Tag: credit score - Page 2

Worried about skipping your student loan payments? Here’s a clear, no-nonsense guide to what happens if you stop paying, real risks, and ways to protect yourself.

Read More

Thinking of remortgaging? Lenders will dig into your finances, credit history, and property details before giving you the green light. They want to be sure you can handle the new payments and that the property is worth the amount you want to borrow. Some of their checks might surprise you. This guide spills the details, helps you prep, and gives tips to boost your chances.

Read More

Curious if your student loans stand between you and your dream home? This guide breaks down how student debt can mess with your chances of buying a house. Get the real impact on your credit, learn what lenders actually look for, and see how your monthly loan payments fit into the bigger mortgage picture. Find practical tips to stay ahead. No fluff, just straight answers.

Read More

Should you use a credit card or just stick with cash and debit? This article lays out the real advantages and pitfalls of using credit cards, breaking it down with facts, simple tips, and everyday examples. Get practical advice on credit scores, avoiding debt, and how rewards can sometimes trip you up. Learn what actually works for families, college students, and busy folks trying to get ahead. Perfect if you’re tired of vague advice and want honest, useful answers.

Read More

Curious if you can score a $5000 personal loan with bad credit? This article breaks down your real options, what lenders look for, and easy ways you can boost your chances. You'll find practical tips, honest advice, and a few surprising facts about getting loans with a low credit score. Learn what to expect before you apply, what alternatives exist, and how smart choices now can help your financial life later. Get answers that actually help you make a good decision instead of empty promises.

Read More

Wondering why your Chase credit card applications keep getting turned down? The 'Chase rule,' especially the 5/24 rule, can make or break your approval chances. This article breaks down what the Chase rule is, how it works, common misunderstandings, and simple tips to boost your odds. If you're juggling multiple cards or thinking about adding a new Chase card, these insights can save you serious frustration. Get ready to finally play by Chase's real rules.

Read More

Wondering if you can buy a house after consolidating your debt? This article breaks down what actually happens to your home-buying plans after debt consolidation, how your credit score is affected, and what lenders look for. Get real tips on improving your chances, common mistakes to avoid, and how timing can make a big difference for your mortgage approval. A practical guide for anyone who wants a fresh start without sacrificing their dream home.

Read More

Wondering how your credit score affects your home insurance rate? This article explains what insurers consider a good credit score, how it impacts your premium, and why some states treat credit differently. Get practical tips for improving your score and learn what to expect if yours isn’t perfect. Make smarter choices for your home coverage today.

Read More

Ever wondered if those tempting 0% financing deals on cars could sneakily mess with your credit score? While it might seem like a sweet offer, it's important to dig into how it could impact your finances. This article breaks down the truth behind 0% financing and its effects on your credit. Whether you're eyeing a new set of wheels or just curious, you'll get a clear picture of the possible pros and cons. Find out how to navigate these deals wisely without taking a hit to your credit.

Read More

Refinancing can seem daunting, especially when you're worried about your credit score. This guide dives into how refinancing affects your credit, offering clarity on credit impacts and highlighting strategies to mitigate risks. While refinancing can initially dip your score, smart management can lead to long-term benefits. Learn the ins and outs for a smoother remortgaging journey.

Read More

Considering a debt consolidation loan but unsure about credit score requirements? Typically, lenders look for a credit score of 650 or higher, but don't lose hope if you're below this mark. Factors like your income, debt-to-income ratio, and financial history can still influence your eligibility. Learn what lenders are really looking for in this guide to make informed financial decisions.

Read More

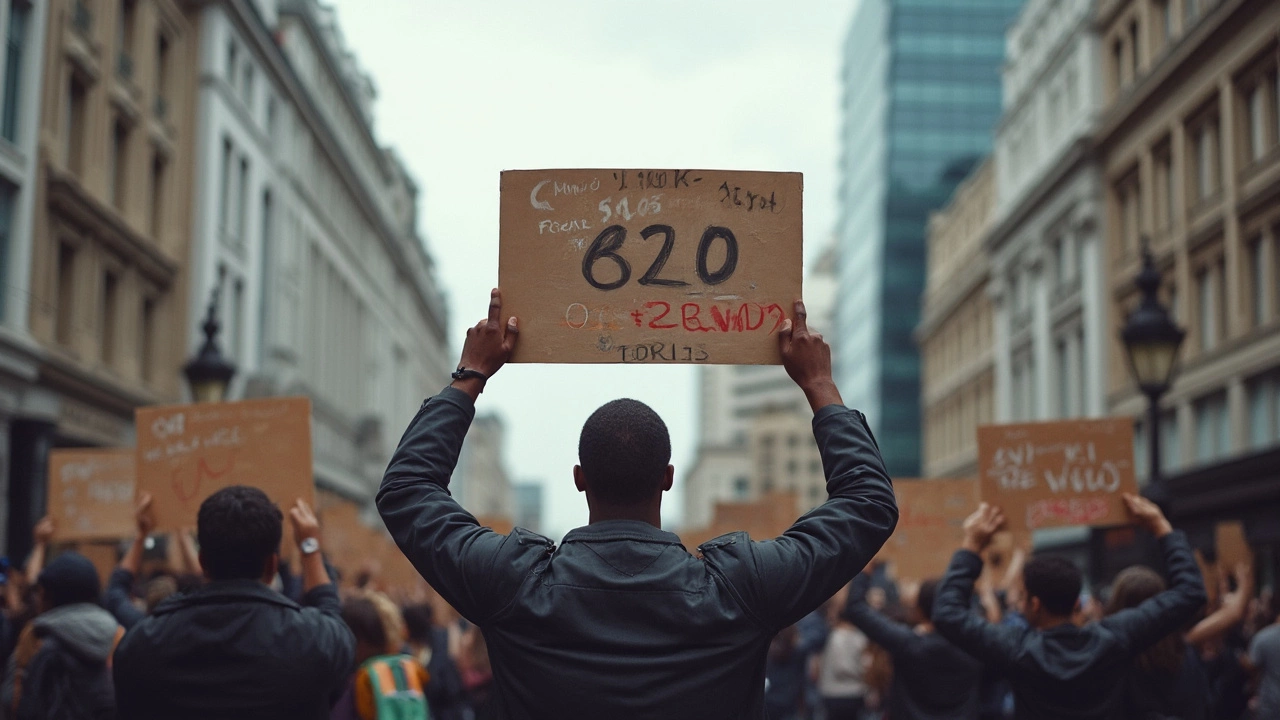

Getting a $30,000 loan can be a substantial financial move, and your credit score plays a crucial role. Most lenders generally look for a score of 620 or higher, but several other factors could come into play. Understanding how different credit scores affect your loan approval chances and terms can save money and stress. This article unpacks the ins and outs of credit scores, offering helpful tips for improving your standing.

Read More