Home Equity Cost Calculator

Estimate how much you'll really pay when borrowing against your home equity and whether it's the right choice for your situation.

Results

Enter your information to see your results.

Millions of homeowners wonder if tapping into their home’s equity is a smart move. You’ve paid off half your mortgage, your neighborhood’s value jumped 40% in five years, and suddenly, your house feels like a piggy bank you can crack open. But is it really that simple? Taking equity out of your house isn’t just a financial decision-it’s a life decision. And the consequences can last longer than your mortgage.

What Does It Mean to Take Equity Out of Your House?

Your home equity is the part of your house you actually own. If your home is worth $400,000 and you still owe $200,000 on your mortgage, you have $200,000 in equity. Taking that equity out means borrowing against that value. You’re not selling your house-you’re using it as collateral for a loan.

There are three main ways to do this:

- Home equity loan: You get a lump sum with a fixed rate and fixed monthly payments. Think of it like a second mortgage.

- Cash-out refinance: You replace your current mortgage with a new, larger one. You get the difference in cash. Your interest rate resets, and your loan term restarts.

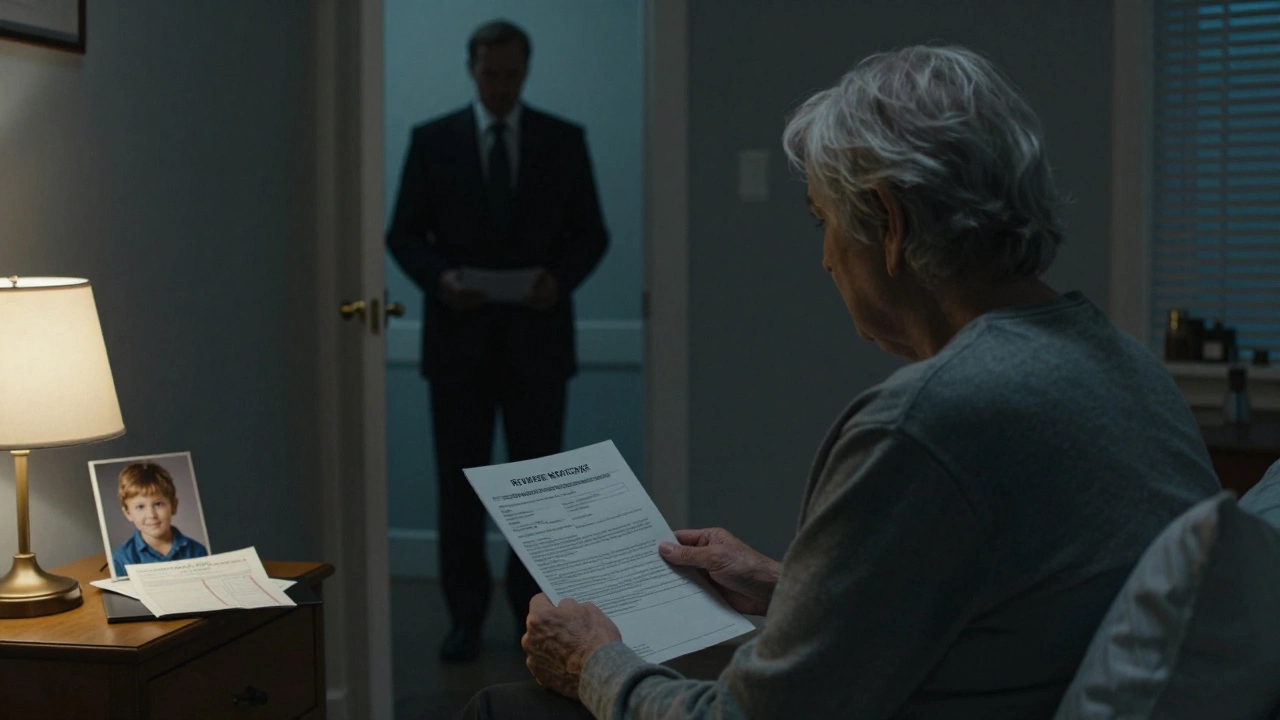

- Reverse mortgage: Only for homeowners 62 or older. You get payments from the lender, don’t have to repay until you move or die, and the loan balance grows over time.

Each option has different costs, risks, and long-term impacts. Choosing the wrong one can trap you in debt you didn’t plan for.

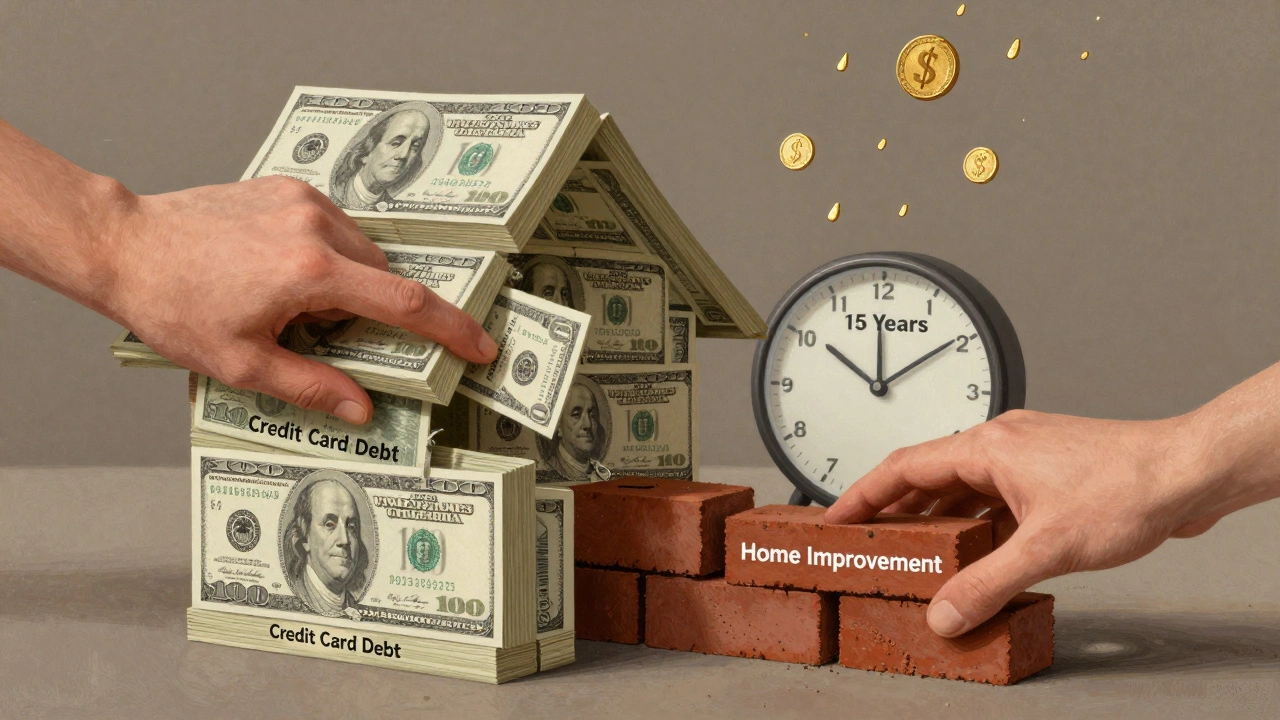

Why People Take Equity Out-And Why It Backfires

People reach for home equity for all kinds of reasons. Debt consolidation. Home renovations. A child’s college tuition. A medical emergency. Some use it to pay off credit cards, thinking they’re solving a problem. But here’s what rarely gets said: you’re not fixing debt-you’re just moving it.

A 2023 study by the Federal Reserve found that 61% of homeowners who used home equity to pay off credit card debt had those same cards reloaded with new balances within 18 months. They traded high-interest credit card debt for lower-interest mortgage debt-but ended up with more total debt and less equity.

Another common mistake? Using equity for lifestyle upgrades. New kitchen. Luxury vacation. Expensive car. These don’t build wealth. They drain it. Your home isn’t an ATM. It’s your shelter, your retirement anchor, and your most valuable asset. Once you give up that equity, it’s hard to get back.

The Real Cost of Tapping Your Equity

Let’s say you have $150,000 in equity and you take out $100,000 as a home equity loan at 7.5% interest over 15 years. Your monthly payment? About $927. That’s not a small amount. Over the life of the loan, you’ll pay $66,860 in interest alone.

Now compare that to a cash-out refinance. You refinance your $200,000 mortgage into a $300,000 loan at 6.8%. Your new monthly payment goes from $1,200 to $2,000. That’s an $800 increase. And you’re now paying interest on $300,000 instead of $200,000. That’s $100,000 more in principal-and more interest over time.

Reverse mortgages have their own traps. Fees can run over $10,000 upfront. Interest compounds monthly. If you live 10 years after taking it out, you might owe more than your home is worth. And if you need to move for health reasons? The loan becomes due immediately.

These aren’t theoretical risks. In 2024, over 12,000 reverse mortgage borrowers in the U.S. lost their homes because they couldn’t keep up with property taxes or insurance-costs they didn’t realize were still their responsibility.

When Taking Equity Out Makes Sense

It’s not all bad. There are times when using home equity is the smartest financial move you can make.

Home improvements that increase value: A new roof, energy-efficient windows, or a kitchen remodel that adds $80,000 to your home’s value? That’s a good investment. The IRS allows you to deduct interest on up to $750,000 of mortgage debt used for home improvements. That’s a real tax benefit.

High-interest debt consolidation: If you’re paying 20% APR on $30,000 in credit card debt and you can get a home equity loan at 7%, you’re saving $3,900 a year in interest. But only if you close those credit cards and never open them again.

Education or business investment: Paying for a degree that leads to a $50,000 salary increase? Funding a small business with a proven model? These can pay for themselves. The key is whether the return on investment exceeds the cost of borrowing.

But here’s the catch: you need a plan. Not a wish. Not a hope. A written plan with numbers, deadlines, and consequences if things go wrong.

What Happens If You Can’t Pay Back the Loan?

This is the part no one talks about until it’s too late.

When you take equity out, your home becomes collateral. If you miss payments, the lender can foreclose. That’s not a threat-it’s a legal right. And foreclosure doesn’t just hurt your credit. It can wipe out your retirement savings if you’re forced to sell your home at a loss.

Even if you avoid foreclosure, you’re locking yourself into higher monthly payments for years. That money could’ve gone into a retirement account, a college fund, or an emergency stash. Instead, it’s going to the bank.

And if your home value drops? You could end up underwater. You owe more than your house is worth. You can’t sell. You can’t refinance. You’re stuck.

Alternatives to Taking Equity Out

Before you sign anything, ask yourself: Is there another way?

- Side income: Freelancing, renting out a room, or selling unused items can bring in $500-$2,000 a month without touching your home.

- Personal loans: Unsecured personal loans under $25,000 often have lower fees than home equity loans and don’t risk your house.

- Government or nonprofit assistance: Programs exist for home repairs, medical bills, and education. Check with your local housing authority or United Way.

- Delay the expense: Can you wait a year? Save $1,000 a month? You’ll have $12,000 in cash with zero interest.

One client I worked with needed $40,000 for her son’s tuition. Instead of cashing out equity, she took a part-time job, cut dining out and subscriptions, and saved the full amount in 14 months. She didn’t touch her home. She didn’t take on debt. She didn’t lose sleep.

The Bottom Line: Is It Smart?

There’s no universal answer. It depends on your numbers, your discipline, and your future.

It’s smart if:

- You’re using the money to increase your home’s value or earn more income

- You have a solid plan to repay it in 5-7 years

- You’ve cut unnecessary spending and built an emergency fund

- You understand the interest, fees, and risks

It’s not smart if:

- You’re using it to pay off credit cards and plan to use them again

- You’re doing it for a vacation, new car, or impulse purchase

- You’re over 60 and don’t fully understand how reverse mortgages work

- You’re already stretching your budget thin

Home equity is powerful-but it’s not free money. It’s borrowed money with your house on the line. Treat it like a scalpel, not a sledgehammer.

Can I lose my home if I take equity out?

Yes. If you fail to make payments on a home equity loan, cash-out refinance, or reverse mortgage (in certain cases), the lender can start foreclosure proceedings. Your home is the collateral, so missing payments puts your ownership at risk. This isn’t a hypothetical-it happens every day.

What’s the cheapest way to take equity out?

A cash-out refinance often has the lowest interest rate, especially if you’re refinancing into a lower rate than your current mortgage. But it comes with closing costs of 2-5% of the new loan amount. A home equity loan may have higher rates but lower upfront fees. Compare total cost over 5 years, not just monthly payments.

How much equity should I keep in my home?

Financial advisors recommend keeping at least 20% equity as a buffer. If your home is worth $500,000, aim to keep at least $100,000 in equity. This protects you if the market dips and gives you flexibility if you need to sell or refinance later. Taking out too much can make it impossible to move or qualify for future loans.

Do I pay taxes on the money I get from equity?

No, you don’t pay income tax on the cash you receive from a home equity loan or refinance. The IRS treats it as a loan, not income. However, you only get a tax deduction on the interest if you use the money to buy, build, or substantially improve your home. Using it for vacations or debt payoff means no tax benefit.

Can I take equity out if I’m retired?

Yes-but with major caveats. Reverse mortgages are designed for retirees, but they’re expensive and complex. You still have to pay property taxes, insurance, and maintenance. If you can’t afford those, you risk losing your home. Many retirees regret taking them out because they end up with less to leave to their family or can’t move to assisted living later.