Home Equity Loan Eligibility Calculator

Determine if you qualify for a home equity loan based on current 2025 lending standards. Input your financial details to see if you meet key requirements for approval.

It’s 2025, and your home has gained value-maybe even doubled since you bought it. You’ve paid down your mortgage, you’ve fixed up the kitchen, and now you want to tap into that equity. But when you walk into your bank or fill out an online application, you hit a wall. Your loan gets denied. Or worse, you get approved for half of what you asked for, with interest rates that make you rethink the whole idea. Home equity loan approvals have gotten tougher, and it’s not just you. Here’s why.

Your home’s value isn’t enough anymore

Five years ago, lenders would look at your home’s appraised value and say, "Great, you’ve got $300,000 in equity-here’s $200,000." Today, they’re not just looking at the number. They’re looking at how stable that number is.

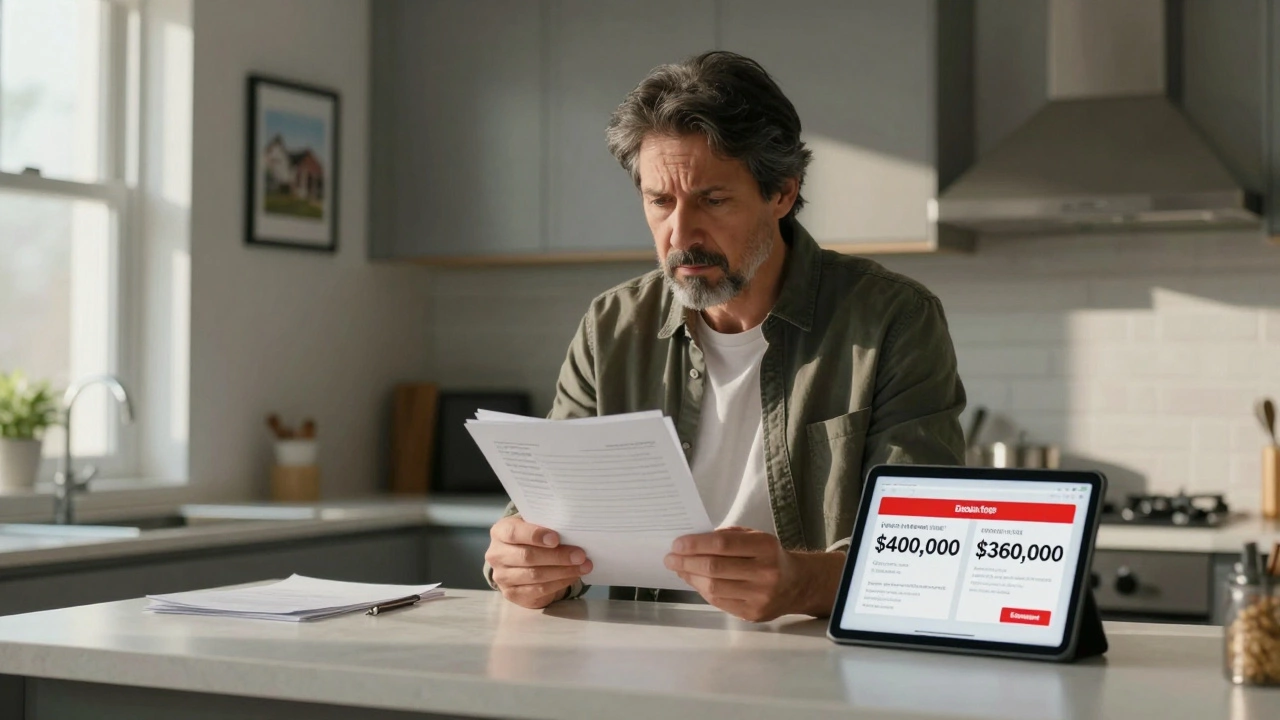

After the 2022-2023 housing bubble, appraisals became stricter. Lenders now require two independent appraisals for loans over $150,000. If one appraisal says your home is worth $400,000 and the other says $360,000, they’ll use the lower number. That wipes out $40,000 of your supposed equity right away.

And it’s not just about the past. Lenders are watching local market trends. If your neighborhood has seen a 10% drop in sales volume over the last six months-even if prices haven’t dropped yet-they’ll treat your home like it’s at risk. Your $300,000 equity might get reduced to $220,000 in their eyes. That’s a huge difference when you’re trying to borrow $250,000.

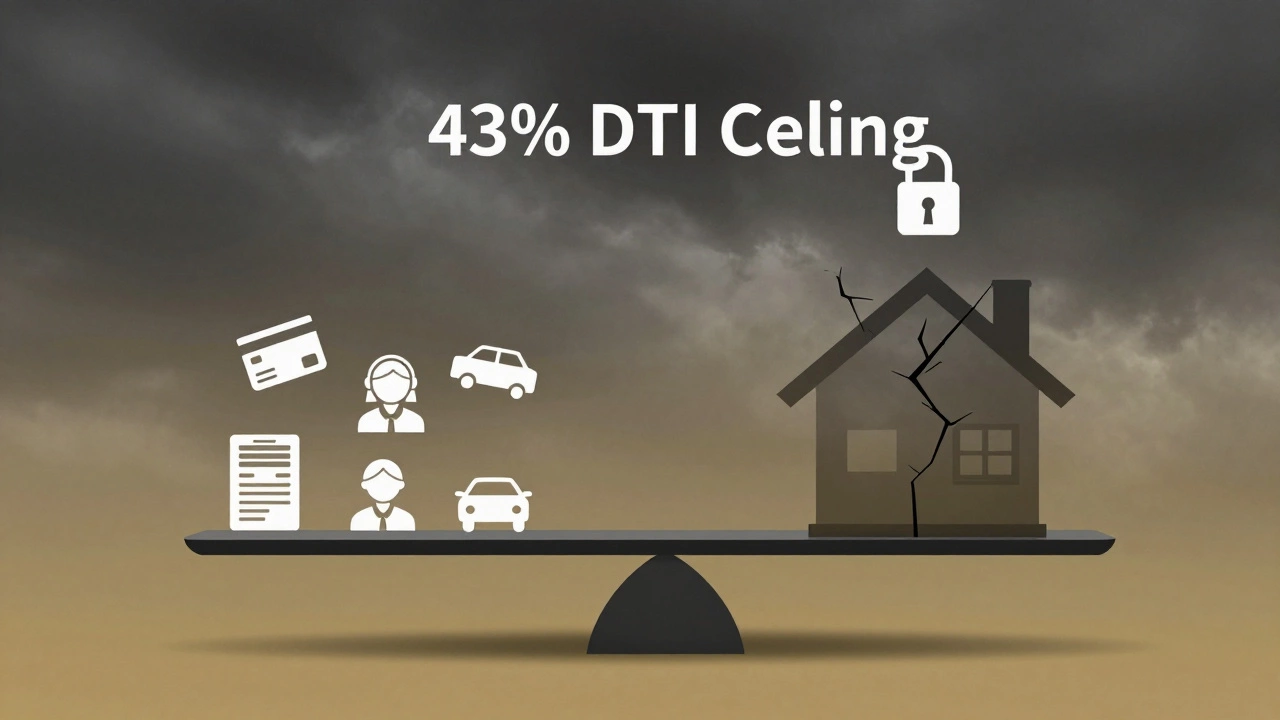

Debt-to-income ratio is the new gatekeeper

You might think your credit score is the main thing lenders care about. It’s not. It’s your debt-to-income ratio (DTI). And in 2025, most lenders won’t approve a home equity loan if your DTI is above 43%.

DTI is your total monthly debt payments divided by your gross monthly income. So if you make $7,000 a month and pay $3,000 toward your mortgage, car loan, student debt, and credit cards, your DTI is 43%. That’s the ceiling. If you’re at 44%, you’re out.

Here’s the catch: many people don’t realize how much their other debts count. That $250/month student loan? It’s in there. That $150/month credit card payment? It’s in there. Even if you’re not using your cards, lenders assume you could max them out. So if you’ve got $50,000 in student loans and a car payment, your DTI might be higher than you think-even if you pay everything on time.

Some lenders will let you go up to 50% DTI if you have a credit score above 760 and a huge down payment on the equity loan. But those are rare. Most will shut you down at 43%.

Credit scores matter more than ever

You’ve heard "620 is the minimum." That’s outdated. In 2025, the average approved home equity loan applicant has a credit score of 740 or higher. If your score is below 700, you’re already fighting an uphill battle.

Why? Because lenders are scared of defaults. After the pandemic, many homeowners used their home equity to pay off credit cards or cover living expenses. Now, those loans are starting to go bad. Lenders are tightening up to avoid repeating that cycle.

Even small credit issues can kill your application. A single late payment from last year? It might not even show up on your credit report anymore, but lenders still pull internal records. If you missed a payment on your utility bill and it went to collections-even if you paid it off two months ago-that can trigger a manual review. And manual reviews often end in denials.

And don’t think you can just fix your credit last minute. Lenders want to see a 12-month history of on-time payments. If you’ve been rebuilding your score, you need to wait. No shortcuts.

Income verification is more invasive than ever

Self-employed? Freelancer? Commission-based? Good luck.

Lenders now require two full years of tax returns-even if you’ve been in business for five years. They want to see consistent income. If your 2023 income was 20% higher than 2022, they’ll still use the lower number to calculate your borrowing power.

W-2 employees aren’t safe either. Lenders are asking for pay stubs from the last 30 days, bank statements from the last 60 days, and even your employer’s contact info. Some will call your HR department to confirm your job status. If you got a raise last month, they won’t count it until you’ve had three paychecks at the new rate.

And if you’ve changed jobs in the last 12 months? You’re probably out. Even if you moved to a better position, lenders see job changes as risk. They want stability. A 10-year career at the same company? That’s a green light. A promotion after six months at a new job? Still a red flag.

Home equity loans aren’t for home improvements anymore

Back in 2018, you could get a home equity loan to pay for a vacation, a wedding, or even to invest in stocks. Not anymore.

Since 2023, federal guidelines have pushed lenders to restrict home equity loans to home-related uses. That means: renovations, repairs, adding a room, fixing the roof, upgrading the HVAC. Even installing solar panels counts.

But if you say you want the loan to pay off credit cards? Or to buy a car? Or to start a business? You’ll be turned down-or worse, approved with a 5% higher interest rate because they classify it as a "non-purpose" loan.

Lenders now require you to submit receipts or contractor estimates before they release funds. If you’re planning to use the money for something outside home improvement, you’ll need to find another option.

There are alternatives-but they come with trade-offs

If you’ve been denied a home equity loan, you’re not out of options. But each one has a cost.

- Home equity line of credit (HELOC): You might qualify for a HELOC even if you didn’t qualify for a lump-sum loan. But HELOCs have variable rates, and rates are at 8.5% in 2025. You’ll pay more over time.

- Personal loan: Unsecured personal loans are easier to get, but interest rates start at 12%. You’ll pay more in interest than you would with a home equity loan.

- Refinance your mortgage: If you have enough equity, cash-out refinancing might be your best bet. But you’ll reset your mortgage term, pay closing costs, and your rate might be higher than your current one.

- Reverse mortgage: Only if you’re 62 or older. You don’t make payments, but you lose equity fast, and you can’t leave the home to your kids without repaying.

None of these are perfect. But if you need cash and your home equity loan got denied, one of these might work-just know what you’re giving up.

What you can do right now

Don’t just apply and hope for the best. Here’s what actually works in 2025:

- Check your DTI. Add up every monthly debt payment. Divide by your gross income. If it’s above 40%, pay down one debt before applying.

- Fix your credit. Get a free credit report. Dispute any errors. Pay down credit card balances to under 30% of your limit.

- Wait six months. If you’ve had a recent job change, missed payment, or big purchase, wait. Lenders want to see stability.

- Get a second appraisal. If you think your home was undervalued, pay for an independent appraisal. Bring it to the lender.

- Apply with a credit union. They’re more flexible than big banks. They look at your whole financial picture, not just numbers.

There’s no magic trick. Getting a home equity loan today is harder because lenders are protecting themselves. But if you’re patient, organized, and realistic about what you can borrow, you can still get one. It just takes more work than it used to.

Why do lenders care so much about my credit score for a home equity loan?

Lenders use your credit score to predict how likely you are to repay the loan. In 2025, with higher interest rates and tighter lending standards, even a small drop in repayment rates can cost them millions. A score below 700 signals higher risk, so lenders either deny you or charge much higher interest to make up for that risk.

Can I get a home equity loan if I’m self-employed?

Yes, but it’s harder. You’ll need two full years of tax returns showing consistent income, and lenders will use your lowest-earning year to calculate your borrowing power. You’ll also need bank statements showing steady deposits. Many self-employed people get approved only after waiting a full year after filing taxes.

Is it better to get a home equity loan or a HELOC?

It depends on how you’ll use the money. A home equity loan gives you a lump sum with a fixed rate-good if you need $50,000 for a renovation. A HELOC gives you a revolving line of credit with a variable rate-good if you need to pay for work done in phases. But HELOC rates are higher now (8.5%+), so you’ll pay more over time unless you pay it off quickly.

What happens if my home equity loan application is denied?

You’ll get a written explanation under federal law. Common reasons: high DTI, low credit score, insufficient equity, or unstable income. Don’t reapply immediately. Fix the issue first-pay down debt, improve your credit, or wait for income to stabilize. Reapplying too soon can hurt your credit further.

Can I use a home equity loan to pay off credit card debt?

Technically, yes-but most lenders won’t approve it. Since 2023, federal guidelines discourage using home equity for non-home-related expenses. Even if you find a lender who says yes, you’ll likely pay a higher interest rate. It’s safer to use a personal loan or balance transfer card for that purpose.

Next steps if you’re still stuck

If you’ve done everything right-paid down debt, improved your credit, waited six months-and you’re still getting denied, it might be time to rethink your goal.

Ask yourself: Do you really need $100,000 right now? Could you do the kitchen remodel in phases? Could you borrow $30,000 instead of $75,000? Sometimes, scaling back your request is the fastest way to get approved.

And if you’re still unsure, talk to a HUD-approved housing counselor. They offer free advice, help you understand your options, and can even help you appeal a denial. You don’t need to fight this alone.