Home Insurance Made Simple: What You Need to Know

Buying a home is a big step, and protecting it with the right insurance should feel easy, not confusing. In this guide we break down the core coverages, point out the usual blind spots, and share real‑world tricks to keep your premium down.

What Does a Typical Home Insurance Policy Cover?

Most policies bundle four main protections: the dwelling itself, personal belongings, liability, and additional living expenses if you can’t stay home after a loss. The dwelling coverage pays to rebuild the house, not just its market value, so it’s key to match the replacement cost. Personal property protects your furniture, electronics, and even clothing. Liability covers legal fees if someone gets hurt on your property, and extra living expenses cover hotel stays while repairs are underway.

Two big gaps often surprise owners: floods and earthquakes. Standard policies rarely include these, so you’ll need a separate rider or a special policy if you live in a risk zone. Skipping this step can leave you with huge out‑of‑pocket bills after a disaster.

How to Cut Your Home Insurance Premium Without Losing Coverage

First, shop around. Getting quotes from three different insurers can reveal a 10‑20% price spread. Don’t worry—most companies use a soft credit inquiry that won’t ding your score. Second, raise your deductible. A higher deductible means a lower monthly cost, but be sure you have cash on hand if you need to claim.

Bundling home and auto insurance with the same carrier often nets a discount. Also, ask about discounts for security upgrades like deadbolt locks, alarm systems, or fire sprinklers. Even a simple smoke detector update can shave a few percent off your bill.

If you’ve made major improvements, update the replacement cost estimate. Over‑insuring can waste money, while under‑insuring triggers the dreaded 80% rule, where the insurer only pays 80% of the replacement cost, leaving you to cover the rest.

Finally, review your policy each year. Life changes—marriage, a new garage, or a home office—can affect your coverage needs. Cancel any riders you no longer need, and verify you aren’t paying for duplicate coverage.

By knowing what’s typically covered, spotting common exclusions, and using these savings tricks, you can keep your home protected without blowing your budget.

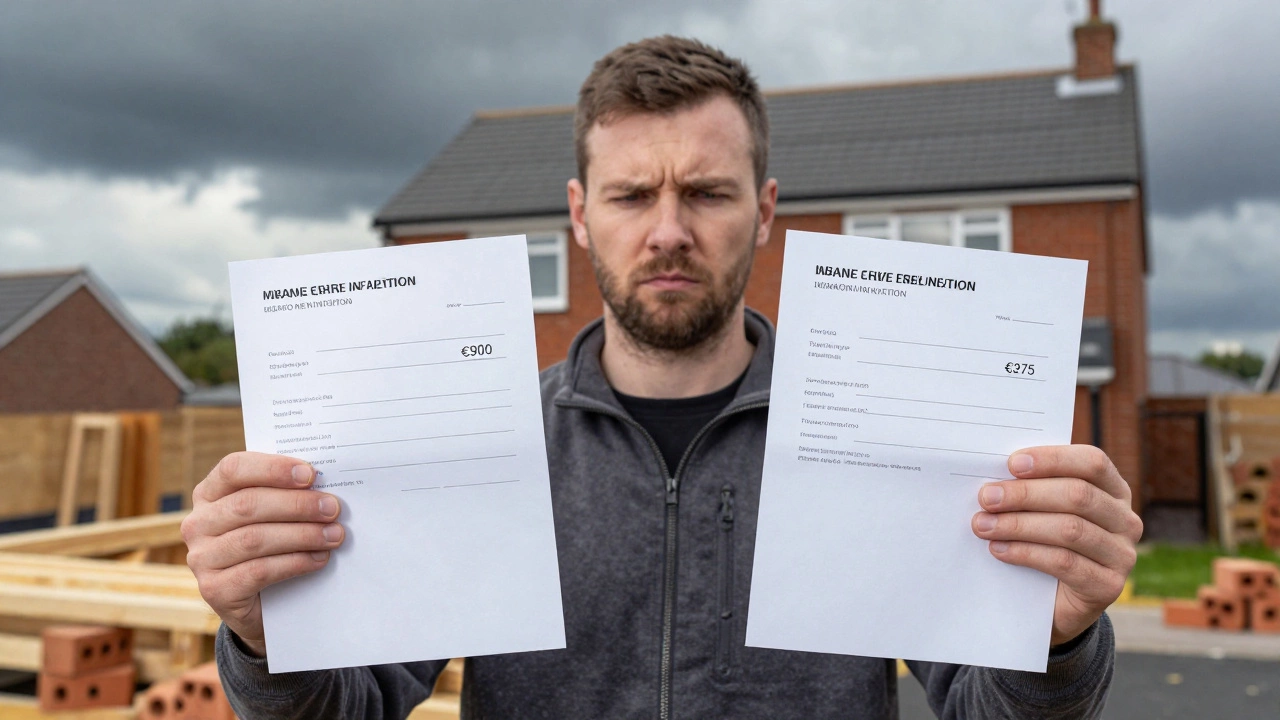

Home insurance premiums in Ireland typically rise each year due to inflation, claims trends, and risk changes. While increases are normal, you can save hundreds by comparing quotes, adjusting coverage, and improving home security.

Read More

Shopping around for home insurance in Ireland can save you hundreds each year. Learn how to compare quotes, avoid common mistakes, and find better coverage without overpaying.

Read More

USAA home insurance is available only to military-affiliated members. Learn exactly who qualifies, from active duty personnel to veterans and their families. Find out how to check eligibility and alternatives if you don't meet the criteria.

Read More

Your homeowners insurance doubled? It’s not you-it’s the market. Learn the 7 real reasons why rates spiked and exactly what to do next to lower your bill.

Read More

The most commonly purchased homeowners insurance is the HO-3 policy, offering broad coverage for home structure and personal property. Learn what it includes, what it excludes, and how to make sure you’re properly protected.

Read More

Discover the #1 home insurance company in the US for 2025, see rankings, compare top providers, and learn how to choose the best coverage for your home.

Read More

Compare Geico and Progressive home insurance premiums, discounts, and coverage options to see which offers the lower price in 2025.

Read More

Discover why the dwelling coverage limit is the key to solid homeowners insurance and how to set it right for real protection.

Read More

Replacement cost sounds simple, but what’s the real price? Learn how it’s calculated, what you’ll pay, and how to avoid underinsurance penalties.

Read More

Many homeowners are shocked to find their insurance won't cover things like floods and earthquakes. Learn the real gaps in coverage before it's too late.

Read More

Discover how much Americans actually pay for home insurance, see real numbers, get tips to save more, and learn why prices keep rising in this 2025 guide.

Read More

Curious if getting a home insurance quote affects your credit score? This article breaks down how insurance companies check your credit, what kind of inquiry they use, and what it actually means for your wallet and your score. We’ll clear up myths, give practical tips for shopping around, and explain why your credit matters in the first place. By the end, you'll know exactly what happens when you ask for a quote—and how to keep your credit safe while getting the best deal.

Read More