Personal Finance Made Simple: Real‑World Tips You Can Use Today

Feeling overwhelmed by money questions? You’re not alone. From figuring out how much of a loan you can actually afford to deciding whether a credit card is worth juggling, everyday decisions add up fast. The good news? Most of these choices follow a handful of clear rules that anyone can apply.

Budgeting Without the Headache

Start with the 4 A’s – Assessment, Allocation, Adjustment, and Accountability. Write down every source of income, then list every expense, big or small. Trim the non‑essentials first: that daily coffee run, streaming services you barely use, or impulse buys that pop up on your phone. Once you know where the money goes, re‑allocate funds toward high‑impact goals like an emergency fund or paying down high‑interest debt. Finally, check in weekly. Small tweaks keep the plan alive and stop overspending before it happens.

Smart Moves With Loans and Credit

Before you apply for a loan, use a simple calculator to see the monthly payment. For example, a $60,000 home‑equity loan at a 6% rate over 10 years comes out to roughly $666 a month. Knowing that number helps you compare offers and avoid surprise spikes.

Credit cards can be useful if you pay the balance in full each month. The “golden rule” is to never carry a balance – the interest you pay can wipe out any rewards. If you’re wondering how low a credit score can be and still get a loan, many lenders will consider scores in the high‑500s, but the terms will be tighter. Boost your score by paying all bills on time and keeping utilization under 30% of your limit.

Thinking about refinancing? UK homeowners should ask if remortgaging makes sense given current rates. A lower rate can shave months off your mortgage term, but watch out for early‑payment penalties that could erase the savings.

Saving isn’t just about stashing cash in a bank. High‑interest savings accounts can offer up to 10% returns if you chase promotional rates and move money strategically. Just remember to check for fees and the flexibility of withdrawals – you don’t want a great rate that locks your money away when you need it.

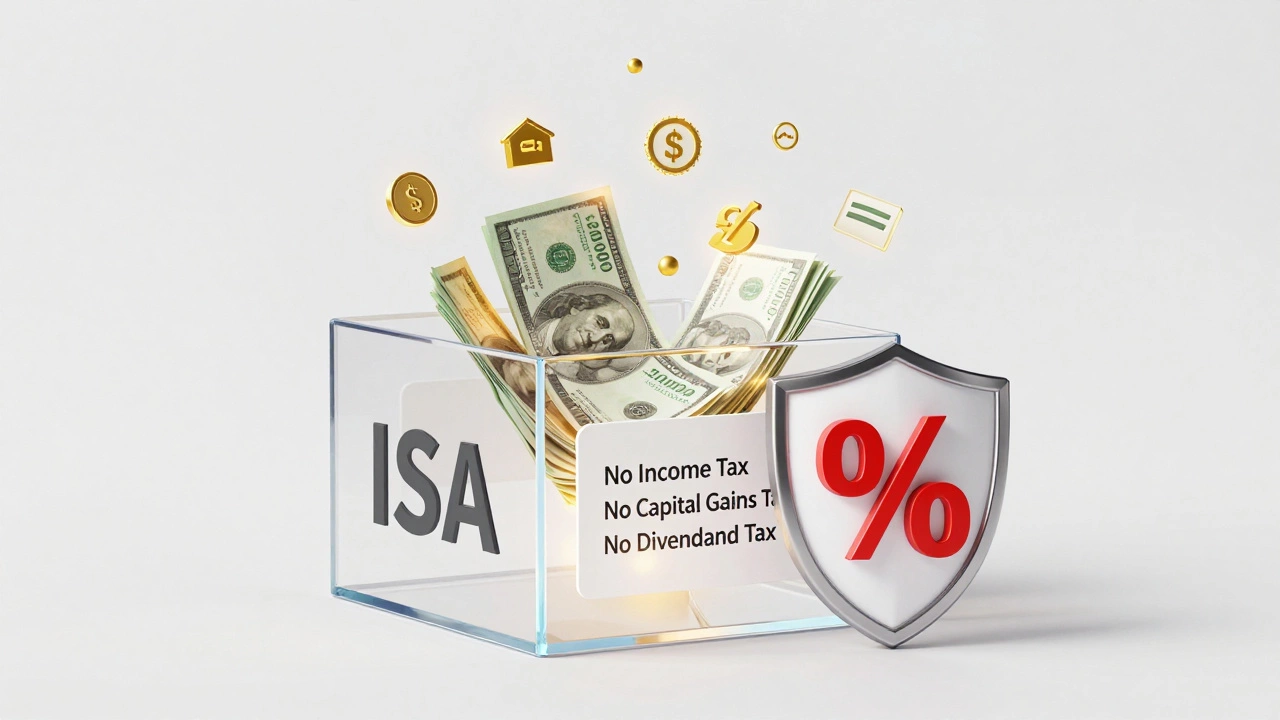

When it comes to ISAs, they’re tax‑free and handy, but they aren’t perfect. Some ISAs have contribution limits, and early withdrawals can lose tax benefits. Weigh the pros and cons against your overall savings plan.

Lastly, if debt feels unmanageable, look at debt‑relief programs. Consolidation can lower interest, while settlement might reduce the total owed – but both affect your credit score. Choose a route that matches your financial health and long‑term goals.

Personal finance is a series of small, consistent choices. Use these practical steps, keep an eye on your numbers, and you’ll steer clear of common pitfalls. Need deeper dives? Our articles on budgeting basics, loan calculations, credit‑card mastery, and ISA pitfalls are right here to guide you further.

Equity release lets you access cash from your home in retirement, but you pay compound interest that grows over time. Understand how it works before committing.

Read More

Warren Buffett doesn't just tell you to save money-he shows you how to build real wealth by saving early, investing wisely, and prioritizing freedom over spending. His advice is simple but life-changing.

Read More

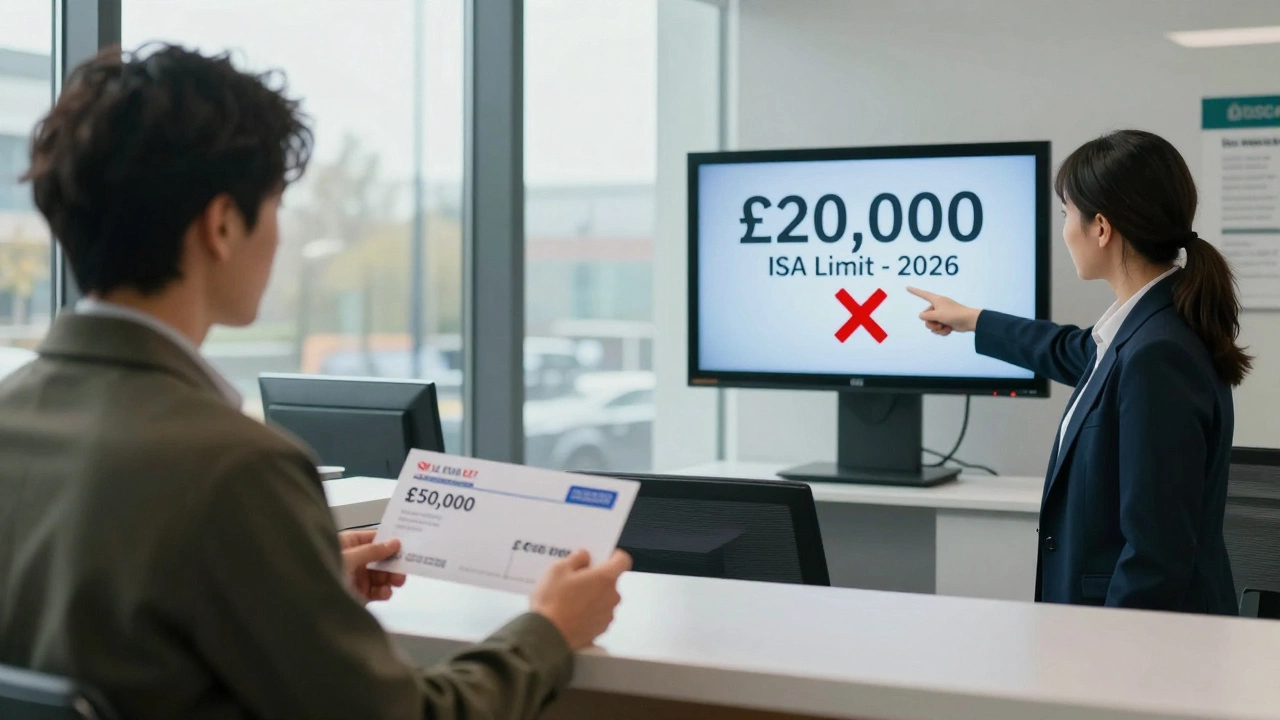

You can't put $50,000 in a cash ISA in one year - the UK limit is £20,000. But with smart planning over three years, you can get there tax-free. Here's how to maximize your ISA allowance and avoid costly mistakes.

Read More

You can't put $20,000 in a UK cash ISA because the allowance is £20,000 (about $25,000) and must be split across all ISA types. Learn how to use your full allowance wisely.

Read More

If you can't get a loan, there are still ways to get cash fast-sell items, use pawn shops, ask for an advance, apply for grants, or borrow from credit unions. No credit check needed.

Read More

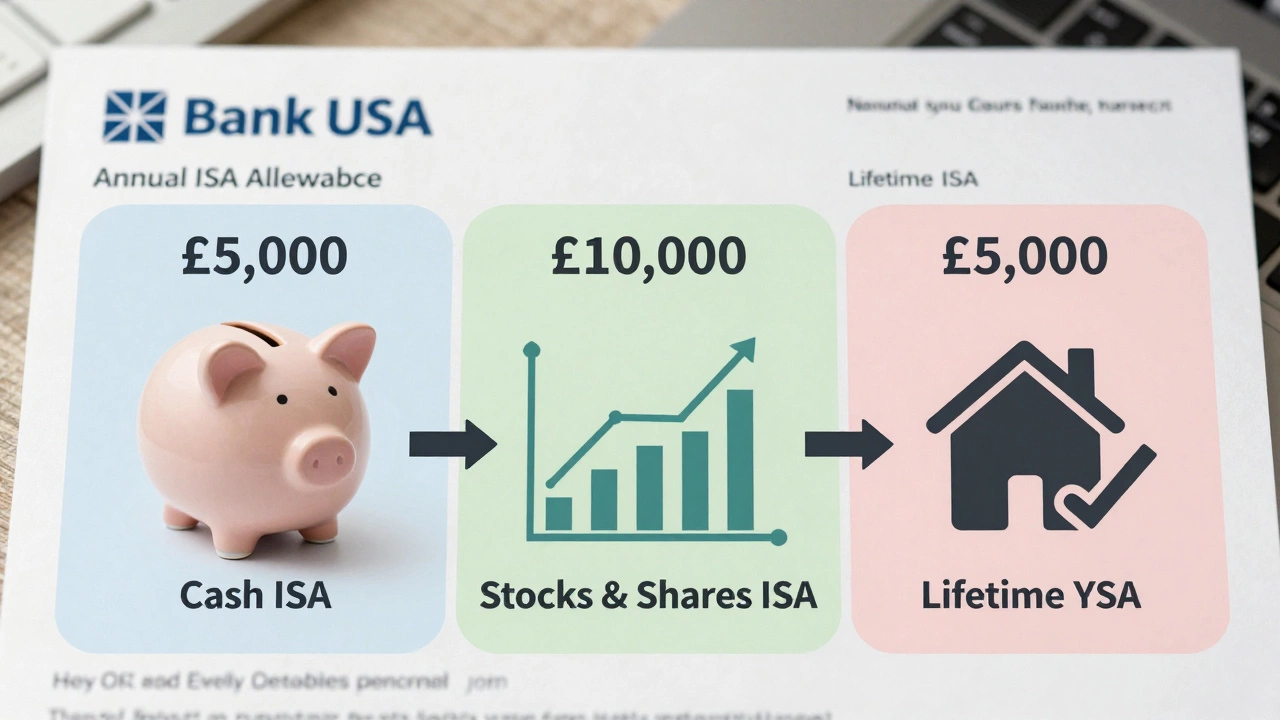

ISA accounts let you save or invest up to £20,000 a year tax-free in the UK. Learn how Cash, Stocks and Shares, and other ISAs work, what you can and can't do, and how to avoid common mistakes in 2026.

Read More

If you can't get a loan, you still have options. Sell unused items, ask for help from family or nonprofits, get paid faster for work you've already done, and avoid high-cost loans. Real ways to get cash when banks say no.

Read More

Taking equity out of your house can help with big expenses-but it risks your home. Learn when it's smart, when it's dangerous, and what alternatives you should consider instead.

Read More

You don't need to refinance to access your home equity. Learn how home equity loans, HELOCs, and reverse mortgages let you take cash out of your house in Ireland without changing your mortgage.

Read More

What income is middle class in 2024? It’s not just about salary - it’s about cost of living, location, and financial security. See real numbers for the U.S. and Ireland, and learn how to tell if you’re truly middle class.

Read More

Taking equity out of your home can help with big expenses, but it also carries serious risks. Learn how it works in Ireland, the real costs, when it makes sense, and safer alternatives.

Read More

Exactly how much to keep in savings: emergency fund rules, step-by-step math, Irish examples, where to park cash in 2025, and pitfalls to avoid.

Read More