Welcome to Treasury Leaders Hub – Your UK Treasury Resource

Looking for clear, up‑to‑date advice on cash flow, risk, or investment moves? You’ve landed in the right spot. We break down complex treasury topics into bite‑size tips you can act on today.

What We Cover

From personal finance basics like budgeting and loan cost calculators to deep dives on mortgage trends and crypto investing, every post is written for busy finance leaders who need fast, reliable answers.

Why Trust Our Insights

Our team follows UK market shifts, regulatory changes, and real‑world case studies. You’ll find step‑by‑step guides on managing a $5,000 loan, planning a $300k early retirement, or spotting the next $1 crypto. Each article is packed with numbers, tools, and actionable steps – no fluff, just what matters.

Ready to level up your treasury game? Browse the latest posts, grab a template, and start making smarter decisions right away.

USAA home insurance is available only to military-affiliated members. Learn exactly who qualifies, from active duty personnel to veterans and their families. Find out how to check eligibility and alternatives if you don't meet the criteria.

Read More

The 40-40-20 budget rule divides your income into 40% for needs, 40% for debt repayment and savings, and 20% for wants. It's a practical way to get out of debt without sacrificing your lifestyle - especially useful if you're consolidating loans or credit card balances.

Read More

A pension plan is your key to financial security in retirement. Learn how workplace, private, and State pensions work in Ireland, how much you need to save, and why starting now changes everything.

Read More

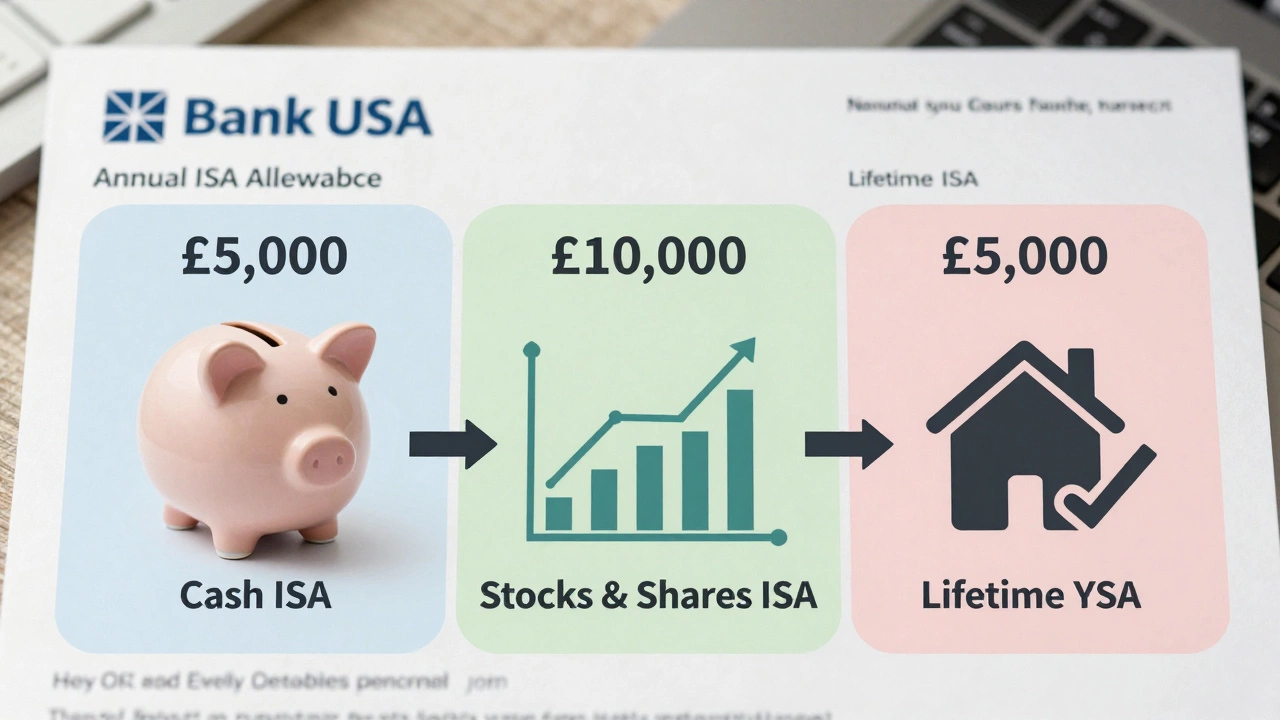

You can't put $20,000 in a UK cash ISA because the allowance is £20,000 (about $25,000) and must be split across all ISA types. Learn how to use your full allowance wisely.

Read More

The cheapest way to take equity out of your home in Ireland is usually a home equity loan or cash-out refinance. Reverse mortgages work if you're over 62 and have no income. Avoid high-cost alternatives and always get independent advice.

Read More

How long will $1 million last in retirement? In 2026, it depends on where you live, what you own, and how you spend. A realistic breakdown for retirees in Ireland shows that $1 million can last - but only with smart planning, downsizing, and using your State Pension.

Read More

A $300,000 annuity pays between $1,800 and $2,700 per month at retirement, depending on age, gender, and payout options. Learn how interest rates, insurance companies, and payment structures affect your income in 2026.

Read More

If you can't get a loan, there are still ways to get cash fast-sell items, use pawn shops, ask for an advance, apply for grants, or borrow from credit unions. No credit check needed.

Read More

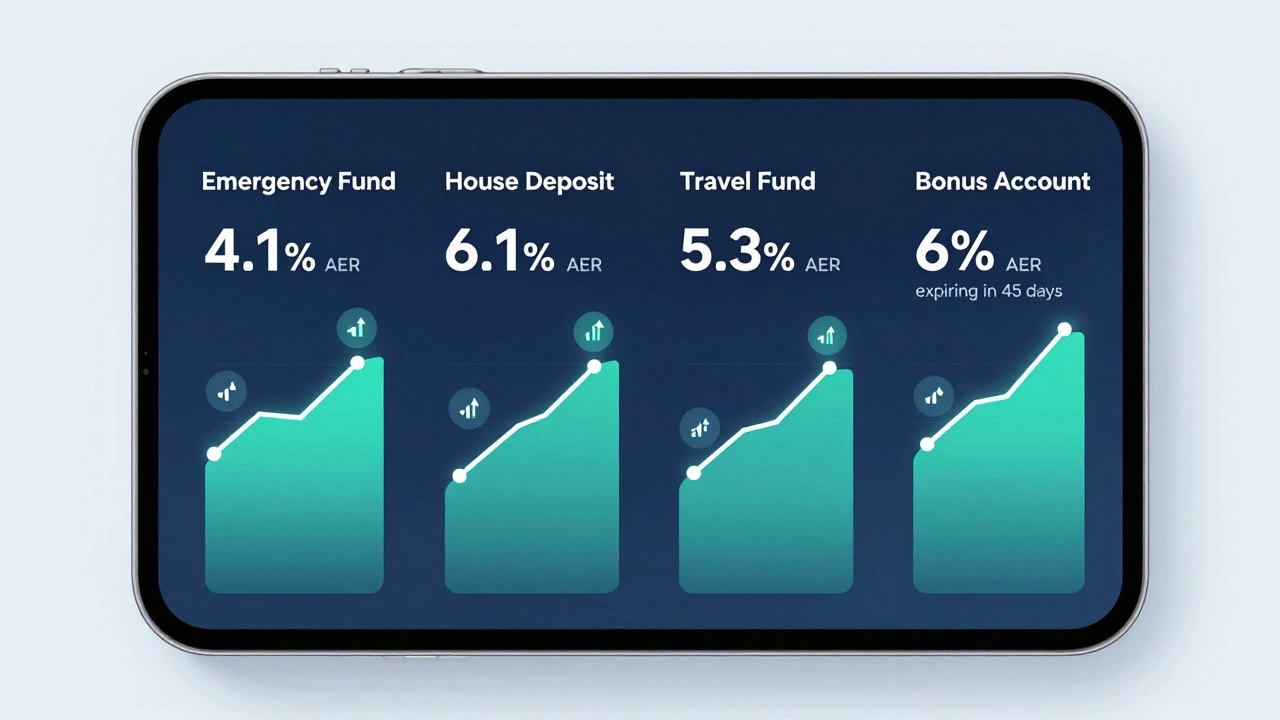

Find out which savings account is best for saving money in 2026 in Ireland, including high-interest options, notice accounts, fixed-term deals, and how to avoid common traps. Learn how to split your savings for maximum growth and safety.

Read More

Debt relief can hurt your credit, but not all types do. Debt settlement damages scores, while debt management plans and consolidation loans may help. Learn how each option affects your credit and how to recover.

Read More

The emergency fund is the only budget line that should come before everything else. Without it, every financial plan is fragile. Learn how to build one step by step - even if you’re starting with €10.

Read More

You can ask your car lender to lower your rate-especially if your credit improved or market rates dropped. Learn how to negotiate, when to refinance, and how much you could save on your car loan.

Read More