Tax‑Free Savings Made Simple

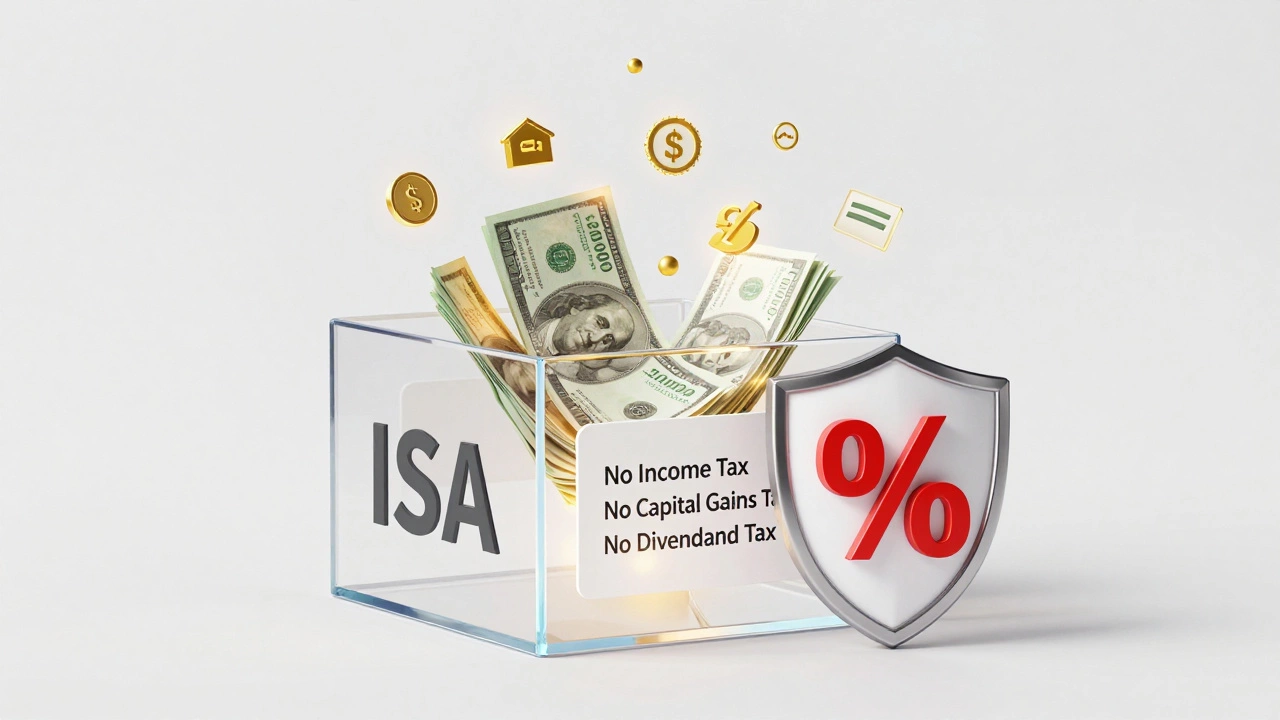

If you’re looking to keep more of what you earn, tax‑free savings are the go‑to option for most UK folks. The idea is simple: you put money into a special account and the government says, ‘You don’t have to pay tax on the interest or growth you make.’ No tricks, just a legal way to boost your nest egg.

What Counts as a Tax‑Free Savings Account?

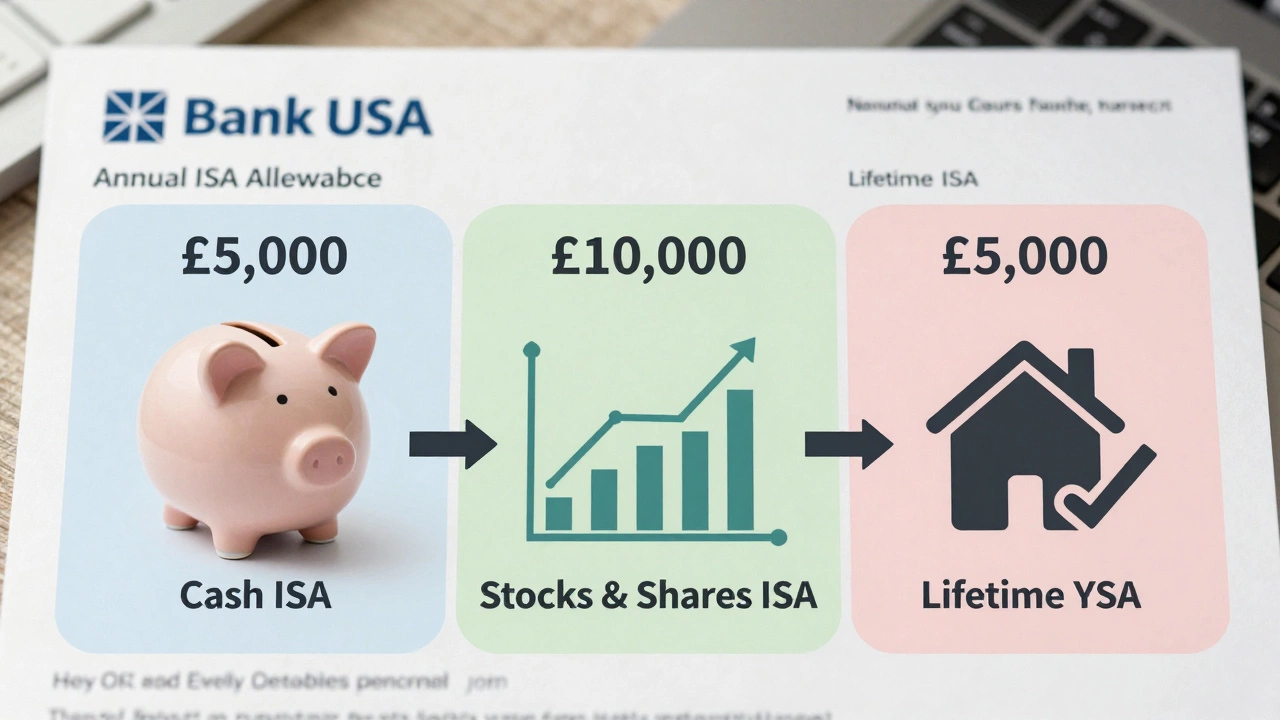

The most popular vehicle is the Individual Savings Account, or ISA. There are three main flavours you’ll run into:

- Cash ISA – works like a regular savings account, but any interest you earn is tax‑free.

- Stocks & Shares ISA – lets you invest in shares, funds, or bonds. Any capital gains or dividends stay tax‑free.

- Lifetime ISA (LISA) – designed for first‑time home buyers or retirement. You can put in up to £4,000 a year and the government adds a 25 % bonus.

All ISAs share the same annual contribution limit – £20,000 for the 2024/25 tax year. You can split that amount across the different types however you like, as long as the total doesn’t exceed the ceiling.

How to Open and Use a Tax‑Free Savings Account

Opening an ISA is quick. Most high‑street banks, building societies and online platforms let you apply online in minutes. You’ll need proof of identity and your National Insurance number. Once it’s set up, you can fund it with a lump sum, regular monthly deposits, or a combination of both.

Key tips to get the most out of your tax‑free savings:

- Use your full allowance. Even if you don’t have £20,000 to invest now, aim to max out each year. The power of compound growth works best when you’re consistent.

- Match the ISA to your goals. Keep cash for short‑term needs (emergency fund, upcoming holiday) and use a Stocks & Shares ISA for longer‑term growth.

- Watch the fees. Some platforms charge account fees or trading commissions. Look for low‑cost providers, especially if you’re starting with a small balance.

- Re‑invest earnings. In a Cash ISA, set the interest to automatically be added to the balance. In a Stocks & Shares ISA, consider reinvesting dividends to keep the compounding effect alive.

- Don’t forget the LISA bonus. If you’re buying your first home or planning to retire after age 60, the 25 % government boost can be a game‑changer.

One mistake people make is assuming they can move money between ISAs whenever they want. You can only transfer ISAs once a year without losing the tax‑free status, and you can’t put the same contribution into two different ISAs in the same tax year.

Also, remember that the £20,000 limit is per person, not per account. If you’re married or in a civil partnership, both of you get your own allowance, effectively doubling the tax‑free space for the household.

Finally, keep an eye on the tax year dates – the limit resets on 6 April each year. If you miss the deadline, you’ll have to wait until the next cycle.

Tax‑free savings aren’t a secret club; they’re a straightforward tool that anyone can use. By choosing the right ISA type, topping up regularly, and avoiding common pitfalls, you’ll watch your money grow without the drag of tax. Start today, and let the government do part of the work for you.

You can't put $50,000 in a cash ISA in one year - the UK limit is £20,000. But with smart planning over three years, you can get there tax-free. Here's how to maximize your ISA allowance and avoid costly mistakes.

Read More

You can't put $20,000 in a UK cash ISA because the allowance is £20,000 (about $25,000) and must be split across all ISA types. Learn how to use your full allowance wisely.

Read More

ISA accounts let you save or invest up to £20,000 a year tax-free in the UK. Learn how Cash, Stocks and Shares, and other ISAs work, what you can and can't do, and how to avoid common mistakes in 2026.

Read More

An ISA isn't an investment-it's a tax-free wrapper. Learn how to use it right in 2025 to grow your savings without paying tax on interest, dividends, or gains.

Read More

Thinking of opening an ISA? This article digs into the lesser-known disadvantages of Individual Savings Accounts (ISAs) in the UK. From restrictive rules and tax quirks to low interest rates and inflexible terms, discover the real-life drawbacks before you make a move. Get pro tips, solid facts, and honest perspectives that will help you make smarter money decisions, without the small print surprises.

Read More

Confused about whether the US has ISA accounts like the UK? This article breaks down what an ISA is, why Americans keep hearing about them, and what options locals actually have. We cover the best alternatives for US savers and list practical tips to get the most out of your money. By the end, you’ll know exactly where your savings could work hardest in the US.

Read More

Wondering if you can open an ISA without being a UK citizen? Non-UK residents have limited options when it comes to opening Individual Savings Accounts (ISAs), which are tax-free savings vehicles primarily meant for UK residents. This article breaks down the requirements, exceptions, and tips for non-UK citizens looking to navigate the world of ISAs. We'll dive into how residency affects eligibility and what alternatives might aid in tax-free saving.

Read More

Individual Savings Accounts (ISAs) are a popular option for saving money without paying tax on the interest earned. This article explores the different types of ISAs available in the UK, the tax benefits each offers, and who might find them most advantageous. Understand how ISAs work, their annual limits, and tips for maximizing your savings. Learn which ISAs could be the best fit for your financial goals.

Read More