Welcome to Treasury Leaders Hub – Your UK Treasury Resource

Looking for clear, up‑to‑date advice on cash flow, risk, or investment moves? You’ve landed in the right spot. We break down complex treasury topics into bite‑size tips you can act on today.

What We Cover

From personal finance basics like budgeting and loan cost calculators to deep dives on mortgage trends and crypto investing, every post is written for busy finance leaders who need fast, reliable answers.

Why Trust Our Insights

Our team follows UK market shifts, regulatory changes, and real‑world case studies. You’ll find step‑by‑step guides on managing a $5,000 loan, planning a $300k early retirement, or spotting the next $1 crypto. Each article is packed with numbers, tools, and actionable steps – no fluff, just what matters.

Ready to level up your treasury game? Browse the latest posts, grab a template, and start making smarter decisions right away.

You can ask your car lender to lower your rate-especially if your credit improved or market rates dropped. Learn how to negotiate, when to refinance, and how much you could save on your car loan.

Read More

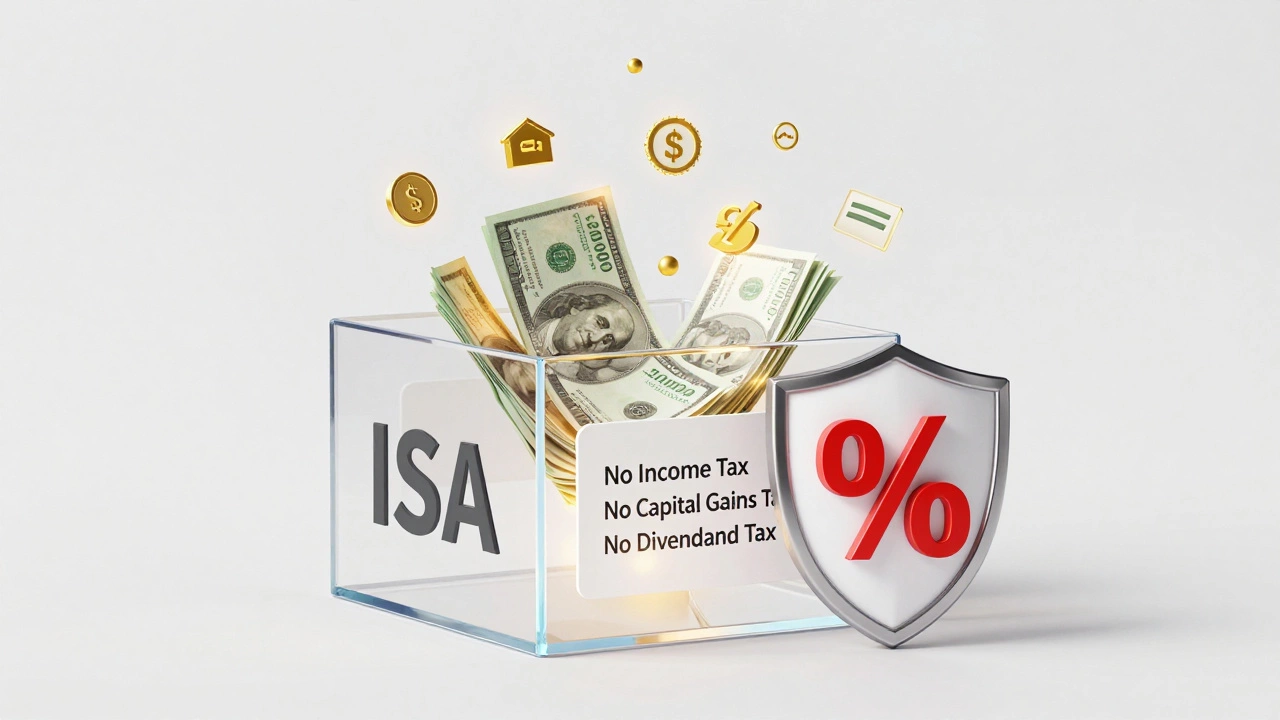

ISA accounts let you save or invest up to £20,000 a year tax-free in the UK. Learn how Cash, Stocks and Shares, and other ISAs work, what you can and can't do, and how to avoid common mistakes in 2026.

Read More

Car finance companies in Ireland look at your credit score from Experian, Equifax, or Credit Info. A score above 700 gets you the best rates, while below 600 means higher costs. Learn what they check and how to improve your chances.

Read More

Your homeowners insurance doubled? It’s not you-it’s the market. Learn the 7 real reasons why rates spiked and exactly what to do next to lower your bill.

Read More

An ISA isn't an investment-it's a tax-free wrapper. Learn how to use it right in 2025 to grow your savings without paying tax on interest, dividends, or gains.

Read More

If you can't get a loan, you still have options. Sell unused items, ask for help from family or nonprofits, get paid faster for work you've already done, and avoid high-cost loans. Real ways to get cash when banks say no.

Read More

US citizens cannot legally invest in ISAs, even if living in the UK. The IRS treats ISAs as taxable accounts, and failing to report them can lead to heavy penalties. Here's what to do instead.

Read More

Learn what not to say at a car dealership when financing a vehicle to avoid overpaying, hidden fees, and bad loan terms. Protect your budget with smart negotiation tactics.

Read More

Visa and Mastercard are the most widely accepted credit cards worldwide. Learn why these networks dominate global payments, why American Express falls short abroad, and what card you should actually carry when traveling.

Read More

High-yield savings accounts don't let you lose your principal, but inflation and low rates can reduce your buying power. Learn how to protect your money and avoid scams.

Read More

Taking equity out of your house can help with big expenses-but it risks your home. Learn when it's smart, when it's dangerous, and what alternatives you should consider instead.

Read More

You don't need to refinance to access your home equity. Learn how home equity loans, HELOCs, and reverse mortgages let you take cash out of your house in Ireland without changing your mortgage.

Read More