Quick Takeaways

- Remortgaging can lower your monthly payment if rates have dropped since you first borrowed.

- It may let you release home equity for renovations, debt consolidation, or investments.

- Watch out for early repayment charges and valuation fees that can eat into any savings.

- Fixed‑rate, variable‑rate and tracker mortgages each have distinct risk profiles.

- A solid credit score and a low loan‑to‑value ratio improve your chances of getting a better deal.

If you’re wondering whether a remortgage makes sense, read on. Below we break down the why, when, and how of swapping your current home loan for a new one.

When you remortgage replace your existing mortgage with a new loan, typically to secure a lower rate or free up equity, you’re essentially refinancing your home loan. The process feels similar to taking out a brand‑new mortgage, but the purpose is to improve the terms of an existing one.

When It Makes Sense to Consider Remortgaging

Three common triggers signal that it might be time to look at a new deal:

- Rate environment shift: If the Bank of England has cut its base rate since you locked in your mortgage, you could lock in a cheaper rate.

- Equity build‑up: Rising property values increase your Loan‑to‑Value (LTV) the ratio of your mortgage balance to your property’s market value. A lower LTV often unlocks better rates.

- Life‑event financing: Need cash for a kitchen remodel, paying off high‑interest debt, or funding a child’s education? Remortgaging can let you tap into the equity you’ve accumulated.

On the flip side, if you’re locked into a low fixed rate that’s still below market, or you’re close to the end of your mortgage term, the savings may be marginal.

How Remortgaging Works - Step by Step

- Check your current mortgage terms: note the interest rate, remaining balance, and any early repayment charge (ERC).

- Assess your credit score: most lenders require a score of 620+ for competitive rates.

- Calculate your property’s current market value: either through an online estimator or a professional appraisal.

- Determine the LTV you’ll be applying for: a lower LTV (e.g., 70% vs 85%) usually means a better rate.

- Shop around: use mortgage comparison sites, direct lender portals, or contact a mortgage broker an intermediary who matches borrowers with suitable lenders for tailored options.

- Submit a full application: provide proof of income, identity, and property details.

- Valuation and legal work: the lender will order a valuation and a solicitor will handle the transfer of deeds.

- Completion: the new lender pays off your existing mortgage, and you begin the new repayment schedule.

Most of the paperwork can be completed online, but factor in 2‑4 weeks for the valuation and legal steps.

Fixed‑Rate vs Variable‑Rate vs Tracker Mortgages

Choosing the right product is crucial because it dictates how your payments will behave over time. Below is a quick side‑by‑side comparison.

| Feature | Fixed‑rate | Variable‑rate | Tracker |

|---|---|---|---|

| Rate stability | Locked for set term (2‑5‑10 years) | Changes with lender’s base rate | Follows Bank of England base rate + margin |

| Typical initial rate (2025) | 4.1% - 4.8% | 3.9% - 4.5% | Base rate + 0.75% - 1.25% |

| Best for | Budget certainty, risk‑averse borrowers | Those who expect rates to stay low or drop further | Homeowners comfortable with modest fluctuations |

| Early repayment charge | Usually applies (2‑5% of remaining balance) | Typically none | Often none, but check lender policy |

| Flexibility | Limited - you’re locked in | High - you can over‑pay without penalties | Medium - over‑pay allowed, but rate follows base |

In a low‑rate environment, a variable or tracker can save a few hundred pounds a year. If rates start climbing, a fixed‑rate offers protection.

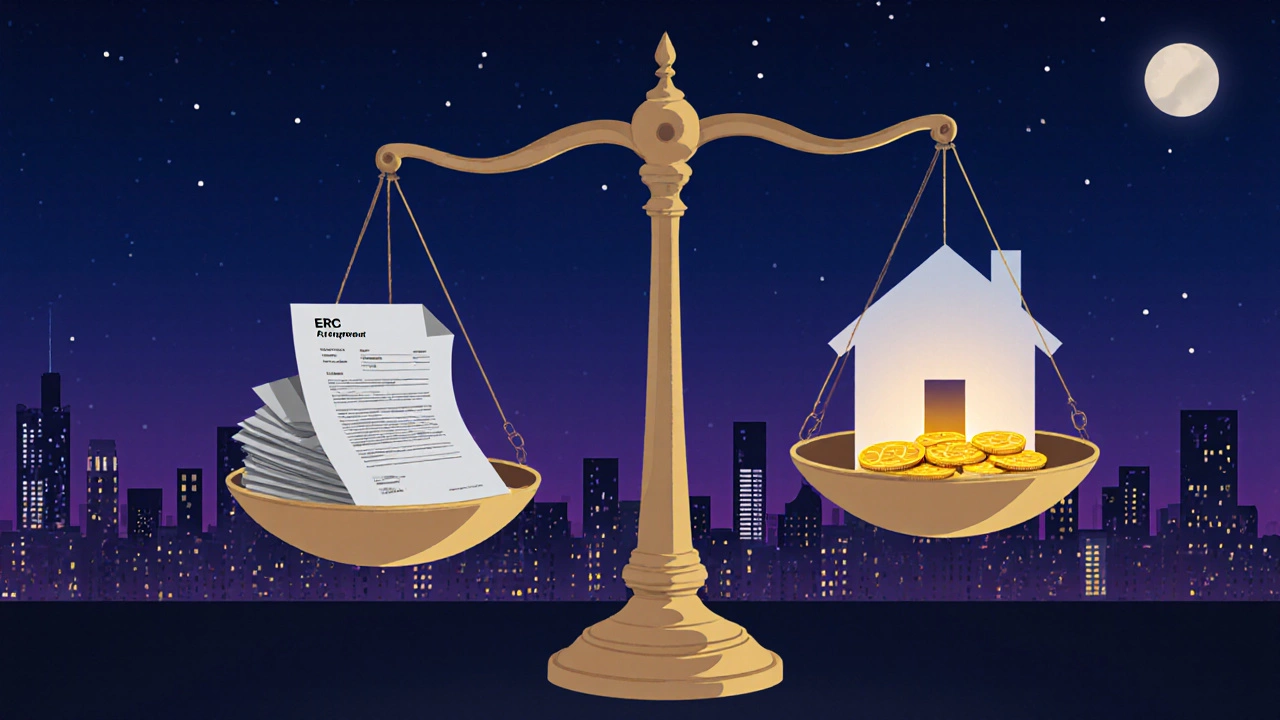

Costs & Fees You Can’t Ignore

Even if the new rate looks great, hidden costs can erode the benefit. Common items include:

- Early repayment charge (ERC): May be 2‑5% of the outstanding balance if you exit a fixed deal early.

- Arrangement fee: Lenders charge anywhere from £0 to £1,500 for setting up the new loan.

- Valuation fee: Typically £150‑£300, paid to the lender’s surveyor.

- Legal fees: Solicitor or licensed conveyancer charges range £500‑£1,200.

- Broker fee: Some brokers earn a commission from the lender; others charge a flat fee (£250‑£500).

Before you sign, ask for a total cost breakdown so you can compare the net savings against staying with your current mortgage.

Calculating Potential Savings

Use a simple spreadsheet to see if the numbers add up. Here’s the core formula:

Monthly Savings = (Current Rate - New Rate) × Current Balance ÷ 12

Then subtract the total of all fees and any ERC. If the result is positive and recoups the upfront cost within the first 12‑24 months, the move is usually worthwhile.

Example (2025 data):

- Current mortgage: £200,000 at 5.0% fixed, 2‑year remaining, ERC 3% (£6,000).

- New offer: 4.2% variable, no arrangement fee, £150 valuation, £700 legal, £250 broker.

- Monthly payment drop: (5.0%-4.2%) × £200,000 ÷ 12 ≈ £133.

- Total upfront cost: £6,000 (ERC) + £150 + £700 + £250 = £7,100.

- Break‑even point: £7,100 ÷ £133 ≈ 53 months (about 4.5 years).

Because the break‑even exceeds the remaining term (2 years), staying put is the smarter choice.

Risks & Pitfalls to Watch Out For

- Over‑borrowing: Pulling too much equity can push your LTV above 90%, leading to higher rates.

- Rate volatility: Variable products can spike if the Bank of England raises rates.

- Unrealistic valuations: Relying on an online estimator may overstate your home’s worth; lenders use their own numbers.

- Credit score dip: Late credit‑card payments during the application window can lower your score and cost you more.

- Hidden terms: Some deals include “payment holidays” that add interest later.

Mitigate these by keeping your credit clean, limiting how much equity you release, and reading the fine print.

Step‑by‑Step Remortgage Checklist

- Gather your current mortgage statement and note the ERC.

- Check your credit report for errors.

- Get a recent property valuation (online tools or a local estate agent).

- Calculate the maximum LTV you can comfortably achieve.

- Contact at least three lenders or brokers for quotes.

- Compare interest rates, fees, and product types using the table above.

- Run the savings calculator to see the break‑even point.

- Choose the offer that gives the best net benefit within your mortgage horizon.

- Prepare required documents: ID, proof of income, bank statements, and property details.

- Submit the application and arrange a valuation.

- Coordinate the legal handover; your solicitor will manage the discharge of the old loan and registration of the new one.

- Start the new repayment schedule and monitor your statements for the first few months.

Following this checklist keeps the process smooth and helps you avoid surprise costs.

Frequently Asked Questions

Is remortgaging right for me if I have an existing fixed‑rate deal?

Only if the savings after fees and any early repayment charge outweigh the cost of breaking the fixed deal. Use a break‑even calculator and consider how many years you have left on the current term.

Can I remortgage with a lower credit score than when I first borrowed?

Lenders prefer a good score, but some specialist lenders will still offer deals to borrowers with scores in the low 600s. Expect a higher interest rate and possibly a larger deposit.

What happens to my existing mortgage if the remortgage is denied?

Your current mortgage stays in place. The lender will usually give a reason, and you can either re‑apply later or try a different lender.

Do I need a mortgage broker, or can I go directly to a bank?

Both routes work. Brokers can access a broader panel of lenders and often negotiate better rates, while going direct can be simpler if you already have a relationship with a bank.

How long does the whole remortgage process usually take?

From application to completion, expect 3‑6 weeks, assuming the valuation goes smoothly and there are no legal complications.

In short, a remortgage can be a smart move when rates have fallen, your equity has risen, or you need cash for a specific purpose. But it’s not a free lunch - you must weigh fees, ERCs, and future rate risk. Use the checklist, run the numbers, and only switch if the net benefit is clear.