Debt-to-Income Ratio Calculator

Calculate Your Debt-to-Income Ratio

Your debt-to-income ratio is one of the most important factors lenders consider when approving debt consolidation loans. Calculate yours to see your approval likelihood.

Getting approved for debt consolidation isn’t about luck. It’s not a secret club you need an invitation to join. But it’s also not as simple as filling out a form and waiting for money to appear. If you’re drowning in credit card bills, medical debts, or payday loans, you’re probably wondering: Is it hard to get approved for debt consolidation? The answer? It depends-on your credit, your income, and how much you actually owe.

What debt consolidation actually does

Debt consolidation isn’t magic. It doesn’t erase what you owe. Instead, it combines multiple debts-like credit cards, personal loans, or medical bills-into one single loan with one monthly payment. The goal? Lower your interest rate, simplify your payments, and maybe pay off the debt faster.

Most people use a personal loan for this. Some use a balance transfer credit card. A few, with enough home equity, use a secured loan. But the most common path is an unsecured personal loan. That’s the one most people are asking about when they say, “Will I get approved?”

Here’s the reality: lenders aren’t looking to help you. They’re looking to make money-and minimize risk. So they ask three basic questions: Can you pay? Will you pay? And how much risk are you?

Your credit score isn’t everything-but it’s the first gate

If your credit score is below 580, you’re in the subprime zone. That doesn’t mean you’re out of luck, but it does mean you’ll face higher rates, smaller loan amounts, or outright denials. Most lenders want at least a 620 to 640 score to even consider you for a decent rate.

But here’s what most people don’t realize: your credit score is just the opening act. A 680 score with a $15,000 debt and a $30,000 income? You’re likely approved. A 720 score with $50,000 in debt and a $28,000 income? You might get turned down.

Lenders look at your debt-to-income ratio (DTI). That’s your total monthly debt payments divided by your gross monthly income. If your DTI is over 40%, you’re considered high risk-even with a great credit score. If it’s under 30%, you’re in the sweet spot.

For example: if you earn €3,000 a month before taxes and your current monthly debt payments (credit cards, car loan, student loans) total €1,300, your DTI is 43%. That’s a red flag. Paying down $300 of debt before applying could be the difference between approval and rejection.

Income matters more than you think

Debt consolidation lenders don’t care how much you made last year. They care about what’s in your bank account right now. Stable, verifiable income is non-negotiable.

Self-employed? You’ll need at least two years of tax returns. Freelancers? Bank statements showing consistent deposits over six months. If you’ve switched jobs twice in the last year, you might need to wait until you’ve been in your new role for at least six months.

Some lenders will approve you with a part-time job if your income is steady. Others require full-time employment. It varies. But if your income is irregular or you’ve recently lost a job, approval becomes much harder.

Don’t lie about your income. Lenders verify everything. A fake pay stub won’t get you a loan-it’ll get you rejected and possibly flagged for fraud.

How much debt you have-and what kind

Not all debt is treated the same. Credit card debt? High interest, easy to consolidate. Medical bills? Often lower interest, sometimes negotiable. Payday loans? Red flag territory. Lenders see those as signs of financial distress.

Most lenders cap the loan amount you can get based on your income and credit. In Ireland, typical unsecured personal loan limits range from €5,000 to €50,000. But if you owe €60,000 and only earn €35,000 a year, you won’t qualify for a loan big enough to cover everything.

That’s okay. You don’t need to consolidate everything at once. Focus on the highest-interest debts first. Credit cards at 18%? Target those. A 5% car loan? Leave it alone.

Also, if you’ve had a County Court Judgment (CCJ) or missed payments in the last two years, that’s going to hurt your chances. Some lenders will still work with you-but expect higher rates and stricter terms.

What lenders check beyond your credit report

It’s not just your score and income. Lenders dig deeper:

- Bank statements-do you live within your means, or do you spend every euro you earn?

- Existing loans-are you already maxed out on credit?

- Applications in the last 90 days-too many hard inquiries signal desperation.

- Outstanding arrears-any unpaid bills or loans still active?

One client I worked with had a 710 credit score and a stable job. But he had applied for three credit cards in the last month. That alone got him denied-even though he had no missed payments. Lenders saw him as someone chasing credit, not solving debt.

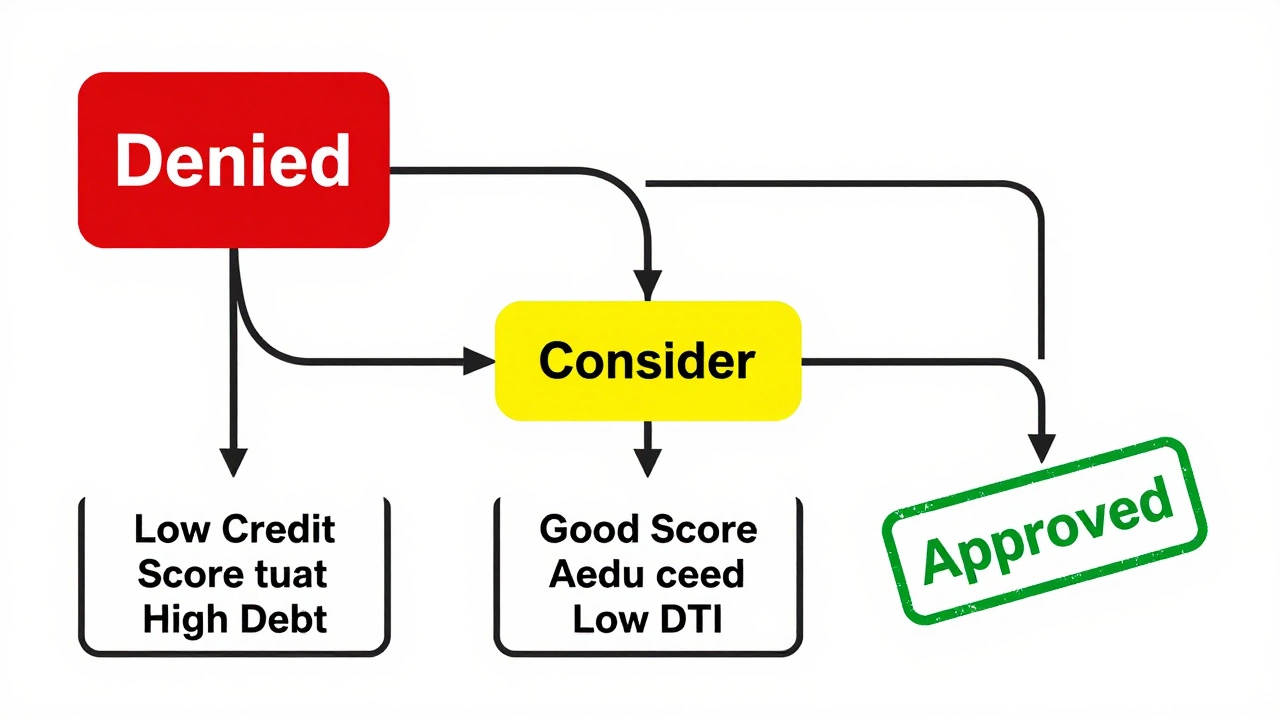

What to do if you’re denied

Getting denied isn’t the end. It’s a signal. Here’s what to do next:

- Wait 3-6 months. Don’t reapply immediately. Each denial leaves a hard inquiry on your report.

- Check your credit report for errors. In Ireland, you can get a free report from the Irish Credit Bureau. Fix any mistakes.

- Pay down one or two debts. Even €1,000 less in balances can lower your DTI enough to qualify.

- Ask for a co-signer. Someone with good credit who can guarantee the loan? That can open doors.

- Try a credit union. They’re often more flexible than big banks. In Dublin, many credit unions offer debt consolidation loans with lower rates and personalized reviews.

Some people turn to debt management plans through nonprofit agencies. These aren’t loans-they’re structured repayment plans negotiated with your creditors. They don’t require approval in the same way, but they do affect your credit report.

Alternatives if consolidation doesn’t work

If you can’t get approved for a consolidation loan, here are three real options:

- Balance transfer card: If you have good credit, transfer high-interest cards to a 0% intro APR card. Watch the timeline-rates jump after 12-18 months.

- Debt management plan: Through a nonprofit like Money Advice and Budgeting Service (MABS), you can get a free plan that freezes interest and reduces monthly payments.

- Debt settlement: Risky. You pay a lump sum less than what you owe. It hurts your credit but can work if you have savings and a serious hardship.

Avoid payday lenders, pawn shops, or “debt relief” companies that charge upfront fees. They’re not helping-they’re profiting from your stress.

How to improve your chances before applying

There’s a simple checklist to follow before you even click ‘apply’:

- Get your credit report and fix errors

- Calculate your DTI-aim for under 35%

- Pay down one debt to reduce your total balance

- Stop applying for new credit

- Save a small emergency fund-even €500 shows stability

- Compare lenders: credit unions, online lenders, banks

Don’t just apply to the first lender that pops up. Rates vary. One person in Cork got a 7.5% rate from a credit union after being denied by three banks. The difference? They asked for help.

Bottom line: It’s not impossible-it’s manageable

Is it hard to get approved for debt consolidation? Yes-if you’re unprepared. But if you know what lenders look for, you can fix the gaps.

You don’t need perfect credit. You don’t need to be rich. You just need to show you’re serious, stable, and capable of paying back what you borrow. That’s it.

Start with your credit report. Calculate your debt-to-income ratio. Pay down one bill. Then apply. You’ll be surprised how much difference those small steps make.

Can I get debt consolidation with bad credit?

Yes, but your options are limited. You’ll likely face higher interest rates, smaller loan amounts, or stricter terms. Credit unions and specialized lenders are more likely to approve you than big banks. You might also need a co-signer or collateral. Don’t expect a 5% rate-expect 12% to 20%. But even at 15%, that’s better than 24% on credit cards.

How long does debt consolidation approval take?

If you have all your documents ready-ID, proof of income, bank statements-it can take as little as 24 to 48 hours. But if you’re missing paperwork or your credit report needs review, it can take 5 to 10 business days. Online lenders are usually faster than banks.

Will debt consolidation hurt my credit score?

Initially, yes. A hard inquiry and a new loan can drop your score by 5 to 10 points. But if you pay the new loan on time and pay off your old accounts, your score will recover-and likely improve over 6 to 12 months. The key is consistency. Miss a payment on your consolidation loan, and you’ll undo all the progress.

Can I consolidate student loans with personal loans?

Technically yes, but it’s usually a bad idea. Student loans in Ireland often have lower interest rates, income-based repayment options, and forgiveness programs. Switching to a personal loan means losing those protections. Only do it if your student loan interest is above 10% and you have a solid plan to pay it off fast.

Do I need to close my credit cards after consolidation?

Lenders don’t require it, but it’s strongly advised. Keeping open credit cards with zero balances can help your credit utilization. But if you’ve struggled with overspending in the past, closing them reduces temptation. The goal isn’t to look good on paper-it’s to stay out of debt.

What’s the difference between debt consolidation and debt settlement?

Debt consolidation means you pay back everything you owe-just in one loan with lower interest. Debt settlement means you pay less than you owe, but it’s negotiated with your creditor. Settlement hurts your credit badly and can trigger tax bills on the forgiven amount. Consolidation is safer and more predictable.

If you’re thinking about debt consolidation, you’re already on the right path. The hardest part isn’t getting approved-it’s making the decision to change. Start small. Check your credit. Know your numbers. Then take the next step.