ISA Allocation Calculator

The UK's annual ISA allowance is £20,000 (as of 2025/2026 tax year). This calculator helps you determine the best allocation across different ISA types for maximum growth and financial goals.

Note: Lifetime ISA contributions are limited to £4,000 annually with a 25% government bonus.

Projected Growth

Cash ISA

5% AER interest rate

Stocks & Shares ISA

7% annual return

Lifetime ISA

25% government bonus + 7% growth

If you’re wondering whether you can put $20,000 into a cash ISA every year, the short answer is: no-but not because you can’t save that much. It’s because the UK government sets a strict annual limit, and $20,000 is way above it. In the 2025/2026 tax year, the ISA allowance is £20,000, which is roughly $25,000 USD. But even that’s the total you can put across all your ISAs-not just cash ones.

How the ISA Allowance Actually Works

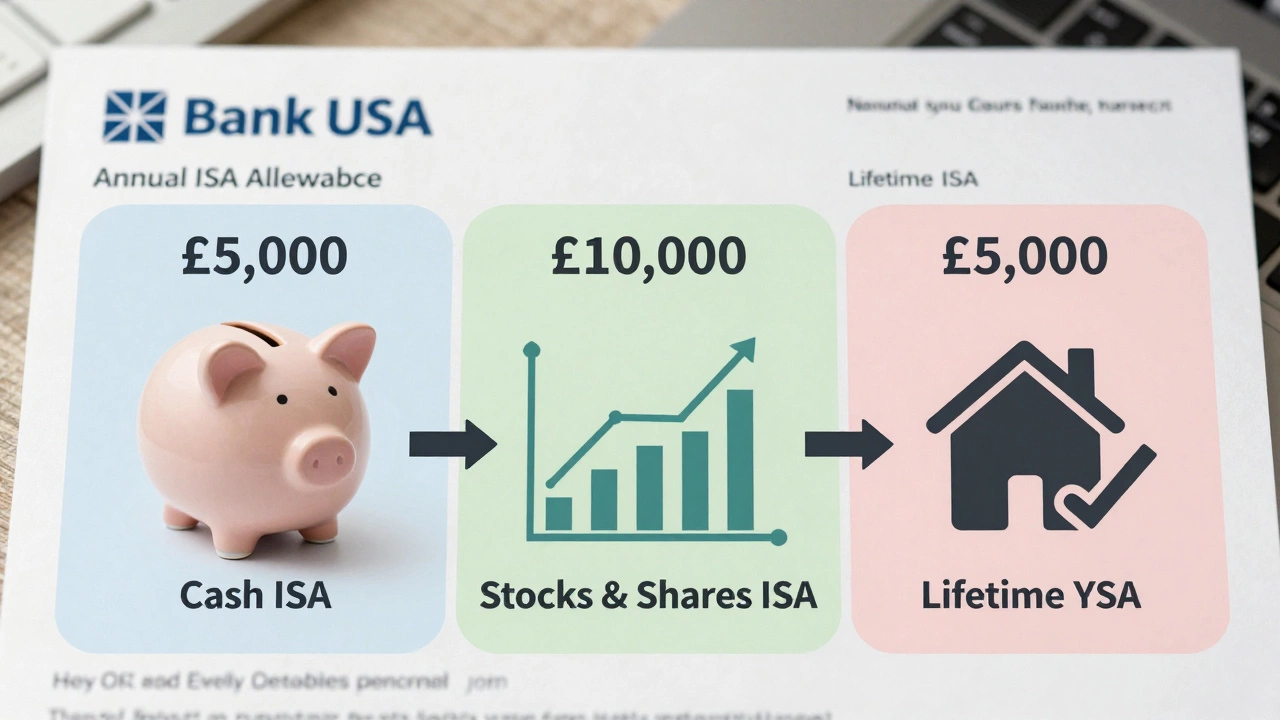

The £20,000 ISA allowance isn’t a separate limit for each type of ISA. It’s a single pot you can split however you want. You could put all £20,000 into a cash ISA. Or you could put £10,000 in cash and £10,000 in a stocks and shares ISA. Or even £5,000 in a Lifetime ISA, £7,000 in a stocks and shares ISA, and £8,000 in cash. The total can’t go over £20,000.

That means if you’re trying to stash $20,000 USD into a cash ISA, you’re likely thinking in dollars, not pounds. The real question should be: Can I put £20,000 into a cash ISA? And the answer is yes-if you’re willing to use your entire annual allowance for just that one account.

But here’s the catch: most people don’t do that. Why? Because cash ISAs usually pay low interest. In 2025, the best cash ISA rates hover around 4.5% to 5.25% AER. That’s good for a savings account, but it’s not beating inflation long-term. If you’re saving £20,000 a year, you’re probably trying to build wealth-not just keep money safe.

Why People Think They Can Save $20,000 in a Cash ISA

A lot of confusion comes from mixing up currencies and misremembering rules. If you’ve heard someone say, “I put $20,000 in my ISA,” they probably meant £20,000. Or they’re thinking of the old £15,000 limit from 2017, which was raised to £20,000 in 2017 and hasn’t changed since. There’s no “$20,000” ISA limit in the UK system. The UK uses pounds, not dollars.

Another reason people get confused? Online calculators and financial blogs sometimes use USD examples for international readers. That’s fine-but if you’re a UK resident, you need to think in GBP. Your ISA is governed by HMRC rules, not IRS rules. You can’t deposit dollars into a UK ISA. You must use pounds.

What Happens If You Try to Over-Contribute?

It’s easy to accidentally go over your ISA limit. Maybe you opened two cash ISAs last year and forgot to track them. Or you transferred money from an old ISA and didn’t realize it counted toward your new year’s allowance. HMRC doesn’t let you just “pay back” the extra. If you exceed your £20,000 limit, you’ll get a letter from HMRC asking you to fix it.

You can’t keep the tax-free benefits on the excess. Any interest earned on the over-contributed amount is taxable. And if you don’t fix it, you could lose the ISA status on the whole account. That’s not a small risk. Imagine earning £1,000 in interest on £5,000 you accidentally overpaid-now you owe tax on that. It’s messy, avoidable, and completely unnecessary.

Here’s how to stay safe:

- Only open one cash ISA per tax year.

- Use your ISA provider’s online dashboard to track your contributions.

- Don’t transfer old ISA balances into new ones unless you use the official transfer process.

- Keep receipts of deposits-especially if you’re making lump sums.

Is a Cash ISA Even Worth It If You Can Save £20,000 a Year?

If you’re putting away £20,000 a year, you’re likely in a high-income bracket. That means you’re probably paying 40% or 45% income tax. A cash ISA’s 5% return looks great-but it’s not the best use of your tax-free allowance.

Here’s a real example:

Let’s say you invest £10,000 in a cash ISA at 5% interest. After one year, you earn £500 tax-free.

Now, put that same £10,000 into a stocks and shares ISA. If you invest in a low-cost index fund that returns 7% annually (a realistic long-term average), you earn £700. And if the fund pays dividends, you get those tax-free too. Plus, you’re not just keeping pace with inflation-you’re beating it.

Over 10 years, that £10,000 in a stocks and shares ISA grows to about £19,670. In a cash ISA? Just £16,290. That’s over £3,000 more-just from choosing the right ISA type.

So if you’re saving £20,000 a year, consider this split:

- £5,000 in a cash ISA for emergency funds

- £10,000 in a stocks and shares ISA for growth

- £5,000 in a Lifetime ISA if you’re under 40 and saving for a first home

That way, you’re using your full allowance-and you’re not leaving money on the table.

What About the Lifetime ISA?

There’s a special ISA called the Lifetime ISA (LISA). If you’re under 40, you can save up to £4,000 a year into it. The government adds a 25% bonus-so £4,000 becomes £5,000. That’s free money. But you can only use it for buying your first home or retirement.

If you’re saving £20,000 a year, putting £4,000 in a LISA gives you an instant £1,000 boost. That’s a 25% return before any investment growth. No other savings account in the UK offers that. Even if you’re not buying a house, you can still use it for retirement after 60. And if you’re under 40, you’ve got 20+ years to let it grow.

Just remember: you can’t put more than £4,000 into a LISA, and it counts toward your £20,000 ISA limit. So if you put £4,000 in a LISA, you only have £16,000 left for cash or stocks and shares.

What If You’re Not a UK Resident?

If you live outside the UK-say, in Ireland, the US, or Australia-you can’t open a UK ISA. Even if you used to live here. Once you’re no longer a UK tax resident, you can’t make new contributions. You can keep your existing ISAs open, and they’ll still earn tax-free interest. But you can’t add more money.

So if you’re an Irish resident thinking, “I’ll just move my savings to a UK ISA,” you can’t. You need to be a UK tax resident to open one. And even if you have a UK bank account, that doesn’t count. Tax residency is about where you live and pay taxes-not where your bank is.

Bottom Line: You Can’t Put $20,000 in a Cash ISA-But You Can Do Better

You can’t put $20,000 in a cash ISA because the UK doesn’t use dollars, and even if you meant £20,000, you’d be wasting your tax-free allowance. Cash ISAs are great for short-term safety-but they’re not for building wealth.

If you’re serious about saving £20,000 a year, here’s what you should do:

- Use your full £20,000 allowance every year-don’t leave it on the table.

- Put most of it into stocks and shares ISAs for long-term growth.

- Use a LISA if you’re under 40-it’s the best deal in UK savings.

- Keep only a small portion in cash for emergencies.

- Track every pound you put in. Don’t let HMRC catch you out.

It’s not about how much you can put in. It’s about how smartly you use the system. The ISA allowance is one of the most powerful tools in UK personal finance. Don’t turn it into a piggy bank. Turn it into a wealth engine.