Cash ISA: Your Tax‑Free Savings Engine

When working with cash ISA, a tax‑free cash savings account available to UK residents. Also known as Individual Savings Account, it lets you lock away cash without paying income tax on the interest. The account is governed by the tax‑free allowance, the yearly limit you can deposit without losing the tax benefit, which for the 2025‑26 tax year sits at £20,000 across all ISA types. To open a cash ISA you must be a UK resident, someone with a permanent address in the United Kingdom and at least 16 years old. Because the interest you earn is exempt from income tax, the savings interest rate, the percentage the provider pays on your deposited cash becomes a key driver of your real returns. In short, a cash ISA offers a simple, low‑risk way to grow money tax‑free while keeping your capital easily accessible.

How a Cash ISA Fits Into Your Financial Plan

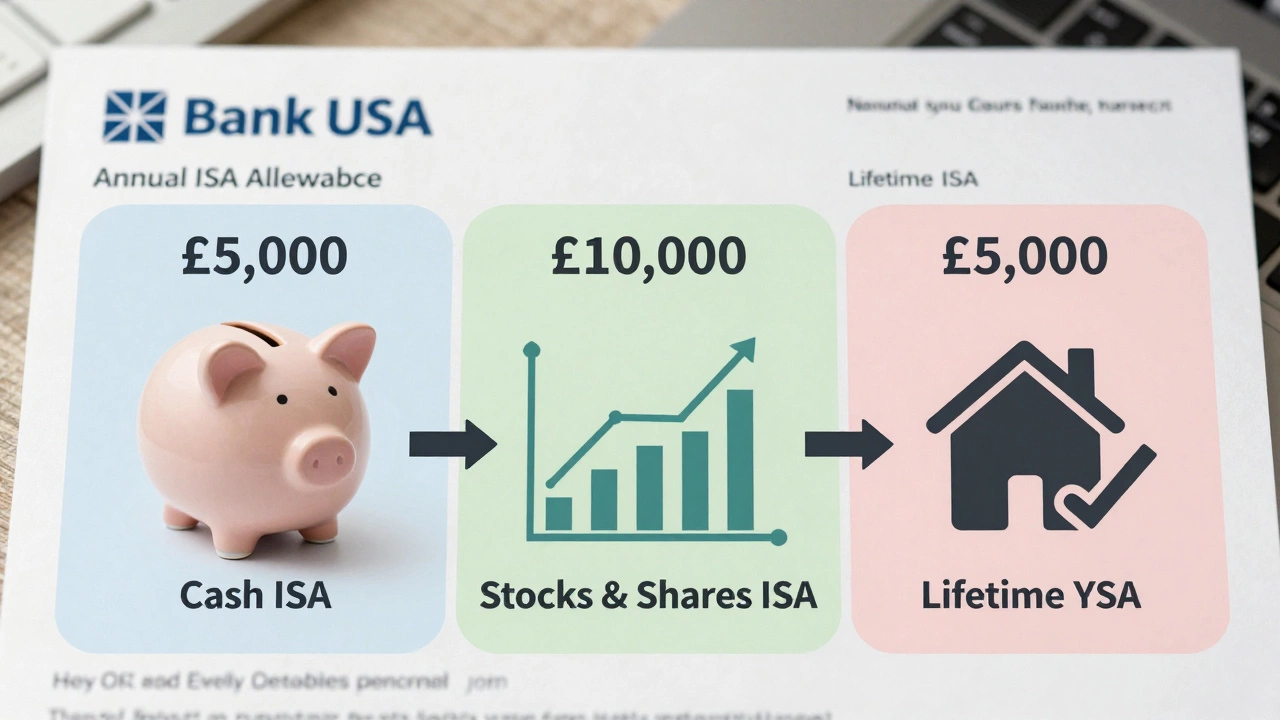

The core of any solid financial planning, the process of setting goals, budgeting and choosing the right savings vehicles is matching the right product to your risk appetite and timeline. A cash ISA sits at the low‑risk end of the spectrum, making it ideal for emergency funds, short‑term goals, or as a stable holding while you decide on higher‑return options. Your annual contribution limit, the maximum amount you can put into an ISA each tax year caps how much you can shelter from tax, so many savers aim to max it each year to lock in the benefit. Compared with a stocks‑and‑shares ISA, a cash ISA offers guaranteed capital protection but typically lower returns; the trade‑off is liquidity and peace of mind. The choice often comes down to whether you need immediate access to cash (cash ISA) or are comfortable with market volatility for potentially higher growth (stocks‑and‑shares ISA).

Knowing these nuances helps you decide where to park each pound. In the sections that follow you’ll find practical tips on choosing the right provider, spotting the best interest rates, and timing your contributions to get the most out of the tax‑free allowance. We also break down common pitfalls—like exceeding the contribution limit or forgetting that the allowance resets every April—and show how to keep your cash ISA aligned with broader wealth‑building goals. Armed with this context, you’ll be ready to evaluate the articles below and apply the insights to your own savings strategy.

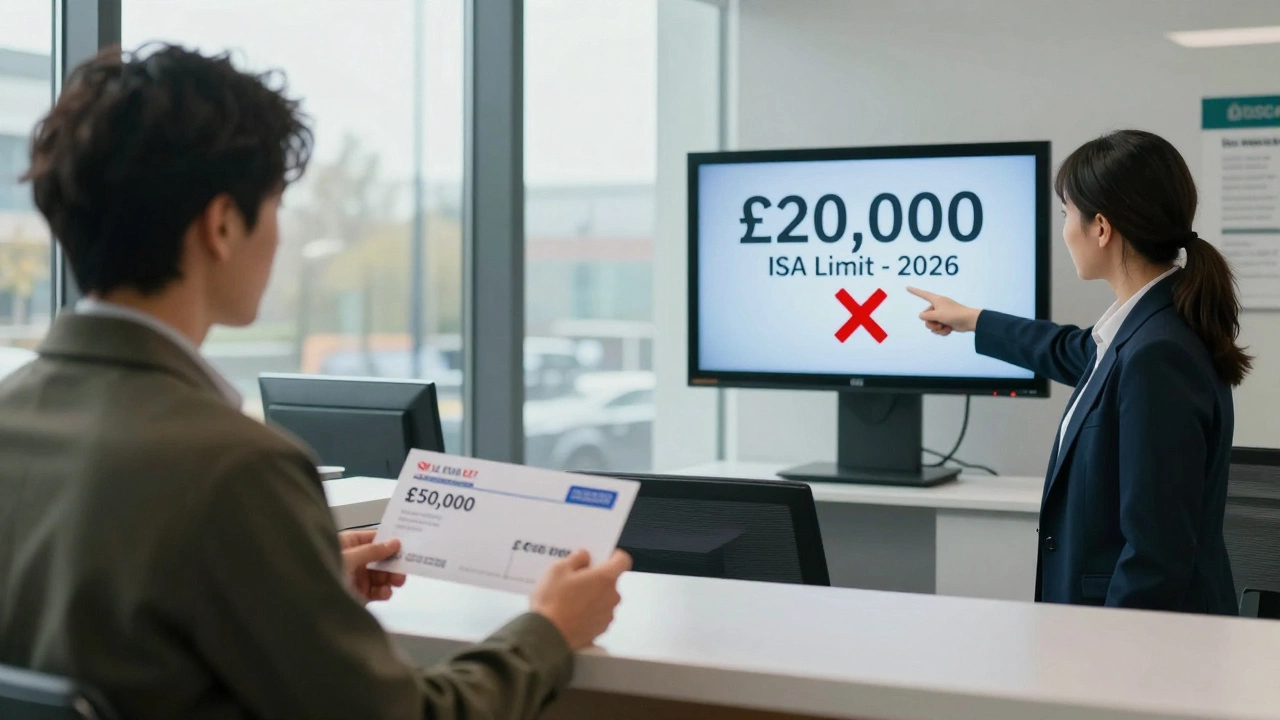

You can't put $50,000 in a cash ISA in one year - the UK limit is £20,000. But with smart planning over three years, you can get there tax-free. Here's how to maximize your ISA allowance and avoid costly mistakes.

Read More

You can't put $20,000 in a UK cash ISA because the allowance is £20,000 (about $25,000) and must be split across all ISA types. Learn how to use your full allowance wisely.

Read More

Explore why an ISA can lose value, the risks of cash, stocks & shares, and innovative finance ISAs, and learn practical steps to safeguard your tax‑free savings.

Read More