Car Loan Rate Reduction Calculator

Calculate Your Savings

See how much you could save by lowering your interest rate. The calculator uses your current loan details to show potential savings.

Important: If you extend your loan term when lowering the rate, you may pay more in total interest. The calculator assumes your loan term remains the same.

You’ve been paying your car loan for a year, and suddenly you notice your friend got a better rate. Or maybe your credit score jumped after you paid off a credit card. Or you’re just tired of seeing that big monthly payment eat into your budget. You start wondering: Can I ask my car lender to lower my rate? The short answer? Yes, you can. But whether they’ll say yes depends on a few things you can control.

Why lenders sometimes say yes

Car lenders aren’t in the business of making customers unhappy. They want you to pay on time, stay loyal, and avoid defaulting. If you’ve been a good borrower-on-time payments, no late fees, no missed payments-they have a reason to keep you happy. That’s why many lenders, especially banks and credit unions, will consider lowering your rate if you ask.It’s not charity. It’s business. If you threaten to refinance with another lender, they lose your business entirely. But if they lower your rate by even 1%, you might stay. And that’s worth more to them than the small loss in interest.

According to data from the Central Bank of Ireland, the average new car loan rate in 2025 was 6.8%. But borrowers with credit scores above 750 were getting rates as low as 4.2%. If your score has improved since you took out the loan, you’re likely eligible for a better deal.

When asking won’t work (and what to do instead)

Not every lender will negotiate. If you got your loan through a dealership or a subprime lender, your chances are lower. These lenders often lock in rates based on risk tiers and don’t have the flexibility to adjust them later.Also, if you’re underwater on your loan-meaning you owe more than the car is worth-it’s harder to get a rate cut. Lenders won’t take a loss just because you asked nicely.

In these cases, your best move isn’t asking for a lower rate. It’s refinancing.

Refinancing means taking out a new loan with better terms to pay off your old one. You’re not asking your current lender to change anything. You’re walking away and finding someone else who wants your business.

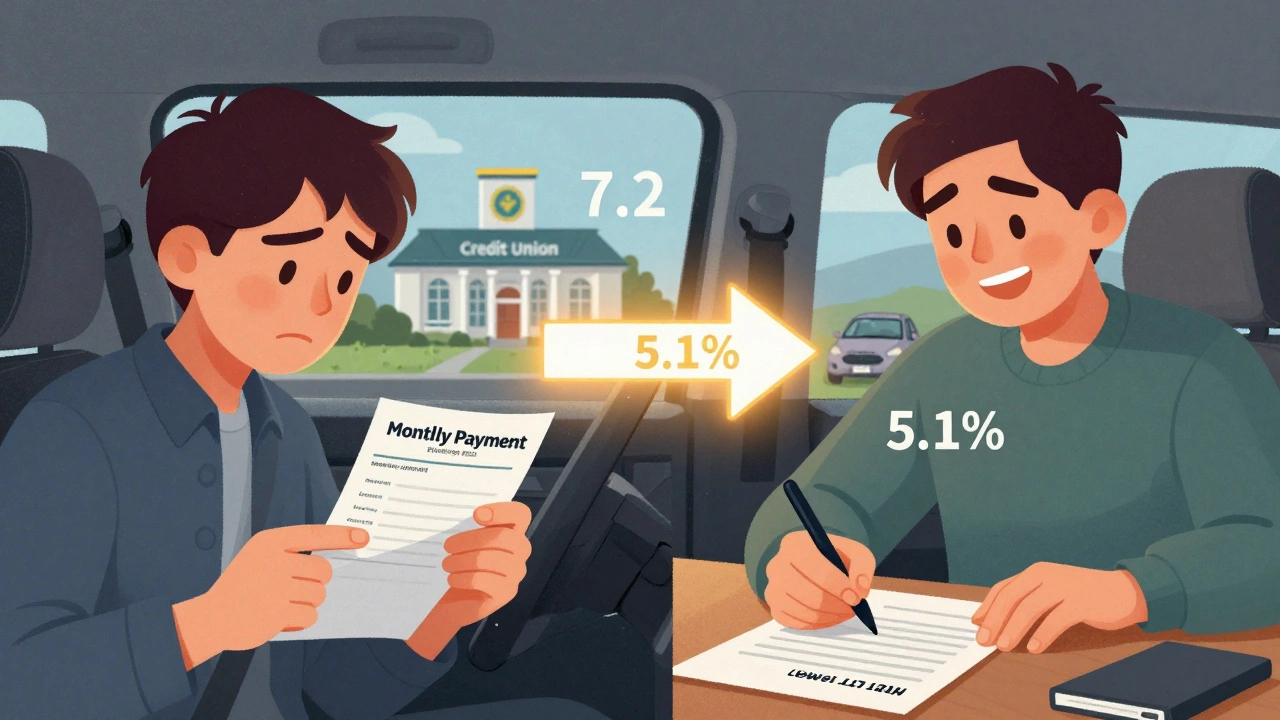

Most lenders in Ireland, including AIB, Bank of Ireland, and credit unions, offer car loan refinancing. Rates for refinanced loans in 2025 averaged 5.1% for borrowers with good credit. That’s nearly 2% lower than the original loan rate for many people.

How to ask your lender for a lower rate

Asking works best when you’re prepared. Don’t just call and say, “Can you lower my rate?” That’s like walking into a shop and asking for a discount on a shirt you’ve already bought. You need to give them a reason.- Check your credit score first. If it’s improved since you got the loan, get a copy of your report. Look for positive changes: fewer inquiries, paid-off debts, on-time payments. You need proof.

- Know your current rate and payment. Write down your loan balance, interest rate, and monthly payment. Know how much you’ve paid so far.

- Research current rates. Check what rates are being offered right now. Use comparison sites like bonkers.ie or Moneytizer to see what’s available for someone with your credit profile.

- Call your lender. Ask to speak with a loan retention specialist. Don’t settle for a general customer service rep. Say: “I’ve been a loyal customer for X years with perfect payments. I’ve seen rates drop since I took out this loan. I’m considering refinancing elsewhere, but I’d prefer to stay with you if you can match a better rate.”

- Be ready to walk away. If they say no, ask if they can offer a one-time reduction or a temporary payment break. If not, start the refinancing process.

One woman in Cork, who had a 7.2% rate on her 2021 Ford Focus, called her credit union after her score jumped from 680 to 765. She showed them her new credit report and a quote from Bank of Ireland offering 4.9%. They lowered her rate to 5.1%-saving her €1,200 over the remaining term.

Refinancing: Your real power move

If your lender won’t budge, refinancing is your next step. It’s not complicated, but it does take a few days.You’ll need:

- Your current loan balance and account number

- Your car’s registration number and V5C document

- Your latest payslip or proof of income

- Your credit report (you can get this free from Credit Info or Experian)

Apply with at least three lenders. Compare:

- The new interest rate

- The monthly payment

- The loan term (don’t extend it unless you need lower payments)

- Any fees (some lenders charge €50-€150 for refinancing)

Once approved, the new lender pays off your old loan. You start paying them instead. The whole process usually takes 5-7 business days.

Pro tip: Don’t refinance if you’re close to paying off your loan. The savings might be too small to justify the paperwork and fees.

What if you have bad credit?

If your credit score is below 600, your options are limited. But not gone.Some credit unions in Ireland specialize in helping people with past credit issues. They may not lower your rate dramatically, but they can offer:

- Extended payment terms to reduce monthly costs

- One-time interest reduction as a goodwill gesture

- Debt restructuring if you’re struggling to pay

Also, consider adding a co-signer with better credit. That can open the door to refinancing even with a low score.

Don’t fall for “rate reduction” scams. Companies that promise to “fix your loan” for a fee are usually just reselling free advice. You can do this yourself.

What happens if you get a lower rate?

If your lender agrees to lower your rate, they’ll send you a new loan agreement. Read it carefully.Make sure:

- The new rate is lower than the old one

- The monthly payment is reduced

- There are no hidden fees

- The loan term hasn’t been extended (unless you want it to be)

Once signed, your payments will change. You might see the new amount on your next statement. If not, call your lender to confirm.

Some people get confused and think a lower rate means they’ll pay off the car faster. It doesn’t. Your payoff date stays the same unless you pay extra. So if you want to pay it off sooner, keep paying the same amount you used to pay before the rate drop. That’s how you save the most.

Common mistakes to avoid

- Asking too soon. Most lenders won’t consider a rate reduction until you’ve made at least 6-12 payments.

- Not checking your credit. If your score hasn’t improved, you have no leverage.

- Accepting a longer loan term. Lower monthly payment? Great. But if you stretch the loan from 3 to 5 years, you’ll pay more in total interest.

- Ignoring fees. Some lenders charge €100+ to process a rate change. Make sure the savings outweigh the cost.

- Missing payments after the change. Even with a lower rate, one missed payment can undo your progress and hurt your credit.

Final thought: It’s not about luck-it’s about timing

Asking for a lower car loan rate isn’t a shot in the dark. It’s a strategic move. The best time to ask is when:- Your credit score has improved

- Market rates have dropped

- You’ve made at least a year of on-time payments

- You’re not underwater on your loan

If all those boxes are checked, pick up the phone. Be polite, be prepared, and be ready to walk away. You might be surprised at how easy it is to save hundreds-or even thousands-on a loan you thought was locked in forever.

Can I ask my car lender to lower my rate even if I’m not late on payments?

Yes, and in fact, lenders are more likely to help you if you’ve never missed a payment. Being a responsible borrower gives you leverage. Lenders want to keep good customers, and a simple rate adjustment is often cheaper than losing you to a competitor.

Will asking for a lower rate hurt my credit score?

No, asking for a lower rate won’t hurt your credit. However, if you apply for refinancing with a new lender, they’ll do a hard credit check, which can temporarily lower your score by 5-10 points. That’s normal and usually recovers within a few months.

How much can I realistically save by lowering my car loan rate?

On a €20,000 loan with 5 years left, dropping your rate from 7% to 4.5% saves about €1,300 in total interest. Even a 1% drop saves you over €400. The bigger your loan and the longer the term, the more you save.

Can I refinance if I have negative equity on my car?

It’s harder, but possible. Some lenders allow you to roll the negative equity into a new loan, but you’ll pay more over time. Better options: wait until your car’s value rises, pay down some of the balance yourself, or trade in the car and cover the difference with savings.

What’s the difference between lowering my rate and refinancing?

Lowering your rate means your current lender changes your existing loan terms. Refinancing means you take out a brand-new loan with a different lender to pay off your old one. Refinancing gives you more options and often better rates, but it requires a new application and credit check.