Student Loan Default Calculator

Enter Your Details

Real-World Impact

Enter your details above to see how missed payments affect your finances.

Not paying your student loans doesn’t make them disappear. It makes them worse. Every month you skip a payment, the debt grows. Interest keeps adding up. Fees pile on. And the longer you wait, the harder it becomes to fix. This isn’t a myth. It’s the reality for hundreds of thousands of people who ignore their loans - and it’s not just about credit scores.

Default kicks in fast - and it’s permanent

In most countries, including Ireland and the U.S., student loans go into default after just 9 to 12 months of missed payments. There’s no warning call. No grace period after that. Once you hit default, your loan is handed over to a collection agency. That means you’re no longer dealing with your original lender. You’re dealing with people whose job is to get you to pay - no matter what.

Default doesn’t expire. It doesn’t go away after seven years like some credit card debt. Student loans are one of the few debts that survive bankruptcy. Even if you file for insolvency, your student loan will still be there, waiting. And it’ll keep growing.

Your credit score takes a hit - and stays down

Your credit report doesn’t just record missed payments. It records default. Once your loan defaults, that mark stays on your credit file for up to seven years. That means you’ll struggle to get a mortgage, a car loan, or even a phone contract. Landlords check credit. Employers in finance or public sector roles check credit. Some utility companies require deposits from people with bad credit.

It’s not just about being denied. It’s about paying more. If your credit score drops because of a defaulted student loan, you’ll pay higher interest rates on everything else. A €200,000 mortgage could cost you €30,000 extra over 25 years just because your score is damaged.

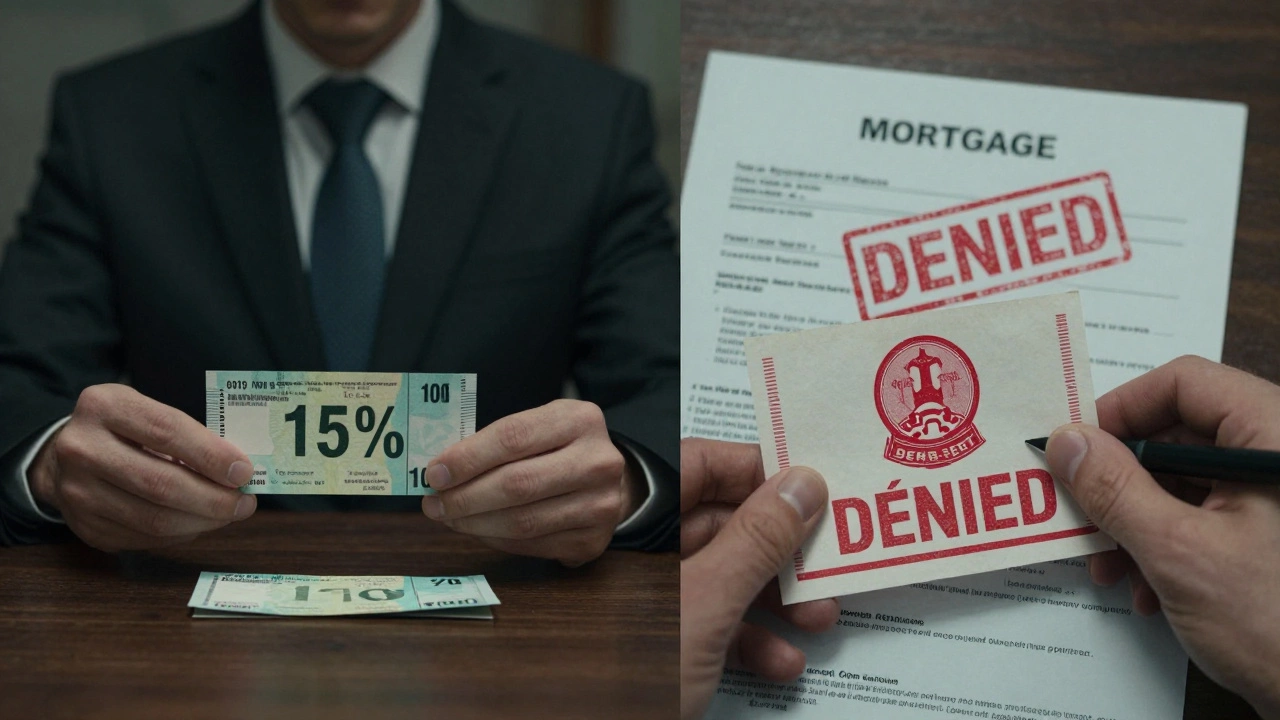

Wage garnishment can take 15% of your paycheck

One of the scariest things about defaulted student loans is that the government or lender doesn’t need a court order to take money from your pay. In many systems, they can simply notify your employer and start withholding up to 15% of your disposable income. That’s not a suggestion. That’s a legal deduction.

Imagine earning €3,000 a month. After tax and pension, you’re left with €2,200. Suddenly, €330 vanishes - not because you chose to pay it, but because the system took it. And it keeps taking it. Every month. Until the debt is paid - or until you die.

Tax refunds and benefits can be seized

If you’re receiving tax refunds, stimulus payments, or government benefits, those can be taken to pay your student loan. In Ireland, the Revenue Commissioners can intercept tax refunds. In the U.S., the Department of Education can seize federal tax refunds and even Social Security payments if you’re retired.

This isn’t rare. In 2023, over 200,000 Americans had their tax refunds taken to pay defaulted student loans. That’s not a glitch. That’s policy. And it’s getting more common as loan balances climb and repayment rates fall.

Legal action and collection fees add thousands

When your loan goes to collections, you’re hit with fees. These aren’t small. They can be 20-30% of your outstanding balance. That means if you owe €25,000, you could suddenly owe €30,000 - not because interest spiked, but because you didn’t pay on time.

Collection agencies can sue you. If they win, they can place a lien on your property. They can freeze your bank accounts. They can force you to appear in court. And if you don’t show up? A warrant could be issued. This isn’t fiction. It’s happened to teachers, nurses, and small business owners who thought they could wait it out.

Professional licenses can be suspended

Some professions require state or national licenses to work. Teaching, nursing, accounting, law, engineering - these fields often check your financial standing. In over 30 U.S. states, licenses can be suspended or denied if you have defaulted student loans.

In Ireland, while there’s no direct law suspending licenses, public sector employers increasingly run financial checks. A defaulted loan can block promotions, applications for grants, or even entry into certain government roles. Your career doesn’t stop because you can’t pay - but your options do.

Loan forgiveness is harder than you think

You might have heard about student loan forgiveness programs. They exist - but they’re not magic. Most require you to make 120-240 on-time payments under specific repayment plans. If you’ve been skipping payments for years, you’re not eligible. You’re not close. You’re starting from zero.

Even income-driven repayment plans require you to submit paperwork every year. If you miss a deadline, you lose your place. And if you’re in default, you’re automatically kicked out of all forgiveness programs until you rehabilitate your loan - which costs money and takes months.

It follows you for life - even after death

In some countries, if you die, your student loan is forgiven. In others, it’s passed to your estate. In the U.S., federal loans are discharged upon death. But private loans? Those often go to your co-signer - or your family is forced to pay.

In Ireland, student loans from the Student Universal Support Ireland (SUSI) program are written off if the borrower dies. But if you have a private student loan from a bank? That debt doesn’t vanish. It becomes part of your estate. Your children or spouse may be forced to pay it from your savings or property.

There’s a way out - but you have to act now

Default doesn’t mean you’re trapped forever. There are options - but they require action, not avoidance.

- Rehabilitation: Make nine on-time payments over ten months. Your loan comes out of default. The default mark stays on your credit report, but it’s marked as "rehabilitated."

- Consolidation: Combine multiple loans into one. You might get a lower monthly payment, but you’ll pay more in interest over time.

- Income-driven repayment: Your payment is based on what you earn. If you make €20,000 a year, you pay €100. If you make €60,000, you pay €500. This is available in many countries.

- Hardship deferment or forbearance: Pause payments for up to 12 months at a time. Interest still grows, but you avoid default.

None of these are easy. But they’re possible. And they’re better than silence.

What most people don’t tell you

The biggest lie about student loans is that they’re "just debt." They’re not. They’re tied to your future. Your job. Your home. Your freedom. Ignoring them doesn’t make them go away. It just makes the consequences bigger, slower, and more painful.

People who wait often end up paying three times what they borrowed. They lose opportunities. They live in fear. They miss out on weddings, homes, and even travel because they’re stuck paying off a debt they thought they could ignore.

You’re not alone. Millions are in the same boat. But the people who get out? They didn’t wait. They called their loan servicer. They asked for help. They started small. And they kept going.

Can student loans be forgiven after 20 years?

Yes - but only if you’re on an income-driven repayment plan and you’ve made consistent payments for 20 to 25 years. If you’ve missed payments or defaulted, you’re not eligible. Forgiveness isn’t automatic. You must apply, and you may owe taxes on the forgiven amount.

Can I go to jail for not paying student loans?

No, you can’t be jailed just for not paying. But if you ignore a court order to appear or provide financial information, a judge can hold you in contempt - and that can lead to arrest. Most people who end up in court do so because they didn’t respond to legal notices.

Do student loans affect my ability to get a mortgage?

Yes. Lenders look at your debt-to-income ratio. If your student loan payment is high compared to your income, they may deny your mortgage or offer you a smaller amount. A defaulted loan makes it even harder - many lenders won’t approve you at all until the default is cleared.

What if I’m unemployed or on low income?

You still owe the loan, but you may qualify for reduced payments, deferment, or forbearance. In Ireland, SUSI offers hardship options. In the U.S., income-driven plans cap payments at 10% of your income. The key is to contact your lender before you miss a payment - not after.

Can I refinance my student loans to lower payments?

You can refinance private loans with a new lender - but only if you have good credit and steady income. Refinancing federal loans means losing protections like income-driven plans and forgiveness. Never refinance government-backed loans unless you’re sure you won’t need those benefits.

What to do next

If you’re behind on payments, don’t panic. Don’t hide. Call your loan servicer today. Ask about rehabilitation, income-driven plans, or forbearance. Write down what they say. Follow up in writing. Keep records.

If you’re not behind yet - don’t wait. Set up automatic payments. Even €20 a month keeps you out of default. Use budgeting tools. Talk to a financial advisor. You don’t need to pay it all now. You just need to start.

Student loans are a long-term responsibility. But they’re not a life sentence. The only thing worse than paying them is pretending they don’t exist.