How to Turn $30 Into Real Financial Progress

Got $30 sitting in your wallet and wonder what to do with it? You don’t need a big sum to start feeling more in control of your money. Below are simple, no‑nonsense ideas that let you stretch that $30 farther than you think.

Quick Wins You Can Do Right Now

First, treat $30 like a mini emergency fund. Slip it into a high‑interest savings account or a cash‑ISA if you’re in the UK. Even a 1% rate adds a few pennies each month, and the habit of saving gets stronger.

If you’re paying off a personal loan, use the $30 to make an extra payment. A single extra payment can shave a few weeks off the term and cut a bit of interest. It’s a tiny step that adds up over time.

Another fast win is to hunt for a discount on a recurring expense. Cancel a subscription you barely use or switch to a cheaper plan and put the saved cash back into your $30 pool. You’ll see the same $30 turn into $40 or $50 over a few months.

Smart Spending Hacks

When you need to spend the $30, focus on value. Buying a generic brand instead of a name brand can save you 20‑30% instantly. Use price‑comparison apps, and you’ll often find the same product for less.

If you enjoy eating out, skip the pricey restaurant and try a “$30 dinner challenge”: a decent meal for two at a local cafe, plus a dessert you make at home. You still get the social experience without blowing the budget.

For those who like crypto, treat $30 as a learning budget. Pick a reputable, low‑fee exchange and buy a tiny amount of a well‑established coin. Use it to understand how wallets work, but don’t expect big returns. It’s a safe way to dip your toe in.

Thinking about a bigger purchase later? Use the $30 as a deposit on a layaway plan or a “save‑first” strategy. Each week, add a little more to the pot until you can buy what you need without a loan.

Lastly, consider investing the $30 in yourself. A short online course on budgeting, a book about personal finance, or a one‑hour coaching session can give you tools that pay off far beyond the original amount.

Bottom line: $30 might look small, but with a few smart moves you can turn it into savings, reduced debt, or knowledge that helps you handle larger sums later. Start with one of the ideas above, watch the impact, and keep the momentum going.

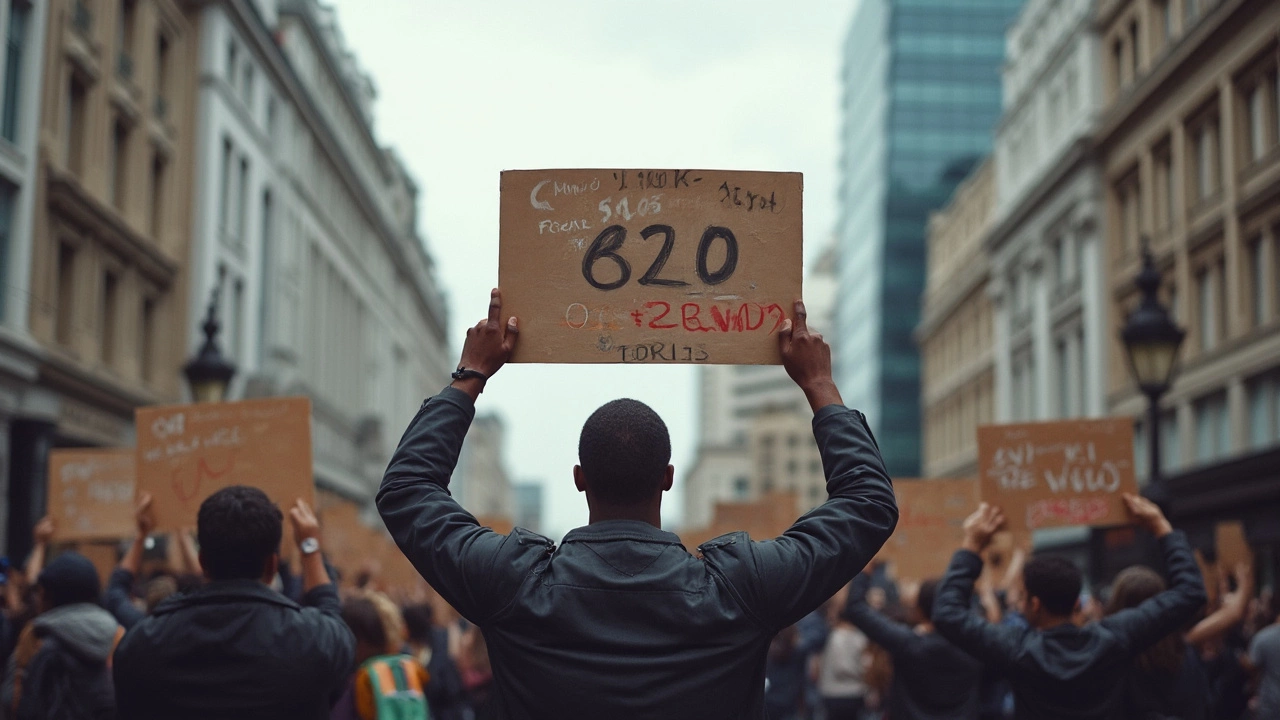

Getting a $30,000 loan can be a substantial financial move, and your credit score plays a crucial role. Most lenders generally look for a score of 620 or higher, but several other factors could come into play. Understanding how different credit scores affect your loan approval chances and terms can save money and stress. This article unpacks the ins and outs of credit scores, offering helpful tips for improving your standing.

Read More