home, job, or health. Otherwise, no. Paying off debt with your emergency fund leaves you vulnerable. Instead, pay your minimums and keep building your fund. Once your fund is full, then focus on debt. The goal is to avoid needing to use it in the first place.

Where should I keep my emergency fund?

In a savings account that’s easy to access but not too easy. Avoid checking accounts - you’ll spend it. Avoid high-risk investments. Look for an online savings account with no fees, good interest, and instant withdrawal. In Ireland, banks like Permanent TSB, AIB, or credit unions offer these. Make sure you can get the money within 24 hours if you need it.

Is an emergency fund the same as a rainy day fund?

No. A rainy day fund is for small, predictable surprises - like a broken appliance or a missed paycheck. An emergency fund is for life-altering events - job loss, medical crisis, major repairs. You need both. Start with the emergency fund first. Once it’s full, then build a smaller rainy day fund (€500-€1,000) for minor issues.

How long does it take to build an emergency fund?

It depends on your income and how much you can save. Most people build a €3,000-€5,000 fund in 6 to 18 months. If you’re saving €100 a month, it’ll take 30 to 50 months. But if you increase your savings after paying off a debt or getting a raise, you can cut that time in half. The key is consistency, not speed.

If you’ve read this far, you already know what matters. It’s not about cutting out lattes or using cash envelopes. It’s about building a foundation so strong that nothing knocks you off your feet. Start today. Even if it’s just €10. Because the budget that comes first isn’t about money. It’s about safety.