Find the Best Savings Account for Your Money in 2025

Everyone wants a place to stash cash that actually grows. With interest rates bouncing around, picking the right savings account can feel like a guessing game. Good news – you don’t need a finance degree to sort it out. In this guide we’ll break down the basics, show you what to watch for, and hand you a short list of top‑performing UK accounts.

What to Look For

First up, the three things that matter most:

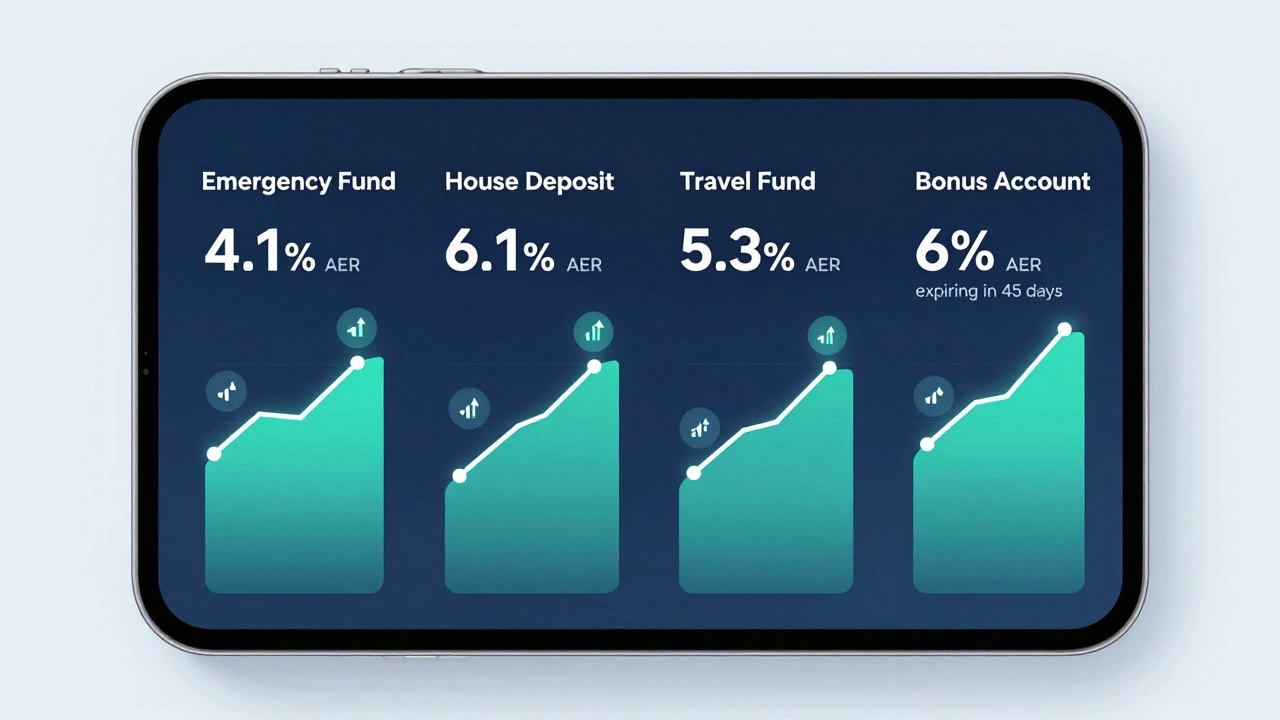

Interest rate. This is the headline number you’ll see in ads. It tells you how much your money could earn in a year, before tax. Look for the Annual Equivalent Rate (AER) – it includes compounding, so it’s a more realistic picture.

Fees and charges. Some accounts slap a monthly maintenance fee or charge for withdrawals. Those fees can wipe out any extra interest you earned, so aim for a no‑fee or low‑fee product.

Access rules. Can you pull money out anytime, or do you need to give notice? Fixed‑term accounts often pay more but lock your cash for 6‑12 months or longer. If you need flexibility, a notice‑free instant account is safer.

Other nice‑to‑have features include mobile banking, automatic transfers, and whether the account is covered by the FSCS (Financial Services Compensation Scheme) – which protects up to £85,000 per bank.

Top Picks for UK Savers

We’ve scanned the main high‑street banks, challenger banks and online‑only firms. Here are three options that consistently rank high on rate, low fees and ease of use.

1. Sky Savings – 5.25% AER, instant access. No monthly fee, fully online, and you can set up weekly auto‑deposits. Great for people who want a solid rate without locking money away.

2. Nationwide Flex Saver – 4.85% AER, 30‑day notice. Offers a slightly higher rate if you’re happy to give a month’s notice before pulling funds. Ideal if you have an emergency fund you don’t touch often.

3. Atom Bank Fixed‑Term – 6.10% AER, 12‑month lock. Best for cash you can leave untouched for a year. The rate jumps higher because you give up instant access.

All three are FSCS‑protected and let you manage the account through a smartphone app. If you already have a current account with any of these banks, opening a savings account is usually a few clicks.

Remember, rates change regularly. A good habit is to review your savings every three months and switch if a better deal appears. Most banks let you transfer funds online with no exit fees, so moving isn’t a big hassle.

Another tip: don’t chase the absolute highest rate if the account has strict limits on how much you can deposit. Some “super‑high” rates cap the balance at £5,000 – anything above that earns the lower standard rate.

Finally, think about your tax situation. Interest earned over £1,000 (or £500 if you’re a basic‑rate taxpayer) is taxable. Using an ISA (Individual Savings Account) can shield that interest from tax, so compare the AER of a regular savings account with the tax‑free ISA rate you qualify for.

Bottom line: the best savings account is the one that matches your cash flow, gives you a competitive rate, and doesn't charge hidden fees. Use the checklist above, compare the three picks, and you’ll have your money working harder in no time.

Find out which savings account is best for saving money in 2026 in Ireland, including high-interest options, notice accounts, fixed-term deals, and how to avoid common traps. Learn how to split your savings for maximum growth and safety.

Read More

Trying to figure out which bank truly has the best savings account for 2025? This article cuts through the confusion with current facts, highlighting the banks offering the highest rates and the lowest fees. Whether you’re saving for a new car, an emergency fund, or your kid’s next big hobby, you’ll find practical info and tips to actually boost your balance. We’ll also look at online vs. traditional banks, smart banking features, and what to watch out for with the fine print. Read on if you want your savings to actually grow—without surprise headaches.

Read More