Credit Card Acceptance Checker

Check Card Acceptance by Country

Acceptance Results

Visa

Mastercard

American Express

Discover

Travel Tips

Visa and Mastercard are accepted in over 200 countries and territories worldwide. For the vast majority of places you'll visit, either card will work seamlessly.

American Express is widely accepted in major cities and tourist areas, but many small shops and local businesses don't accept it due to higher merchant fees.

Discover is primarily accepted only in the United States and Canada. Avoid relying on it for international travel.

If you’ve ever stood at a small shop in a foreign country, handed over your card, and watched the clerk shake their head, you know the frustration. Not all credit cards work everywhere - even if they’re from big banks and carry familiar logos. The question isn’t just which card has the best rewards or lowest fees. It’s: what credit card is the most accepted?

Visa and Mastercard Dominate Global Acceptance

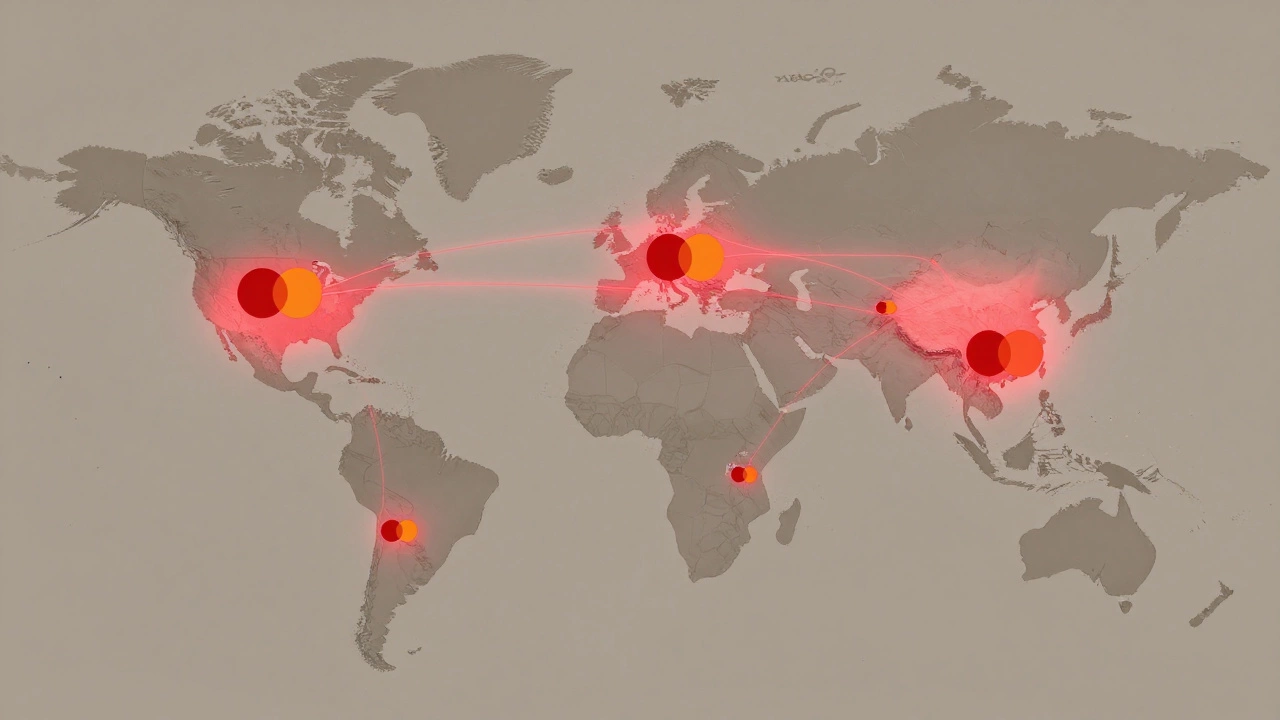

When it comes to where your card will actually work - from a street vendor in Hanoi to a gas station in rural Iceland - Visa and Mastercard are the clear winners. Together, they’re accepted in over 200 countries and territories. That’s not a guess. It’s based on data from global payment networks and travel industry reports. Visa processes transactions in more than 200 countries; Mastercard isn’t far behind, with presence in nearly every nation that has a banking system.

Why does this matter? Because acceptance isn’t about brand recognition. It’s about infrastructure. Merchants don’t sign up for a card because it looks cool. They sign up because their payment terminal supports it, their bank processes it, and their customers use it. Visa and Mastercard have spent decades building that infrastructure. They’re the plumbing behind most card payments worldwide.

In Europe, Asia, and Latin America, you’ll find Visa and Mastercard on nearly every terminal. Even in places where local cards dominate - like China’s UnionPay or Japan’s JCB - Visa and Mastercard are still accepted in tourist areas, hotels, airports, and major retailers. If you’re traveling, these two are your safety net.

American Express and Discover: Limited Outside the U.S.

American Express is often seen as a premium card. It offers great perks, strong customer service, and solid travel protections. But here’s the catch: it’s accepted in far fewer places globally. In the U.S., Amex has strong merchant partnerships - but outside North America, that changes fast.

In countries like Germany, Italy, or India, many small businesses, family-run hotels, and local markets don’t accept American Express. Why? Because Amex charges merchants higher fees than Visa or Mastercard. Many small shops simply can’t afford the cost. In 2023, a World Bank survey found that only 68% of small businesses in Western Europe accepted Amex, compared to 97% for Visa and Mastercard.

Discover is even more limited. It’s practically invisible outside the United States. Even in Canada, many vendors don’t take Discover. If you’re planning to travel internationally, relying on Discover is like bringing a paper map to a city with no GPS.

Why Some Cards Work in Some Places - And Not Others

Acceptance isn’t random. It’s tied to three things: merchant agreements, currency handling, and local payment habits.

First, merchants have to sign contracts with card networks. Visa and Mastercard have standardized, low-cost entry for small businesses. Amex often requires direct negotiations, which favors large chains over mom-and-pop stores.

Second, currency conversion matters. Visa and Mastercard handle multi-currency transactions smoothly. Their systems automatically convert prices at competitive rates. Amex sometimes forces the merchant to handle currency manually - a headache for small operators.

Third, local preferences shape what sticks. In South Korea, local cards like KCP dominate. In Russia, Mir is the main network. But even there, Visa and Mastercard are still accepted in international hotels and airports. You’re not stuck - you just need the right card.

What About Contactless and Digital Wallets?

You might think Apple Pay or Google Pay changes the game. But here’s the truth: those apps still rely on the underlying card network. If your Apple Pay is linked to an American Express card, and the terminal doesn’t take Amex, your phone won’t magically fix it.

Some countries, like Sweden and the UK, have pushed hard for contactless payments. But even there, the card networks behind the taps are still mostly Visa and Mastercard. In fact, contactless adoption has only made Visa and Mastercard more dominant - because they’re the ones built into most mobile wallets.

Bottom line: your phone isn’t a magic wand. It’s just a different way to use the same card.

What Should You Carry When Traveling?

Here’s the practical advice: always carry at least two cards.

- One Visa or Mastercard as your primary - the one you use 90% of the time

- A second card from a different network - ideally a different bank - as backup

Don’t rely on cash alone. In many countries, ATMs charge high fees for foreign cards. And in some places, like Japan or parts of Eastern Europe, cash-only spots are still common. But you don’t want to be stuck without a card when you need one.

For international travel, pick a Visa or Mastercard with no foreign transaction fees. Many banks offer these now - including Capital One, Chase, and some credit unions. Avoid cards that charge 3% every time you swipe abroad. That adds up fast.

Is There a Single Card That Works Everywhere?

No. Not really.

Even Visa and Mastercard have gaps. In remote areas of Papua New Guinea, parts of the Amazon, or conflict zones, no card works. But for 99% of the places you’ll ever visit - from Paris to Phuket - Visa and Mastercard will get you through.

Some people swear by the Chase Sapphire Preferred or the Capital One Venture card. Those are great choices - but not because they’re magically accepted everywhere. They’re great because they’re Visa or Mastercard, they have no foreign fees, and they offer solid travel perks.

So don’t chase the myth of the one universal card. Chase the reality: a Visa or Mastercard with no foreign transaction fees, and a backup card in your wallet.

What About Credit Cards from Local Banks?

If you live in the U.S., you might assume your local bank’s card is the same as everyone else’s. But that’s not true abroad. Cards issued by regional banks sometimes have limited international support, even if they carry a Visa or Mastercard logo.

Some smaller issuers don’t activate international transactions by default. You might get declined because your bank blocked overseas use for security reasons. Always call your issuer before you leave and confirm your card works abroad. Ask them to remove any travel blocks and verify that foreign transaction fees are zero.

Same goes for prepaid cards. Many don’t work internationally, even if they say they’re Visa or Mastercard. Stick to traditional credit cards issued by major banks.

Real-World Example: A Trip to Portugal

Last summer, a traveler from Chicago arrived in Lisbon with three cards: a Visa, an American Express, and a Discover.

She paid for her hotel, rental car, and museum tickets with the Visa. Easy.

At a small family-run restaurant in Sintra, the owner shook his head when she pulled out the Amex. "Não aceitamos American Express," he said. She paid with cash.

At a local market in Porto, the vendor didn’t even have a card reader. She bought cheese and wine with cash again.

Her Discover card? Never used. Never even taken out of her wallet.

She didn’t need a fancy card. She just needed one that worked.

Final Advice: Stick to the Basics

The most accepted credit card isn’t the one with the most points. It’s the one that doesn’t get rejected.

Choose a Visa or Mastercard. Make sure it has no foreign transaction fees. Carry a backup. Keep some cash on hand. That’s it.

You don’t need to own five cards. You don’t need the fanciest rewards program. You just need to know what works - and stick to it.

Is Visa or Mastercard more accepted worldwide?

Visa and Mastercard are accepted in nearly the same number of countries - both cover over 200. Visa has a slight edge in volume, especially in Asia and Latin America, but for practical purposes, they’re interchangeable. Either one will work almost everywhere.

Can I use American Express outside the U.S.?

You can - but not everywhere. In major cities and tourist spots, Amex is often accepted. But in small shops, rural areas, and local markets, many places don’t take it. Merchants avoid Amex because it charges higher fees. Always have a Visa or Mastercard as backup.

Do I need a card with no foreign transaction fees?

Yes. Most cards charge 1% to 3% every time you use them abroad. That’s extra money you don’t need to pay. Many banks now offer cards with zero foreign transaction fees - including Capital One, Chase, and some credit unions. Pick one.

What if my card gets declined abroad?

Call your bank immediately. Many banks block international transactions by default to prevent fraud. Ask them to remove the block and confirm your card is activated for overseas use. Always notify your bank before you travel.

Are digital wallets like Apple Pay better than physical cards?

No. Apple Pay and Google Pay are convenient, but they still use your underlying card. If your card is Amex and the merchant doesn’t accept Amex, your phone won’t help. The network matters more than the payment method.

Should I carry cash instead of relying on cards?

Yes - but not as a replacement. Carry enough cash for small purchases, markets, and places that don’t take cards. But rely on your Visa or Mastercard for bigger expenses. Cash is backup, not your main tool.