50/30/20 Budget Calculator

How It Works

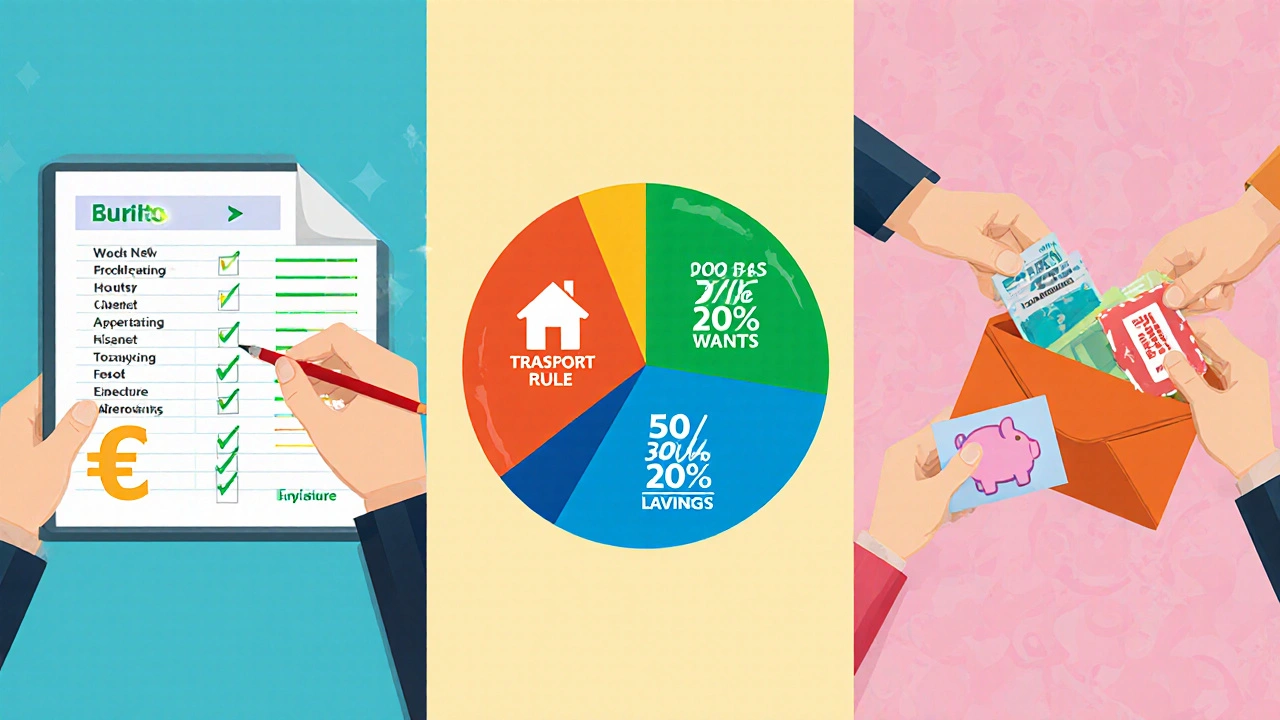

This tool applies the 50/30/20 rule recommended in the article. Allocate 50% of your income to needs, 30% to wants, and 20% to savings/debt.

Enter your monthly net income to see your ideal budget breakdown.

If you’ve ever stared at a bank statement and felt lost, you’re not alone. Getting a grip on your money doesn't have to be a nightmare. This guide walks you through the basics of budgeting for beginners so you can start saving without a finance degree.

What is Budgeting?

Budgeting is a process of planning how to allocate your income to cover expenses, savings, and financial goals. Think of it as a roadmap that tells your money where to go, instead of wondering where it went.

Core Principles Every Newbie Should Know

- Track every euro. If you don’t know where the money is coming from or going, you can’t control it.

- Separate needs from wants. Essentials like rent and groceries top the list; the rest are flexible.

- Set realistic goals. Whether it’s a vacation fund or an emergency cushion, clear goals guide your spending limits.

- Adjust regularly. Life changes, and so should your budget.

Beginner‑Friendly Budgeting Methods

There’s no one‑size‑fits‑all, but three methods dominate the starter‑kit world. Below is a quick side‑by‑side look.

| Method | How It Works | Best For | Key Drawback |

|---|---|---|---|

| Zero‑based budgeting | Every euro is assigned a job, so income minus expenses equals zero. | People who like detailed control and can stick to a plan. | Time‑intensive to set up each month. |

| 50/30/20 rule | Allocate 50% to needs, 30% to wants, 20% to savings or debt. | Those who prefer a quick, rule‑of‑thumb approach. | Less precise for irregular income. |

| Envelope system | Cash for each spending category is placed in separate envelopes. | People who respond well to physical limits. | Hard to use for digital‑only transactions. |

Step‑by‑Step: Build Your First Budget

- Gather your numbers. Pull recent pay slips, bank statements, and any recurring bills.

- List all income sources. Include salary, side‑gig earnings, freelance work, and any passive income.

- Identify fixed expenses. Rent/mortgage, utilities, insurance, loan payments - these rarely change month to month.

- Estimate variable expenses. Groceries, transport, entertainment - use the past three months to find an average.

- Set a savings target. Aim for at least 10% of net income if you can; adjust upward as you get comfortable.

- Choose a budgeting method. Pick one from the table above that matches your personality.

- Pick a tool. Spreadsheet, app, or paper envelope - we’ll cover options next.

- Monitor weekly. Compare actual spend to your plan and tweak as needed.

Tools & Templates to Make Life Easier

While pen‑and‑paper works, digital tools save time and reduce errors.

- Google Sheets: Free, cloud‑based spreadsheet with ready‑made budgeting templates. You can customize categories and view charts instantly.

- YNAB (You Need A Budget): Paid app that follows the zero‑based philosophy. Great for people who need prompts and community support.

- Mint: Free aggregator that pulls transactions from your banks, categorizes them, and offers alerts when you’re close to limits.

Pick the one that feels least daunting. For most beginners, a simple Google Sheet works wonders because you stay in control of the data.

Common Pitfalls and How to Dodge Them

- Over‑estimating income. Use net pay after taxes, not gross salary.

- Ignoring irregular costs. Include quarterly insurance, car maintenance, and holiday spending in a “sinking fund” column.

- Setting unrealistic limits. A budget that’s too tight leads to frustration and abandonment.

- Skipping the review. Money habits change; schedule a brief check‑in every Sunday.

Quick Checklist for Budgeting Newbies

- Collect all income and expense statements.

- Choose a budgeting method that matches your style.

- Set up a simple spreadsheet or download an app.

- Allocate every euro - even if it goes to a “miscellaneous” bucket.

- Review and adjust weekly for the first month.

- Celebrate small wins - hitting your savings target, paying off a credit card, etc.

What is the easiest budgeting method for absolute beginners?

The 50/30/20 rule is often recommended because it requires only three numbers and works for most income types.

How often should I update my budget?

Check it at least once a week. If you have a variable income, a daily glance can prevent surprises.

Can I budget without a spreadsheet?

Yes. The envelope system works with cash, and many free apps (like Mint) handle everything digitally.

What should I do about irregular expenses?

Create a “sinking fund” category. Divide the total cost of the irregular item by 12 and set aside that amount each month.

Is budgeting worth it if I earn a low salary?

Absolutely. Even small adjustments can free up money for emergencies or debt repayment, which improves financial stability.