UK Savings: Simple Ways to Grow Your Money Fast

If you’re trying to build a bigger nest‑egg, the UK offers plenty of tools that don’t need a finance degree. From tax‑free ISAs to high‑interest savings accounts, you can start seeing real progress in a few months if you follow a few basic steps.

Pick the Right Account for Your Goals

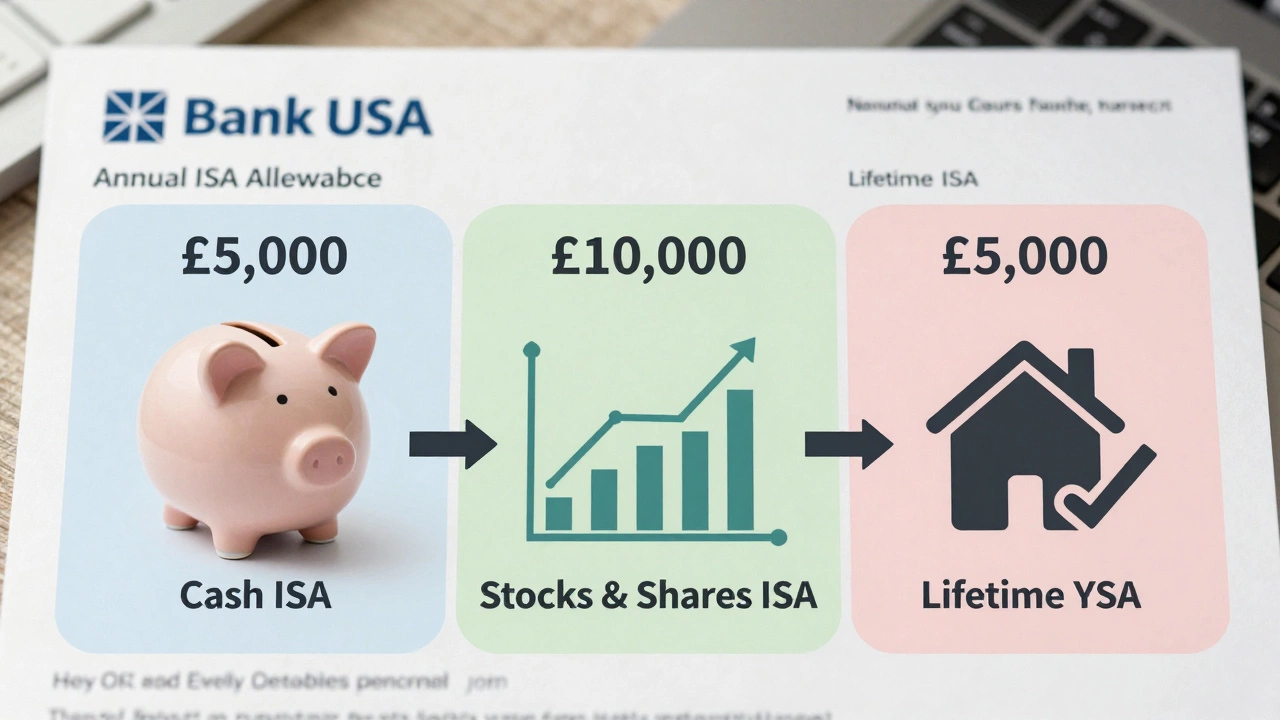

First, match the account to what you need. A Cash ISA lets you earn interest without paying tax, perfect for short‑term goals like a holiday fund. If you can lock your money for a year or more, a Fixed‑Rate Savings Account often pays a higher rate than everyday accounts. For those who want flexibility, a Easy Access ISA gives you the tax benefit while still letting you dip in when needed.

Don’t forget Premium Bonds if you enjoy the chance of a tax‑free prize instead of regular interest. The odds are low, but the fun factor can keep you motivated to keep the money saved.

Make Your Savings Work Harder

Automation is a game‑changer. Set up a standing order from your current account to your chosen savings product each payday. Even £50 a month adds up, and you won’t have to remember to transfer money manually.

Shop around for the best rates. Websites that compare UK banks update weekly, and a few extra basis points can mean hundreds more over a few years. When you spot a better deal, move your money quickly—most providers let you transfer without fees.

Take advantage of the 12‑month ISA allowance. In the 2024/25 tax year you can put up to £20,000 into ISAs. If you haven’t used the full amount, consider topping it up now; the tax‑free benefit lasts for the whole life of the account.

Lastly, watch inflation. If your savings earn less than the cost of living rise, you’re losing purchasing power. Aim for accounts that at least keep up with inflation, or blend in a low‑risk investment like a Stocks & Shares ISA for higher potential growth.

By picking the right account, automating deposits, and staying on top of rates, you can make your UK savings work harder without any heavy lifting. Start with one of the free tools mentioned above, set a small weekly goal, and watch your balance climb.

You can't put $20,000 in a UK cash ISA because the allowance is £20,000 (about $25,000) and must be split across all ISA types. Learn how to use your full allowance wisely.

Read More

US citizens cannot legally invest in ISAs, even if living in the UK. The IRS treats ISAs as taxable accounts, and failing to report them can lead to heavy penalties. Here's what to do instead.

Read More

Thinking of opening an ISA? This article digs into the lesser-known disadvantages of Individual Savings Accounts (ISAs) in the UK. From restrictive rules and tax quirks to low interest rates and inflexible terms, discover the real-life drawbacks before you make a move. Get pro tips, solid facts, and honest perspectives that will help you make smarter money decisions, without the small print surprises.

Read More