Savings Account Interest Calculator

Calculate how much interest you'll earn on your savings based on account type and duration. Rates reflect 2026 Irish market conditions.

Results

Your interest earnings will be displayed here

Choosing the right savings account isn’t about finding the fanciest name or the one with the prettiest app. It’s about getting your money to work for you without risking it or locking it away when you need it. In 2026, with inflation still hovering around 2.8% in Ireland and interest rates holding steady after last year’s hikes, your savings account can either grow quietly in the background-or sit there losing value. So what account is actually best for saving money right now?

High-Interest Savings Accounts Are Still the Top Choice

If your goal is to grow your savings without touching it, a high-interest savings account is your best bet. These accounts typically offer between 3.8% and 5.2% AER (Annual Equivalent Rate) in Ireland as of early 2026. That’s a big jump from the 0.1% rates you’d see just five years ago.

For example, if you save €5,000 in an account paying 5% AER, you’ll earn €250 in interest over 12 months. That’s €20 extra per month-enough to cover a weekly coffee or a bus pass without dipping into your main account. The trick? Make sure the interest is paid monthly, not annually. Monthly compounding means you earn interest on your interest, which adds up faster.

Some top-performing accounts in 2026 include those from digital-only banks like Revolut, N26, and Fidor, which often undercut traditional banks by offering higher rates because they have lower overhead. But don’t ignore credit unions-they’ve started matching these rates too, especially for members who set up direct debits or use other services.

Don’t Ignore Bonus Interest Accounts-But Read the Fine Print

You’ve probably seen ads for accounts offering 6% or even 7% interest-for the first six months. These bonus interest accounts can be great if you’re saving for a short-term goal, like a holiday or a new laptop. But here’s the catch: after the bonus period ends, the rate often drops to 1.5% or lower.

One common tactic is to open a bonus account, save your money over six months, then move it to another bonus account before the offer expires. This is called ‘rate hopping.’ It works if you’re disciplined. But if you forget to switch, you lose the advantage. Set calendar reminders. Or better yet, only use bonus offers if you know you’ll move the money anyway.

Notice Accounts Are the Hidden Gem

Many people overlook notice accounts, but they’re perfect for people who don’t need instant access but aren’t ready to lock money away for years. These accounts require you to give 30, 60, or 90 days’ notice before withdrawing. In return, they pay 4.5% to 5.5% AER-sometimes higher than instant access accounts.

For example, if you’re saving for a house deposit and plan to buy in 18 months, a 90-day notice account lets you earn more than a regular savings account while still giving you flexibility. You won’t be able to pull out cash on a whim, but that’s the point. It removes temptation. And in Ireland, notice accounts from AIB, Bank of Ireland, and Permanent TSB are FDIC-insured equivalents under the Deposit Guarantee Scheme, meaning your first €100,000 is protected.

Fixed-Term Deposits Are for Long-Term Savers

If you know you won’t need your money for 1, 2, or even 3 years, fixed-term deposits (also called term savings accounts) offer the highest rates. As of early 2026, 2-year fixed-term accounts are paying up to 5.8% AER. Some 3-year deals even hit 6.1%.

But here’s the trade-off: you can’t touch the money. If you withdraw early, you’ll lose most or all of the interest earned. That’s fine if you’re saving for a specific milestone-like a wedding, a car, or retirement-but terrible if your car breaks down or your boiler dies.

Only lock money away if you have an emergency fund already in place. That emergency fund should be in an instant access account, separate from your fixed-term savings. Don’t mix them.

Instant Access Accounts Are for Emergency Cash

Not all savings accounts are meant to earn the most interest. Some exist to keep your money safe and ready. That’s the role of instant access accounts. These are your emergency fund accounts. You need them to cover unexpected bills-medical, car repairs, job loss.

In 2026, the best instant access accounts in Ireland pay between 3.5% and 4.2% AER. That’s not the highest, but it’s good enough for cash you might need tomorrow. Look for accounts with no withdrawal limits, no minimum balances, and no fees. Avoid accounts that require you to pay in a certain amount each month-that’s a trap. You’re paying for convenience, not earning.

Use this rule: your emergency fund should cover three to six months of essential living costs. For most people in Dublin, that’s between €6,000 and €12,000. Keep that entire amount in an instant access account. Don’t split it. Don’t invest it. Just keep it there.

What to Avoid: Cash ISAs and Offshore Accounts

Some people still think Cash ISAs (Individual Savings Accounts) are the best option. But Ireland doesn’t have ISAs-that’s a UK product. If you see an Irish bank advertising an “ISA-style savings account,” it’s marketing fluff. You’re not getting any tax advantage. You’re just paying for a label.

Same goes for offshore savings accounts. They sound exotic and high-yielding, but they’re rarely worth it for most people. You’ll pay currency conversion fees, lose deposit protection, and deal with complex tax reporting. Unless you’re a high-net-worth individual with a financial advisor, stick to Irish-based accounts protected under the Deposit Guarantee Scheme.

How to Choose: A Simple Decision Tree

Here’s how to pick the right account without getting overwhelmed:

- Do you need the money within 30 days? → Go for an instant access account.

- Will you need it in 1 to 6 months? → Use a bonus interest account, but set a reminder to move it before the bonus ends.

- Can you wait 3 to 12 months? → Choose a notice account (30- or 60-day notice).

- Are you saving for a goal 1+ years away? → Lock it in a fixed-term deposit.

- Is this for emergencies? → Put it in an instant access account, no exceptions.

Don’t try to do everything in one account. Split your savings based on your goals. That’s how the smart savers do it.

Setting Up Your Savings Strategy

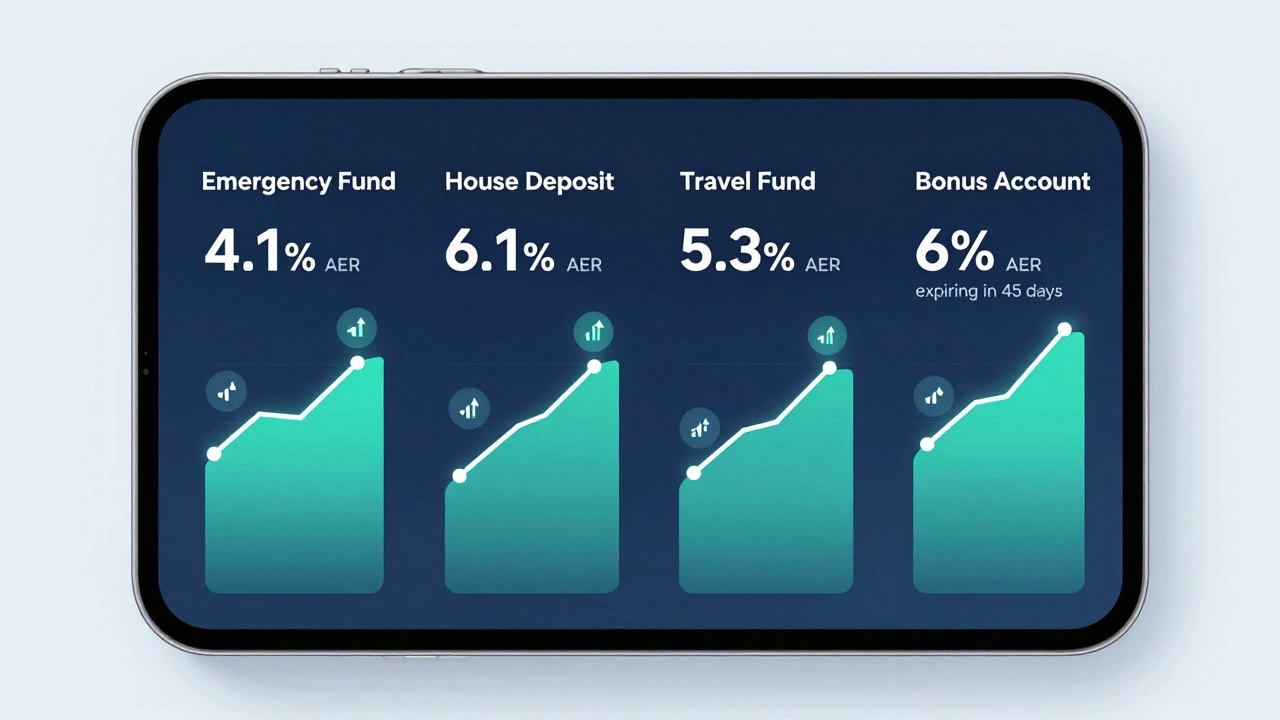

Here’s a real example from someone living in Cork: Maria, 34, earns €4,200 a month after tax. She wants to save for a house deposit (goal: €40,000 in 3 years), build an emergency fund (target: €10,000), and have some extra cash for travel.

She splits her savings like this:

- €500/month → 3-year fixed-term deposit (6.1% AER) for her house fund

- €300/month → instant access account (4.1% AER) for emergencies

- €150/month → 90-day notice account (5.3% AER) for travel

She uses automatic transfers set up on payday. No thinking required. She checks her balances once a quarter and moves money between accounts when bonuses expire or goals shift.

That’s not complicated. It’s just consistent.

Final Tip: Use the Central Bank’s Savings Calculator

The Central Bank of Ireland has a free, official savings calculator on its website. You can plug in your monthly deposit, current rate, and time frame-and it shows you exactly how much you’ll earn, including compound interest.

Don’t trust bank ads that say “Earn over €1,000 in interest!” without showing the conditions. Use the calculator. Compare apples to apples. Then choose the account that fits your life-not the one with the flashiest ad.

Is it better to have one savings account or multiple?

Multiple accounts are better if you have different goals. One for emergencies, one for short-term savings, one for long-term goals. It keeps your money organized and reduces the chance of spending what you meant to save. You can link them all to the same bank or use different providers-what matters is separating the purpose of each pot.

Are savings accounts safe in Ireland?

Yes, if they’re with a licensed bank, credit union, or building society in Ireland. The Deposit Guarantee Scheme protects up to €100,000 per person, per institution. That includes interest earned. So if the bank fails, the state will repay you. Always check that the institution is covered before opening an account.

Can I open a savings account with no initial deposit?

Yes, many accounts in Ireland allow you to open with €0. But you’ll need to make your first deposit within 30 days, or the account may close. Always read the terms. Some accounts require a minimum monthly deposit to earn the advertised rate-those aren’t worth it unless you’re sure you can keep up.

Do I pay tax on savings interest in Ireland?

Yes. Interest earned on savings accounts is subject to Deposit Interest Retention Tax (DIRT), which is currently 33%. This is automatically deducted by the bank, so you don’t need to file anything extra. The rate is applied to gross interest before you receive it. If you’re over 65 and your income is below €18,000, you may qualify for a DIRT exemption-check with Revenue.

Should I use an app-based bank for savings?

App-based banks like Revolut, N26, and Fidor often offer better rates and easier management tools than traditional banks. They’re fully licensed in Ireland and covered by the Deposit Guarantee Scheme. If you’re comfortable managing money digitally and don’t need branch access, they’re a smart choice. Just make sure the app doesn’t charge fees for withdrawals or transfers.

Next Steps

Start by checking your current savings account. What rate are you earning? Is it above 3.5%? If not, you’re leaving money on the table. Move it.

Then, ask yourself: when will you need this money? Use the decision tree above. Open one new account if you need to. Set up one automatic transfer. That’s it. You don’t need to overhaul your finances. Just make one smart move.

Money grows slowly-but consistently. The best savings account isn’t the one with the highest headline rate. It’s the one you actually use.