Savings Accounts: What You Need to Know in 2025

Looking for a place to park cash that’s safe and earns a bit of interest? A savings account is the go‑to for many, but not all accounts are created equal. In this guide we’ll break down the key things to check, the hidden costs that steal your earnings, and when you should consider an ISA or a CD instead.

How to Spot a Good Savings Account

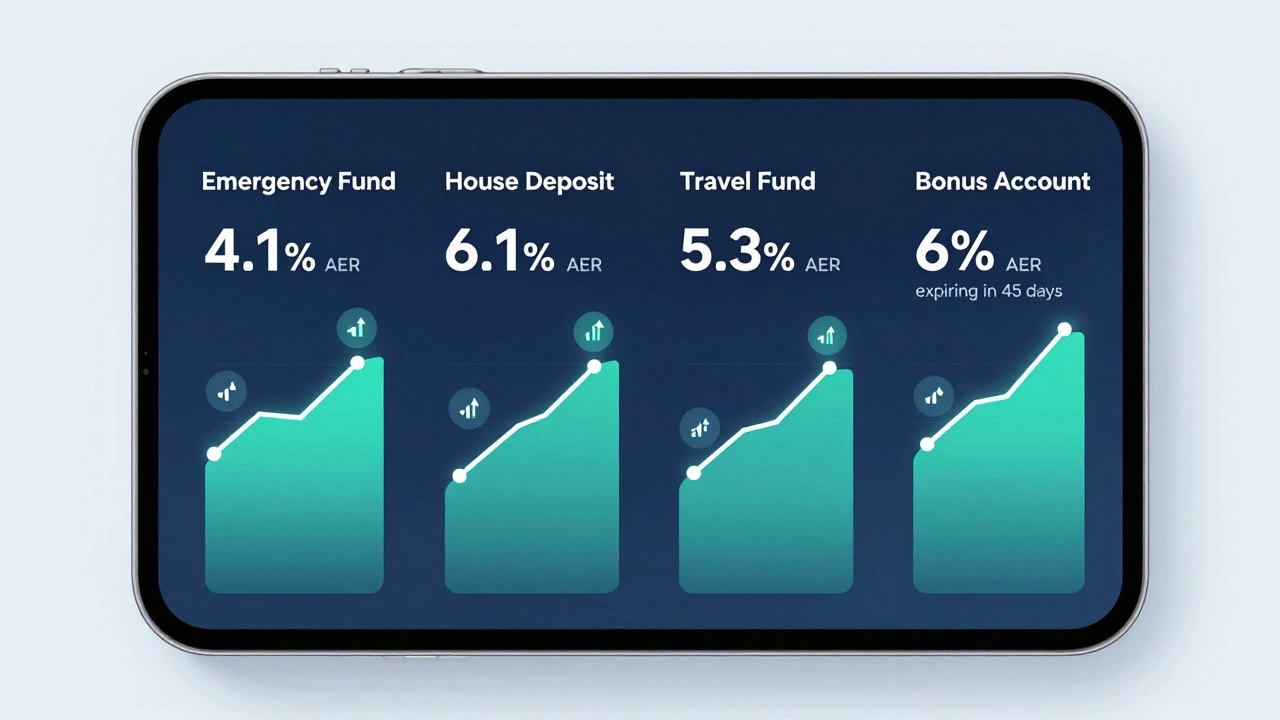

First thing to compare is the interest rate – the annual percentage yield (APY). A higher APY means more money in your pocket, but watch out for introductory offers that drop after a few months. Next, look at fees. Some banks charge monthly maintenance fees unless you meet a balance threshold. If you’re paying a fee on a low‑interest account, you’re essentially losing money.

Another factor is accessibility. Does the bank let you withdraw without penalty? Many online‑only banks offer free transfers and instant access, while traditional brick‑and‑mortar banks may limit withdrawals to a few per month. Check the terms for any limits that could inconvenience you.

Common Pitfalls and When to Look Beyond a Savings Account

Low interest rates are the biggest downside. In 2025 many standard savings accounts still sit under 1%, which often can’t keep up with inflation. If your money loses purchasing power, you’re better off exploring higher‑yield options.

Also, remember that some accounts tie up your cash in a “fixed term” – think 6‑month or 12‑month bonds. Early withdrawals may incur penalties that eat into any earned interest. If flexibility matters to you, stick with a true “easy‑access” account.

When the numbers don’t add up, consider an ISA (Individual Savings Account) if you’re in the UK. ISAs let you earn interest tax‑free, which can boost net returns dramatically. Look for providers that offer competitive rates and flexible withdrawal options, especially if you plan to use the money for a big purchase or an emergency fund.

For those comfortable locking money away for a set period, a Certificate of Deposit (CD) can deliver rates higher than most savings accounts. A 12‑month CD with a solid bank might give you 3‑4% APY, but you’ll lose access to those funds until maturity. Weigh the higher yield against the loss of liquidity.

Security is another piece of the puzzle. All UK banks are covered by the Financial Services Compensation Scheme (FSCS) up to £85,000 per person, per institution. That means even if the bank fails, your money is safe. Choose banks with strong cyber‑security records – a few high‑profile hacks have shown that not every bank is equally protected.

Finally, keep an eye on the fine print. Some accounts brag about “no fees” but impose a minimum balance that’s hard to maintain. Others may charge for paper statements or for moving money between accounts. A quick skim of the terms can save you from surprise charges later.

Bottom line: a good savings account offers a competitive APY, zero (or low) fees, easy access, and solid security. If you can’t find that combo, explore an ISA for tax‑free growth or a CD for higher returns, but only if you’re okay with the trade‑off in flexibility. Use these tips to make sure your cash works harder for you, not the other way around.

Most experts recommend keeping 3 to 6 months' worth of essential expenses in a savings account. In Ireland, that means €4,500 to €27,000 depending on your household size and income. Learn how to calculate your ideal emergency fund and where to keep it for maximum safety and returns.

Read More

Find out which savings account is best for saving money in 2026 in Ireland, including high-interest options, notice accounts, fixed-term deals, and how to avoid common traps. Learn how to split your savings for maximum growth and safety.

Read More

An ISA isn't an investment-it's a tax-free wrapper. Learn how to use it right in 2025 to grow your savings without paying tax on interest, dividends, or gains.

Read More

High-yield savings accounts don't let you lose your principal, but inflation and low rates can reduce your buying power. Learn how to protect your money and avoid scams.

Read More

Saving $20 a week adds up to $1,040 in a year-without interest. With a decent savings account, you could earn an extra $18 or more. Learn how small, consistent savings build real financial security.

Read More

Find out who can open an ISA in 2025, covering age, residency, contribution limits and the specific rules for Cash, Stocks & Shares, Lifetime and Innovative Finance ISAs.

Read More

Curious about how much interest $1,000 earns in a year? This guide breaks down calculations, rates, options, and smart tips using real numbers for 2025.

Read More

ISA accounts sound perfect with their tax-free perks, but there are several drawbacks people overlook. This article unpacks the main disadvantages of ISAs, from strict contribution limits to confusing rules and penalties. It also touches on the practical frustrations savers face, like switching providers or getting access to funds. Expect honest details, simple language, and helpful tips for everyday savers.

Read More

Trying to figure out which bank truly has the best savings account for 2025? This article cuts through the confusion with current facts, highlighting the banks offering the highest rates and the lowest fees. Whether you’re saving for a new car, an emergency fund, or your kid’s next big hobby, you’ll find practical info and tips to actually boost your balance. We’ll also look at online vs. traditional banks, smart banking features, and what to watch out for with the fine print. Read on if you want your savings to actually grow—without surprise headaches.

Read More

Confused about whether the US has ISA accounts like the UK? This article breaks down what an ISA is, why Americans keep hearing about them, and what options locals actually have. We cover the best alternatives for US savers and list practical tips to get the most out of your money. By the end, you’ll know exactly where your savings could work hardest in the US.

Read More

Wondering if you can keep or open a UK ISA after moving to the US? This article explains the exact rules, why residency matters, and what happens to your existing ISA if you become a US taxpayer. It also tackles the tricky tax situation for Americans with UK accounts and shares practical tips for Brits who still want to save efficiently while living abroad. Get straight answers and avoid expensive mistakes.

Read More

Not sure whether to stash your cash in checking or savings? This article breaks down the real differences between these accounts, exploring which option is safest, smartest, and fits your style. Get clear tips to avoid common pitfalls and make your money work harder for you. Learn about interest rates, fees, and what most people get wrong about these accounts. Perfect if you want practical advice—and not vague financial lingo.

Read More