Student Loan Default Calculator

See How Your Debt Grows

Calculate how your student loans could grow over time due to interest and fees if you don't make payments.

Results

Enter your loan details to see how your debt could grow over time.

Not paying your student loans isn’t something that disappears with time. It doesn’t vanish after a few missed payments. It doesn’t go away because you forgot about it. And it definitely doesn’t get easier the longer you wait. If you never pay off your student loans, the consequences pile up-slowly at first, then all at once. By the time you realize what’s happening, your credit is damaged, your wages are being taken, and the government is already chasing you down.

Your credit score takes a hit-fast

Student loans are reported to credit bureaus just like any other debt. Miss one payment? That shows up. Miss three? Your credit score drops noticeably. Miss six? You’re officially delinquent. After 270 days of non-payment in the U.S., your loan goes into default. That’s when things get serious.

Once in default, the entire balance becomes due immediately. That’s not a suggestion. That’s a legal demand. And the default stays on your credit report for seven years from the date it was reported. Even if you pay it off later, the damage is already done. Landlords check credit. Employers check credit-especially for jobs involving finance, government, or security clearances. Banks won’t approve you for a car loan. You won’t get approved for a mortgage. And if you do, you’ll pay thousands more in interest.

The government has powers no private lender can touch

Unlike credit card debt or personal loans, federal student loans are backed by the U.S. government. That means they come with extraordinary collection powers. No court order needed. No lawsuit required. The government can take your tax refunds. It can seize your Social Security payments. It can garnish up to 15% of your disposable income directly from your paycheck.

Let’s say you’re earning $3,000 a month after taxes. If your loan is in default, they can take $450 of that every month-without asking. And they don’t stop when you change jobs. They’ll track you down. They’ll find your new employer. They’ll keep taking money until the debt is paid-or until you get into a repayment plan.

And here’s the kicker: interest keeps growing. Even if you don’t make a payment, the balance grows. Late fees pile on. Collection costs add up. What started as $25,000 in student debt can balloon to $40,000-or more-just from penalties and accrued interest.

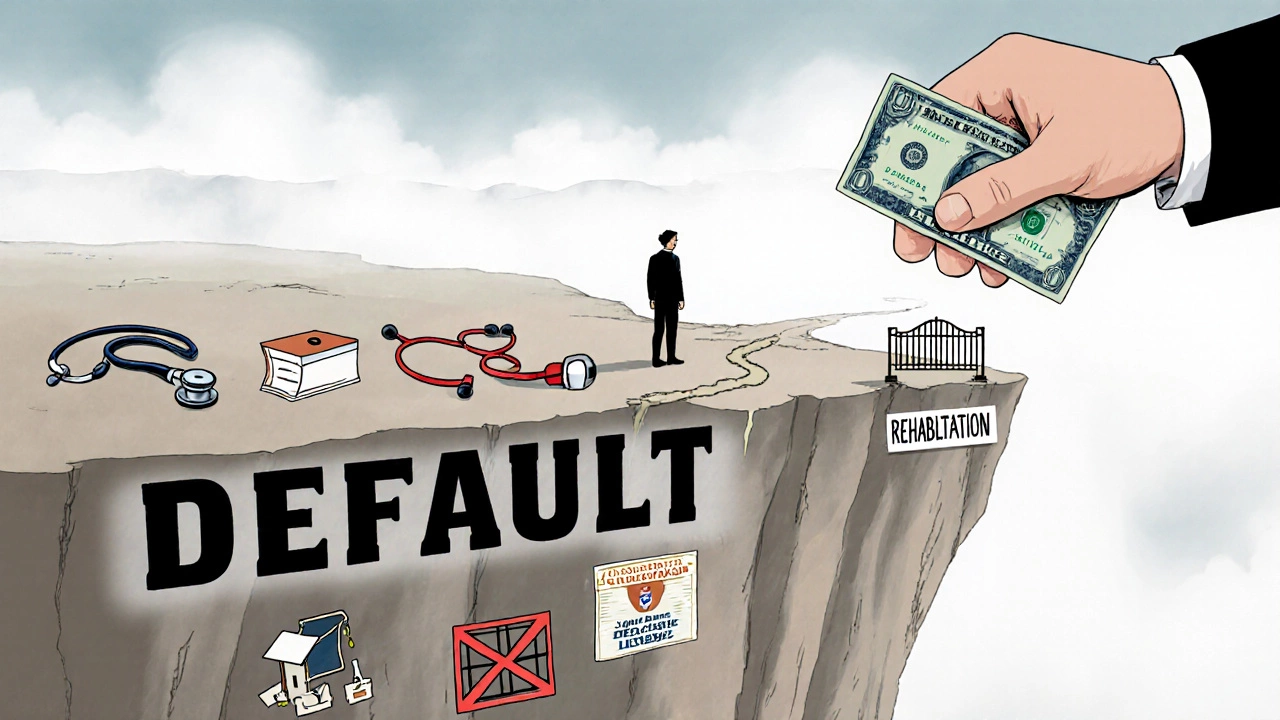

You lose access to future financial aid

If you ever think about going back to school-whether it’s a certificate program, a master’s degree, or even a community college course-you won’t be able to get federal financial aid. Not grants. Not work-study. Not another student loan. The government blocks you until you resolve your default.

This isn’t a minor inconvenience. For many people, education is their only path out of low-wage work. If you’re stuck in a job that doesn’t pay enough to cover rent, let alone student debt, being locked out of further education traps you in a cycle you can’t escape.

Professional licenses and certifications can be revoked

In more than 30 U.S. states, professional licensing boards can suspend or deny licenses to people with defaulted student loans. That includes nurses, teachers, accountants, engineers, real estate agents, and even cosmetologists. Imagine spending years training for a career-only to have your license pulled because you missed a payment five years ago.

Some states don’t just suspend licenses-they require you to pay off the debt before they’ll even consider renewing it. That’s not a repayment plan. That’s a full payoff. And if you’re already struggling to pay rent, how are you supposed to pay $20,000 all at once?

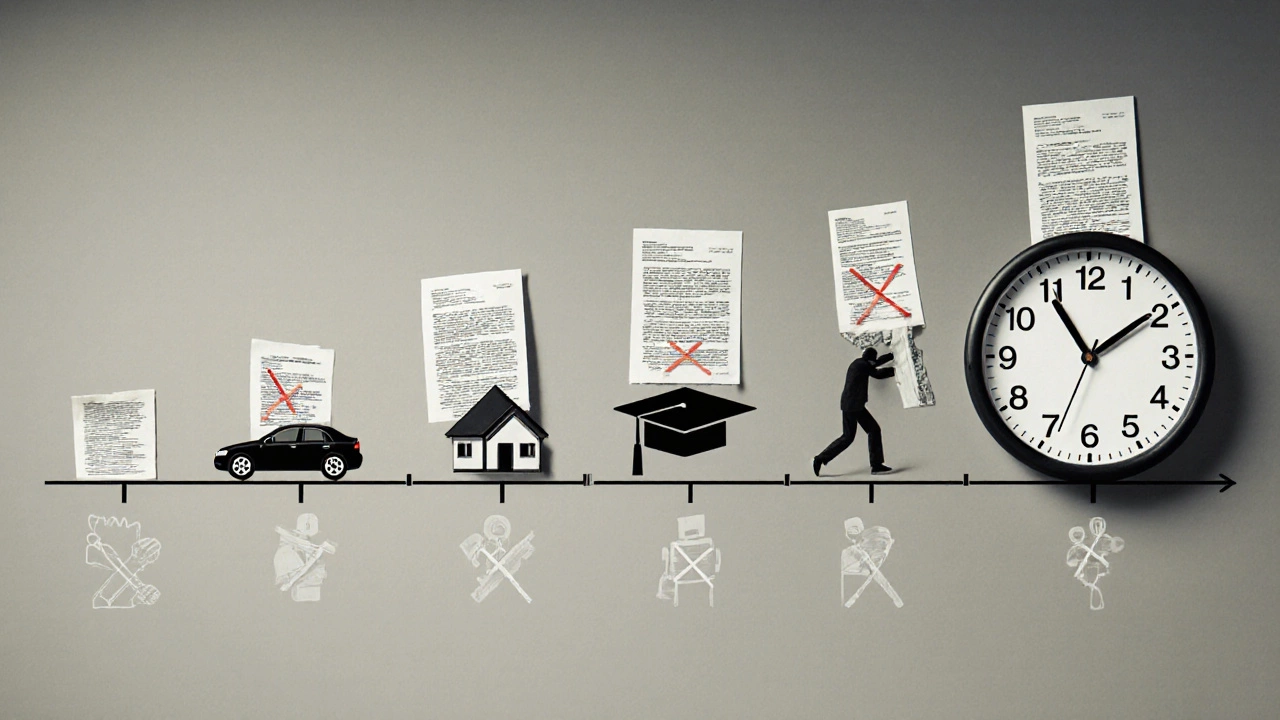

There’s no statute of limitations

Here’s what most people get wrong: student loans don’t expire. Unlike credit card debt, which can be discharged after a certain number of years in some states, federal student loans have no time limit. The government can come after you in your 30s, 40s, 50s-even your 60s. They can take your tax refund when you retire. They can take part of your Social Security check. There’s no clock running out.

Private student loans are different. Some have statutes of limitations, usually between 3 and 10 years depending on the state. But even then, if you make a payment-even $5-after the clock runs out, it can restart the timer. So pretending the debt doesn’t exist doesn’t make it go away.

Loan forgiveness isn’t automatic

You might have heard stories about people getting their loans forgiven after 20 or 25 years. That’s true-but only if you’re on an income-driven repayment plan and you’ve made 240 or 300 qualifying payments. If you’ve never made a single payment, you don’t qualify. You’re not on the path. You’re outside the system.

Public Service Loan Forgiveness (PSLF) is another option-but only if you’ve worked full-time for a qualifying employer (government or nonprofit) and made 120 on-time payments. If you’ve skipped payments, you’re not eligible. And if you’ve defaulted, you’re locked out until you rehabilitate your loan.

Rehabilitation is possible-but it’s hard

If you’ve defaulted, you’re not stuck forever. There’s a way out: loan rehabilitation. You can get your loan out of default by making nine voluntary, on-time, full monthly payments over ten months. Once you do, the default is removed from your credit report. You regain access to federal aid. Your wages stop being garnished.

But here’s the problem: those payments have to be affordable. The government will calculate what you can pay based on your income. If you’re making $2,000 a month, they might ask for $20. If you’re making $1,200, it could be $10. But you still have to pay it-every month-for ten months straight. Miss one, and you’re back to square one.

And even after rehabilitation, you’re not free. The loan is still there. You just get a second chance to pay it under a new plan.

Bankruptcy won’t save you

Most people think bankruptcy wipes out debt. It doesn’t-especially not student loans. You have to prove “undue hardship,” which means you can’t maintain a minimal standard of living if you pay, your financial situation won’t improve, and you’ve made good faith efforts to repay. Courts rarely grant this. In fact, fewer than 1% of student loan bankruptcy cases succeed.

So don’t count on bankruptcy. It’s not a loophole. It’s a dead end.

What should you do instead?

If you’re behind on payments, don’t ignore it. Don’t hope it goes away. Reach out to your loan servicer-right now. Ask about income-driven repayment plans. Ask about deferment or forbearance. Ask about rehabilitation. Most servicers want to help. They don’t want to garnish your wages. They want you to pay, but they know you can’t if you’re struggling.

There are options. You just have to act before the system catches up to you.

Can student loans be forgiven if I never pay them?

No. Student loans are not forgiven simply because you never pay them. Forgiveness programs require you to be on a qualifying repayment plan and make a set number of on-time payments. If you’ve never paid, you don’t qualify. Ignoring your loans doesn’t erase them-it makes things worse.

Will my student loans disappear after 7 years?

No. The default will fall off your credit report after seven years, but the debt itself never expires. The government can still collect on it indefinitely. They can take your tax refunds, Social Security, and wages-even decades later.

Can the government take my Social Security benefits?

Yes. If you default on federal student loans, the government can garnish up to 15% of your Social Security retirement or disability payments. They can’t take your entire benefit, but they can take enough to make a difference. This applies even if you’re retired or disabled.

Can I go to jail for not paying student loans?

No, you cannot go to jail for not paying student loans. Debtors’ prisons were abolished in the U.S. in the 19th century. However, you can be held in contempt of court if you ignore a court order to appear or provide financial information. That’s rare, but possible.

What happens if I move to another country?

Moving abroad doesn’t erase your student loan debt. The U.S. government can still garnish your tax refunds if you file them. They can also intercept any U.S.-based income. If you ever return to the U.S., your wages can be garnished, and your credit will still be damaged. Some countries have agreements with the U.S. to share financial data, making it harder to hide.

Can private student loans be discharged in bankruptcy?

It’s extremely difficult, but not impossible. Private student loans have slightly more flexibility than federal ones, but you still need to prove undue hardship. Most people fail this test. Bankruptcy is not a reliable solution for either type of student loan.

Next steps if you’re behind

Step one: Find your loan servicer. Log in to studentaid.gov to see who manages your loans. Step two: Call them. Don’t wait. Ask about income-driven repayment, deferment, or rehabilitation. Step three: Get your payments in writing. Never rely on a verbal promise.

If you’re overwhelmed, contact a nonprofit credit counselor. Organizations like the National Foundation for Credit Counseling (NFCC) offer free advice. They’ll help you understand your options without pushing you into a repayment plan you can’t afford.

Student loans are heavy. But they’re not unbeatable. The longer you wait, the harder it gets. Start today-even if it’s just one small step. You’re not alone. And you’re not out of options.