Home Equity Calculator

Calculate Your Home Equity

See how much equity you have in your home and potential borrowing options

Most people think the only way to access the equity in their home is to refinance their mortgage. But that’s not true. You can take equity out of your house without refinancing - and in many cases, it’s faster, cheaper, and less stressful. If you’re sitting on thousands of euros in home equity and need cash for home repairs, medical bills, or even a family emergency, you don’t have to go through the whole refinancing process. There are real alternatives that work right now in Ireland.

What Is Home Equity, Anyway?

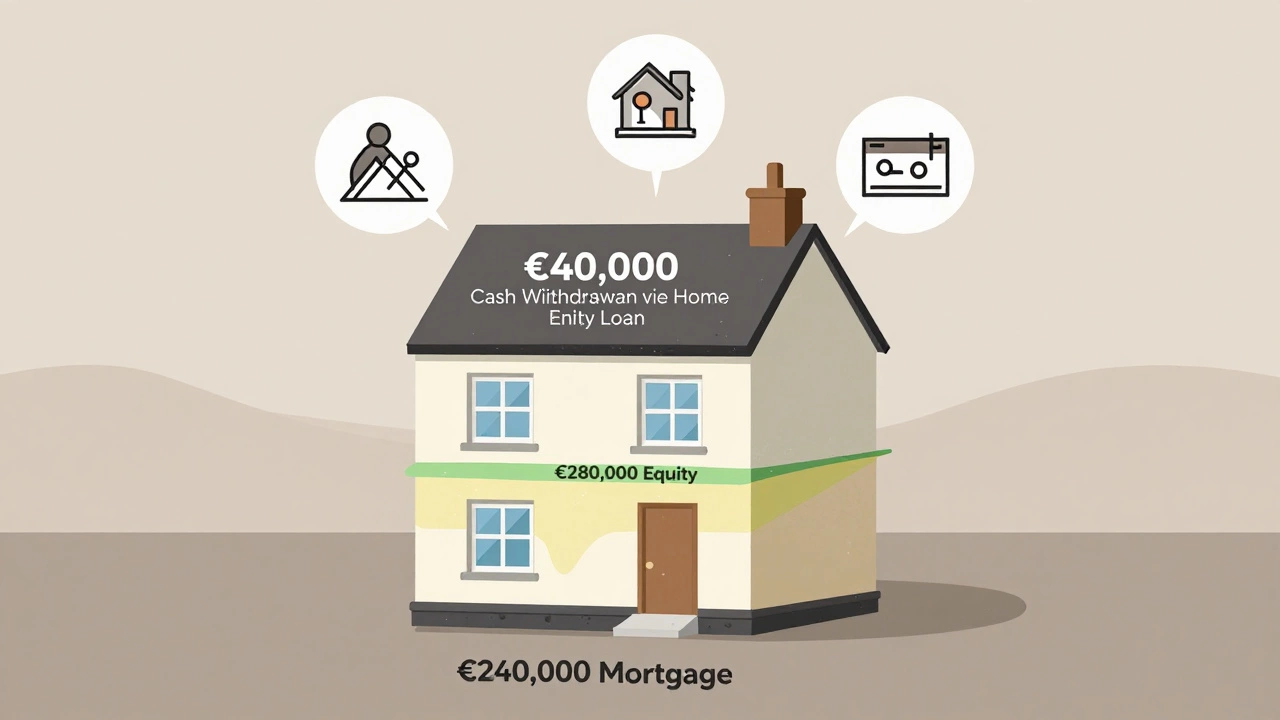

Home equity is the part of your house you actually own. Let’s say your home is worth €400,000 and you still owe €200,000 on your mortgage. That means you have €200,000 in equity. Every time you make a payment or your home’s value goes up, that number grows. It’s not cash in your bank account, but it’s still money you can tap into - if you know how.

Refinancing is the most common way people access this money. You replace your current mortgage with a new, larger one and take the difference in cash. But refinancing means new application fees, credit checks, appraisal costs, and sometimes even a new interest rate. It can take weeks. And if your credit has slipped since you got your original loan, you might not qualify.

Option 1: Home Equity Loan (Second Mortgage)

This is the most straightforward way to get cash without touching your original mortgage. A home equity loan is a separate loan, secured by your house, that you take out on top of your existing mortgage. Think of it like borrowing against your equity with a second lender.

You get a lump sum, fixed interest rate, and fixed monthly payments - just like your first mortgage. The interest rate is usually higher than your original mortgage, but it’s often lower than a personal loan. In Ireland, lenders like AIB, Bank of Ireland, and credit unions offer these. Some even let you borrow up to 80% of your home’s value, minus what you still owe.

For example: Your home is worth €400,000. You owe €200,000. You can borrow up to €120,000 (80% of €400,000 minus €200,000). That’s €120,000 in cash, with no need to refinance your main mortgage.

Option 2: Home Equity Line of Credit (HELOC)

If you don’t need all the money at once, a HELOC might be better. It’s like a credit card backed by your home. You get a credit limit based on your equity, and you can draw money as you need it over a set period - usually 10 years. Then you start repaying what you’ve borrowed.

Interest only kicks in when you use the money. You might pay 0.5% one month and 4.8% the next, depending on the Euribor rate. This flexibility makes HELOCs popular for home renovations, where costs come in stages. Some Irish lenders offer HELOCs with no application fees and no early repayment penalties.

Important: HELOCs have variable rates. If interest rates climb, your payments could go up. But if you’re disciplined and pay off what you borrow quickly, you can save a lot compared to a personal loan.

Option 3: Reverse Mortgage (For Seniors)

If you’re 62 or older and own your home outright - or nearly so - a reverse mortgage lets you turn your equity into cash without making monthly payments. The lender pays you, either as a lump sum, monthly payments, or a line of credit. You don’t repay it until you move out, sell the house, or pass away.

Reverse mortgages are rare in Ireland compared to the US or UK, but a few specialist providers offer them. They’re not for everyone. Fees are high, and they reduce what’s left for your heirs. But for seniors on a fixed income who want to stay in their home, it’s a lifeline.

Before considering this, talk to a financial advisor. The Central Bank of Ireland has strict rules on how these products are sold - and they’re designed to protect older borrowers from being misled.

Option 4: Selling a Partial Share (Equity Release Scheme)

This one’s less common, but it’s growing. Some companies in Ireland offer equity release partnerships. You sell a percentage of your home’s future value - say 25% - and get cash upfront. You keep living in the house. When you sell later, the company gets its share of the profit.

It’s not a loan. You don’t pay interest. But you give up part of your ownership. If your house value jumps 30%, the company gets 30% of their 25% share. That means you lose more than you expected.

This option is best for people who don’t plan to leave the house to their children and want to avoid debt. It’s not regulated like mortgages, so shop carefully. Only use providers registered with the Central Bank.

Why Avoid Refinancing?

Refinancing isn’t bad - but it’s overused. Here’s when it’s worth skipping:

- You’ve had a drop in income or credit score since you got your original loan

- You’ve only had your mortgage for a few years and don’t want to restart the clock

- You need cash fast - refinancing can take 4-8 weeks

- You’re happy with your current interest rate and don’t want to risk a higher one

- You don’t want to pay €2,000-€5,000 in closing costs

Home equity loans and HELOCs often cost less than €500 in fees. Some credit unions offer them with no fees at all. And you keep your original mortgage intact - which means your monthly payment doesn’t change.

What You Need to Qualify

You don’t need perfect credit, but you do need:

- At least 20% equity in your home (some lenders require 25%)

- A stable income - even if you’re self-employed

- A debt-to-income ratio under 43%

- A clean record on your current mortgage (no late payments in the last 12 months)

Most lenders will still check your credit score. But they care more about your home’s value and your payment history than your FICO score. If you’ve been on time with your mortgage for years, you’re already ahead of most applicants.

What to Watch Out For

Not all equity options are safe. Here are the red flags:

- Any lender who says you can borrow 100% of your home’s value - that’s dangerous and often illegal

- Companies that pressure you to sign quickly or say “this deal won’t last”

- Loans with balloon payments or hidden fees

- Equity release schemes that don’t explain how much you’ll owe when you sell

The Central Bank of Ireland requires all equity lenders to give you a Key Information Statement (KIS) before you sign. Read it. If you don’t understand it, ask a solicitor. Don’t be shy - it’s your home.

Real Example: A Dublin Homeowner’s Story

Marina, 58, lives in Rathmines. Her home is worth €520,000. She owes €240,000 on her 20-year mortgage at 3.2%. She needed €40,000 to replace her roof and fix plumbing. Refinancing would’ve cost her €3,500 in fees and raised her monthly payment by €250.

Instead, she got a home equity loan for €40,000 at 4.5% over 15 years. Her new monthly payment? €304. She kept her original mortgage. Her total monthly housing cost went up by just €54. She paid off the equity loan in 9 years by making extra payments. No stress. No refinance.

Next Steps: What to Do Now

If you’re thinking about taking equity out of your house:

- Check your current mortgage balance and home value. Use Daft.ie or MyHome.ie to estimate your property’s worth.

- Calculate your equity: home value minus mortgage balance.

- Call 2-3 local lenders - credit unions, AIB, Bank of Ireland. Ask about home equity loans and HELOCs.

- Ask for the Key Information Statement. Compare fees, rates, and repayment terms.

- Don’t sign anything until you’ve spoken to a free financial advisor through Money Advice and Budgeting Service (MABS).

You don’t need to refinance to access your equity. There are smarter, faster, cheaper ways - if you know where to look.

Can I get a home equity loan if I have bad credit?

Yes, but it’s harder. Lenders care more about your home equity and payment history than your credit score. If you’ve paid your mortgage on time for years, you might still qualify even with a score under 650. But expect higher interest rates. Some credit unions are more flexible than big banks.

How much can I borrow without refinancing?

Most lenders in Ireland let you borrow up to 80% of your home’s value, minus what you still owe. So if your home is worth €500,000 and you owe €300,000, you can borrow up to €100,000 (80% of €500,000 = €400,000; €400,000 - €300,000 = €100,000). Some lenders allow up to 85%, but that’s rare.

Is a home equity loan better than a personal loan?

Usually, yes - if you have enough equity. Home equity loans have lower interest rates because they’re secured by your home. Personal loans are unsecured, so rates can be 10% or higher. But if you’re uncomfortable risking your house, a personal loan might be safer - even if it costs more.

Do I need to pay stamp duty on a home equity loan?

No. Stamp duty doesn’t apply to home equity loans or HELOCs in Ireland. It only applies when you buy or transfer ownership of property. Since you’re not changing ownership, there’s no stamp duty.

Can I use equity to pay off credit card debt?

Yes, and many people do. If you have €15,000 in credit card debt at 14% interest and get a home equity loan at 4.8%, you’ll save hundreds each month. But be careful - you’re turning unsecured debt into secured debt. If you can’t keep paying, you risk losing your home.

Final Thought: Your Home Is an Asset - Use It Wisely

Equity isn’t free money. It’s your future. But it’s also a tool. Used right, it can fix your roof, pay for medical care, or help your kids with university. Used poorly, it can trap you in debt you can’t escape. Don’t rush. Don’t sign the first offer. Compare options. Talk to MABS. Know what you’re giving up - and what you’re gaining.